Special Note about TD Ameritrade Statements and Confirmations

Suppose you recently started receiving additional mail from TD Ameritrade. In that case, it may be because you haven’t logged into your online account and confirmed your mailing preferences since TD Ameritrade and Charles Schwab are in the process of merging.

When you get a chance, please log in to: www.advisorclient.com. You’ll need your full account number to log in if you haven’t registered before. If you have registered and forgotten your password, please click on forgot my password. After you’ve logged in, you’ll see three options: Accounts, Documents, and My Profile. Click on My Profile, and then Communication Preferences. You’ll be able to choose electronic delivery of documents. If we can help, give us a call, or contact TD Ameritrade tech support at 800-431-3500.

Decision Time

The stock and bond markets appear to have stabilized to some degree, which is a great thing. Once we believe the negative volatility is behind us, we plan to jump back into the markets and hopefully ride the wave back up to the end of 2022 on a good note.

Overall, our portfolios are still in “be careful” mode until we see more signs of stability. One of our research companies has said the most important line in the sand is 4150 on the S&P 500. In July, the market closed at 4130, just below this crucial number. If the market jumps above this critical level, that could mean that the worst is behind us. Here are some pieces of evidence that the worst may be behind us soon.

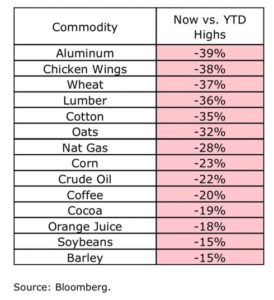

The Federal Reserve will likely stop their interest rate increases when inflation is under control. This would be good for the economy and the stock market. This chart shows how much each of these assets has dropped in price since their peak. So things appear to be heading in the right direction.

The last time we had runaway inflation was in the 1980s. The Federal Reserve chairman at the time, Paul Volcker, used Fed policy tools to reduce inflation. As a result, the stock market responded positively, erased all losses within four months, and then had a great run-up for years. We’re hopeful the same thing will happen in 2022 as the Fed is aggressively using their tools to reduce inflation.

Agile Portfolio Management

As you know, we have many tools in our toolbox, including the ability to purchase investments that profit when the stock market goes down. This is called hedging. Because the current environment is highly challenging with significant ups and downs, we initiated a change recently from previous months this year: We decided to add an inverse fund again at the end of July.

It’s possible we’re going to continue to experience a global growth slowdown. With the Federal Reserve raising rates, that should further slow things down in the short term, so it’s a difficult balance. There is a chance the stock market will take another trip down before it ultimately heads higher again, and we aim to try to profit from that within our managed portfolios.

However, if we’re wrong and the market heads higher from here, we plan to change course quickly. Once we believe the market is low or possibly bottomed for good, we plan to buy stocks low. Our ultimate goal is to make money, so we’re using what we believe to be all the appropriate tools in our toolbox to accomplish that goal potentially. This is why we manage our active portfolios daily.

Future Market Outlook

Anything is possible in the short term. However, we believe that by year-end, stocks will rebound for many reasons, including low unemployment, the Coronavirus-fueled shutdowns and restrictions reducing worldwide (currently, there are lockdowns in parts of China), inflation peaking and then dropping, providing lower prices, consistent housing market prices despite high-interest rates, and consumer spending from Millennials. They have hit their peak spending years.

Here to Help

We would love to meet with you to discuss investments, retirement planning, college planning for kids and grandkids, tax preparation, health insurance, including Medicare supplemental and prescription drug plans, and other financial planning topics. Please contact our office at (586) 226-2100 to schedule a meeting today!

Please contact us immediately if you’ve had any changes to your income, job status, marital status, 401K options, address, or any other financial changes.

We hope you and your family have an excellent, safe, and healthy start to the summer!

Kindest regards,

Bob, Ken, Jim, Zach, and James

Set up A Time To Chat

Notes & Disclaimer: Stock market indices, like the S&P 500 Index, are unmanaged groups of securities considered to be representative of the stock market in general or subsets of the market, and their performance is not reflective of the performance of any specific investment. Investments cannot be made directly into an index. Historical returns data are calculated using data provided by sources deemed to be reliable, but no representation or warranty, expressed or implied, is made as to their accuracy, completeness, or correctness. This information is provided “AS IS” without any warranty of any kind. All historical returns data should be considered hypothetical. Past performance is no guarantee of future results.

This communication is only intended for recipients who reside in states where our agents are licensed to sell these products. Investment advisory services are offered through Summit Financial Consulting, LLC, an SEC registered investment advisor. Registration does not imply a certain level of skill or training. Summit Financial Consulting Investment Advisor Representatives do not render tax, legal, or accounting advice. Insurance products and services are offered through Summit Financial Consulting, LLC. Note: Please update Summit Financial Consulting, LLC, if your investment objectives have changed or if the personal or financial information previously provided has changed. The investment advisory disclosure document that describes Summit Financial Consulting investment advisory services account is provided to you annually. Please consult Summit Financial Consulting for a copy of this document should you need an additional copy. All guarantees are subject to the claims paying ability of the issuing insurance company. Past performance cannot predict future performance. It is not possible to invest directly in an index. The Sherman Group, LLC is not associated with Summit Financial Consulting, LLC in any way, other than a research sharing partnership. Back testing is more heavily scrutinized than any other type of investment analysis because it can be updated to take advantage of past data. The algorithms and trading signals that we receive from the Sherman Group, LLC were created using back testing with the goal of creating a sustainable research process. We have reviewed data from the entire 20 year period which was mostly back tested, and have also personally reviewed the live data for the past 5 years and feel comfortable with it, but we encourage you to meet with us and ask questions so you are fully informed on what we plan to do with your investment assets at TD Ameritrade. It is important to look at fees, taxable repercussions, and trading frequency when looking at a rate of return number. There is no perfect system or research feed, and Sherman Group, LLC has had both longer term and short-term periods where they lost money. Investing involves risk, and these portfolios are no exception.