2026 Charitable Donation Tax Changes Explained

We believe the holiday season tends to correlate with an increase in charitable giving. It is the season of giving, after all. The end of the year is often a time for reflection, and those who have had a successful year may feel more generous when it comes to donating.

While this generosity may apply to gifts for loved ones, we also believe it extends to charitable organizations.

Because of this, we felt it was timely to write a blog about the upcoming changes to charitable donation rules under the One Big Beautiful Bill and how readers may be impacted starting in 2026. (Stay tuned for an upcoming blog summarizing additional tax changes as we head into spring.)

New Deduction Available for Non-Itemizers

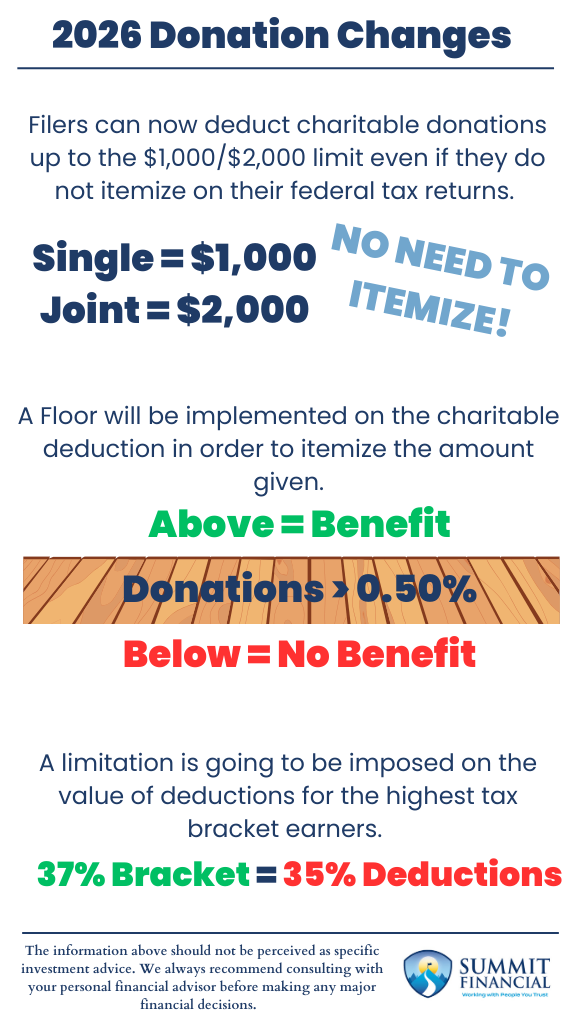

To start, it is important to note that tax filers will be able to deduct a portion of their cash charitable donations even if they do not itemize. The limit will be $1,000 for single filers and $2,000 for joint filers (Investopedia).

Previously, filers had to itemize deductions to receive a tax benefit from charitable donations. These donations must be made in cash to a qualified 501(c)(3) organization. We have seen many filers take the standard deduction because their itemized amounts were not large enough to justify itemizing.

We believe this created a misconception that charitable donations always provide a tax benefit, which has not historically been the case. Starting in 2026, however, all filers will have the opportunity to benefit from their cash donations up to the $1,000 / $2,000 limits—even if they do not itemize.

Charitable Deduction Floor for Itemizers

Next, a floor will be implemented on the amount of charitable donations that can be itemized. This floor will equal 0.50% of a filer’s adjusted gross income (AGI) (Tax Foundation).

A “floor” means any donation amount below that threshold will not be deductible. Donations must exceed the floor to qualify. For example, a filer with an AGI of $100,000 would need to donate more than $500 before any charitable contributions could be itemized.

In our opinion, this rule likely exists to offset the new non-itemized deduction mentioned above. Filers cannot claim both benefits, so this may encourage individuals to evaluate which option is more advantageous. Those who give less than 0.50% of AGI may benefit more from the non-itemized deduction, while those who give more may see a reduced benefit since the full amount may not be deductible.

Limits for High-Income Earners

Lastly, there are changes that apply specifically to individuals in the highest income brackets. Itemized deductions will generally be capped at 35 cents per dollar, which impacts those in the 37% tax bracket (Kiplinger).

These filers may lose approximately 2% in tax savings when itemizing deductions. We are concerned this change could reduce charitable giving among high earners, despite their greater capacity to donate.

While we hope generosity continues, it will be interesting to see how donation and income data evolves once these rules take effect in 2026.

Coordination With Summit Tax Services

This blog was written in coordination with Heemer, Klein & Company, PLLC, DBA Summit Tax Services. For specific tax questions, you may contact them at (586) 459-5340.

Questions or Planning Support

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100.

If you’ve had changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please reach out so we can schedule a review meeting.

We hope you learned something today. If you have feedback or suggestions, we’d love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert L. Wink, Kenneth R. Wink, and James D. Wink

Zach Bachner

After graduating from Central Michigan University in 2017 with specialized degrees in Finance and Personal Financial Planning, Zachary “Zach” Bachner set himself apart by earning the CFP® designation and passing the Series 7, 63, 65 licensing exams early in his career. Zach gained valuable real-world experience with the team at Summit Financial Consulting, who treated him like family. Their guidance helped him refine his skills in practical, client-centered planning, where putting their needs first was non-negotiable. This focus on trust-building not only allowed him to cultivate strong relationships, but also allowed him to continue doing what he loves most: solving client problems through efficient financial planning strategies. Leveraging his experience, Zach now helps others navigate finances through clear, informative writing. His work has been published in major outlets like Yahoo Finance, MarketWatch, and Investment Business Daily, establishing him as a valued resource. By simplifying complex topics, Zach aims to empower everyday people to confidently pursue their financial goals