2026 Retirement Plan Landscape: New Contribution and Income Limits

As we move into 2026, the IRS has released the updated cost-of-living adjustments for retirement accounts. I often tell my clients that these updates are the “annual physical” for their portfolio, a critical moment to diagnose issues and ensure everything is on track.

Staying ahead of these changes helps allow you to maximize your tax-advantaged savings and ensure your long-term plan remains on track.

Here is a breakdown of what has changed from 2025 to 2026.

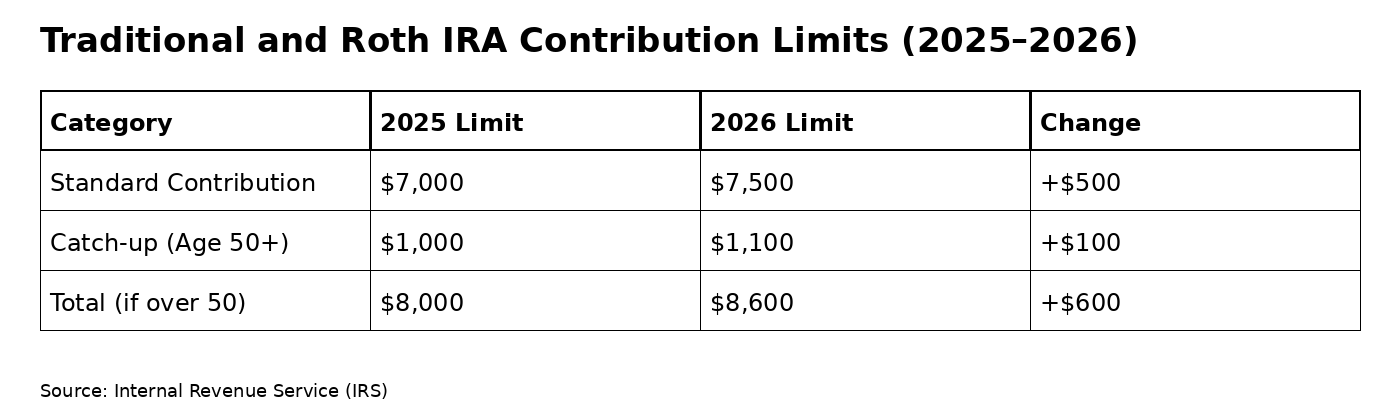

1. Traditional and Roth IRA Contributions

The annual contribution limit for IRAs (both Traditional and Roth) has seen a modest increase for 2026 to keep pace with inflation.

Source: https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500

Note: Total contributions to all your IRAs (Traditional and Roth combined) cannot exceed these limits.

2. 401(k), 403(b), and 457 Plans

For those utilizing employer-sponsored plans, the 2026 limits provide a significant opportunity for high earners to shield more income from immediate taxation.

- Employee elective deferral: $24,500 for 2026 (up from $23,500 in 2025)

- Catch-up Contribution: For those ages 50 and older, the catch-up remains $8,000 for 2026 (up from $7,500 in 2025), bringing the total possible contribution to $32,500.

- Total Defined Contribution Limit: The "all-in" limit (employee + employer contributions) has increased to $72,000.]

Source: https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500

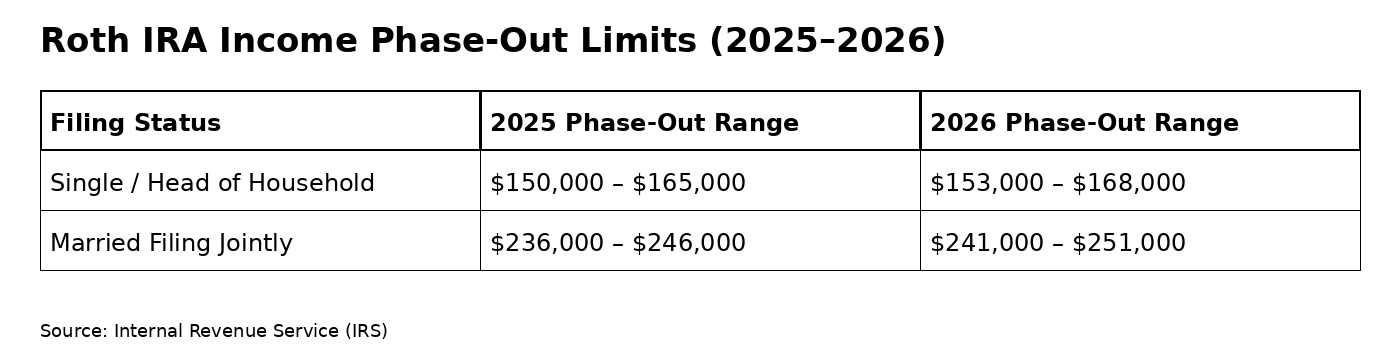

3. 2026 Roth IRA Income Phase-Out Limits

Perhaps the most important numbers for high-income earners are the phase-out ranges. If your Modified Adjusted Gross Income (MAGI) exceeds these levels, your ability to contribute directly to a Roth IRA is reduced or eliminated.

Source: https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500

4. Traditional IRA Deduction Phase-Outs

If you (or your spouse) are covered by a retirement plan at work, your ability to deduct Traditional IRA contributions is also subject to income limits:

- Single/Head of Household: $81,000 to $91,000.

- Married Filing Jointly (Active Participant): $129,000 to $149,000.

- Married Filing Jointly (One spouse covered): $242,000 to $252,000.

Source: https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500

Retirement Plan Takeaways for 2026

- Automate the Increase: If you currently max out your 401(k), remember to update your payroll deferral to hit the new $24,500 target.

- Evaluate the "Backdoor" Roth: If your income has climbed into the phase-out ranges mentioned above, let's discuss if a Backdoor Roth IRA strategy remains appropriate for you.

- Review Beneficiaries: With every new year, it’s wise to ensure your account beneficiaries are up to date alongside your contribution adjustments.

These are not formal recommendations. Always consult with a qualified financial advisor or tax professional before making changes to your retirement strategy.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker.

If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

James Baldwin

Disclaimer: This information is for educational purposes only and does not constitute specific tax or legal advice. Always consult with a qualified financial advisor or tax professional before making changes to your retirement strategy.

James Baldwin

James is an Advisor at Summit Financial Consulting, LLC. He graduated from Michigan State University with a B.A. in Finance in 2021. With extensive licensing that includes the Series 7, Series 65, Series 63, and Life, Health, & Accident, James is a core member of our advisory team dedicated to creating transparent financial strategies for our clients. During his time at MSU, he was actively involved in student investment groups, including the Student Investment Association and the Student Venture Capital Fund Group. Outside of the office, he enjoys playing golf and going on various trips and adventures with his friends.

Sources

- Internal Revenue Service (IRS): https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500