Social Security

Understanding your Social Security benefits is crucial for smart retirement planning. By reviewing and understanding your benefits before or during retirement, you can maximize your income, ensure you’re eligible, explore different options available, and adjust to any changes in the Social Security system. This empowers you to make informed decisions that guarantee you receive the benefits you’ve earned throughout your career, helping to provide financial stability during your retirement years.

Staying informed about updates to Social Security is also essential. Laws and policies can change, impacting benefit calculations and retirement age requirements. Additionally, having a clear understanding of your benefits helps with lifestyle planning, enabling you to make choices that support your retirement goals and aspirations, whether it’s traveling, pursuing hobbies, or providing for loved ones.

We are happy to help you navigate your options now and in the future!

Create a Social Security account online so you can see your estimated future benefits, view your SS statement, and plan ahead: https://www.ssa.gov/myaccount

Your SS Questions, Our Answers (AND MORE)

How is Social Security Financed?

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $168,600 (in 2024), while the self-employed pay 12.4 percent.

How Do I Contact Social Security?

Follow the Link for the 800 Number, tips on the best time to contact SS, and Branch Locator: https://secure.ssa.gov/ICON/main.jsp#officeResults

How Do I View My Estimated Social Security Benefits?

Creating a Social Security account allows you to check your Social Security Statement, estimate your future benefits, and more: https://www.ssa.gov/myaccount/

How Are My Benefits Calculated?

Although you need at least 10 years of work, or 40 credits to qualify for Social Security retirement benefits, the benefit is based on your highest 35 years of earnings. If you don’t have a full 35 years of earnings when you apply for Social Security benefits, your benefit amount could be lower. Working additional years can boost your benefits by replacing those zeroes or low-earning years in the calculation, ultimately increasing your benefit amount.

The highest 35 years of earnings are used to calculate your average indexed monthly earnings. A formula is then applied to these earnings to determine the benefit amount you would receive at your Full Retirement Age (FRA), which is between 66 and 67 depending on your birth year. Starting benefits before full retirement age reduces monthly payments, while delaying benefits can increase them up to age 70.

Note: In the case of early retirement, a benefit is reduced 5/9 of one percent for each month prior to FRA, up to 36 months. If the number of months exceeds 36, then the benefit is further reduced 5/12 of one percent per month (https://www.ssa.gov/myaccount/assets/materials/additional-work.pdf)

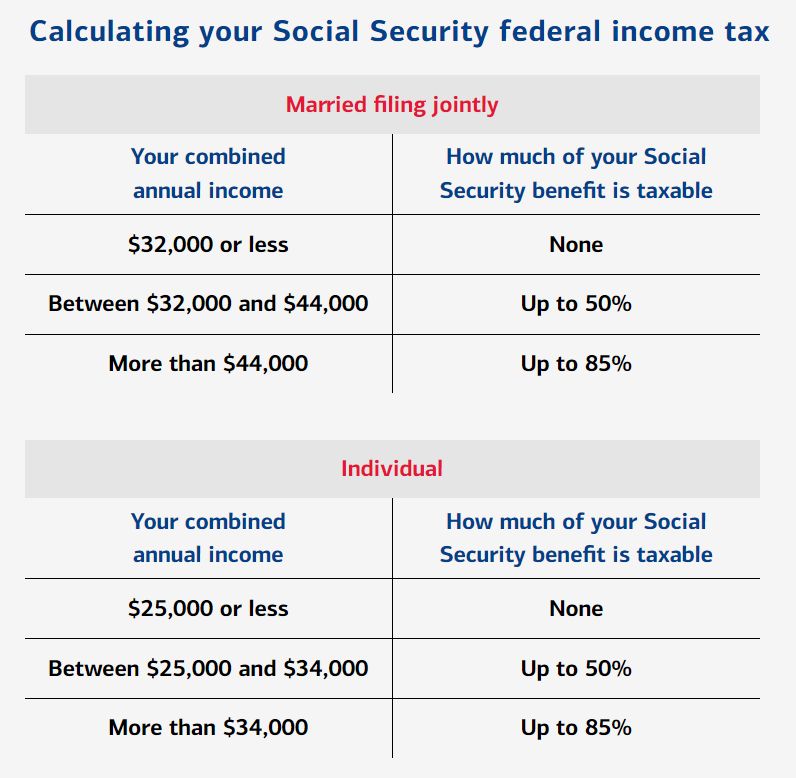

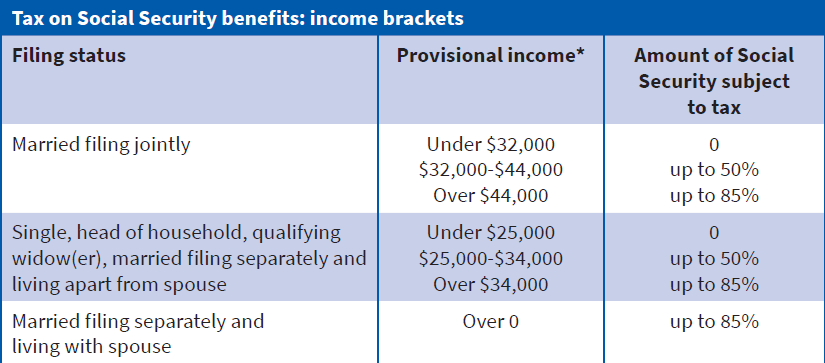

Are My Benefits Taxable?

Spousal Benefit

When it comes to Social Security benefits, spouses have their own set of considerations and opportunities. Understanding how spousal benefits work can help you maximize your household’s financial security in retirement.

1. Spousal Benefits: Spouses may be eligible for Social Security benefits based on their partner’s work record. This means even if you haven’t worked yourself or have lower earnings, you could still receive benefits.

2. Qualification Criteria: To qualify for spousal benefits, you typically need to be married for at least one year. In some cases, you may also be eligible if you have dependent children.

3. Benefit Amount: Spousal benefits are generally up to 50% of the higher-earning spouse’s benefit amount. However, the actual amount you receive depends on factors such as your age when you claim benefits. A spousal benefit is reduced 25/36 of one percent for each month before Full Retirement Age, up to 36 months. If the number of months exceeds 36, then the benefit is further reduced 5/12 of one percent per month.

4. Effect on Own Benefits: Claiming spousal benefits can impact your own retirement benefits, especially if you claim before reaching full retirement age. If the primary worker is not receiving any retirement benefits yet, then the spouse could technically take their regular Social Security benefit as early as age 62. When the primary working spouse files for their benefit later you could switch to spousal benefits.

5. Survivor Benefits: In the unfortunate event of your spouse’s passing, you may be eligible for survivor benefits. The surviving spouse typically receives the higher of the two benefit amounts.

6. Maximizing Benefits: To maximize your Social Security benefits as a couple, consider coordinating your claiming strategies. By carefully timing when each spouse claims benefits, you can optimize your lifetime benefits. The maximum spousal benefit you can receive is 50% of the primary working spouse’s benefit at their full retirement age. So it may make sense for the primary worker to wait until FRA to start their SS benefit as that can increase a spousal benefit as well.

7. Additional Resources: For more detailed information on spousal benefits and to run calculations, visit the Social Security Administration website. https://www.ssa.gov/oact/quickcalc/spouse.html

Understanding your options regarding spousal benefits is an important part of planning for retirement. By making informed decisions, you can help ensure that you and your spouse receive the benefits you deserve for a secure and comfortable retirement.

Taking Social Security While Working

As of 2024, the earnings limit for Social Security benefits applies regardless of marital status. For individuals who have not yet reached full retirement age, including both single individuals and married couples, the earnings limit is $22,320 per year. If you earn above this limit, $1 in benefits will be withheld for every $2 earned above the limit until you reach full retirement age. Once you reach full retirement age, there is no earnings limit, and you can work and earn as much as you want without any reduction in your Social Security benefits.

Contact Us

Summit Financial Consulting LLC

Working With People You Trust.

43409 Schoenherr Road, Sterling Heights, MI 48313

Phone: 586-226-2100

Fax: 586-226-3584

info@summitfc.net

Check the background of your financial professional on FINRA’s BrokerCheck

Our Office

Summit Financial Consulting

The Fine Print

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Summit Financial Consulting LLC and our editorial staff. Material presented is believed to be from reliable sources; however, we make no representations as to its accuracy or completeness. All information and ideas should be discussed in detail with your individual adviser prior to implementation.

The presence of this web site shall in no way be construed or interpreted as a solicitation to sell or offer to sell investment advisory services to any residents of any State other than the State of Michigan, Florida, Texas or where otherwise legally permitted. All written content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. All investing involves risk including loss of principal. Past performance does not guarantee future results.

Advisory services are offered through Summit Financial Consulting LLC, DBA Summit Financial Working With People You Trust, an SEC Investment Advisor. Being registered with the SEC and being a registered investment adviser does not imply a certain level of skill or training. Summit Financial Consulting LLC and its representatives do not render tax, legal, or accounting advice. Health/Life/Annuity Insurance products and services offered by the individual insurance agent. Group Health insurance and ancillary benefits are offered through Summit Health Services, LLC. Property/Casualty (P&C) Insurance is offered through Summit Insurance Services, LLC and our local P&C agency partners. Representatives of Summit Financial Consulting LLC offer tax preparation services through Summit Tax Services. Summit Tax Services is a DBA of Heemer Klein & Company and they are owned and operated independently. Tax products and services are offered through Summit Tax Services LLC. Summit Financial Consulting LLC, Summit Health Services LLC, Summit Tax Services LLC, and Summit Insurance Services, LLC are affiliated entities.

Summit Financial Consulting LLC, Summit Health Services LLC, Summit Tax Services LLC, and Summit Insurance Services, LLC are not affiliated with the Social Security Administration or any government agency.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.