SPECIAL NOTE ABOUT TD AMERITRADE STATEMENTS AND CONFIRMATIONS:

If you recently started receiving additional mail from TD Ameritrade, it may be because you haven’t logged into your online account and confirmed your mailing preferences since TD Ameritrade and Charles Schwab are in the process of merging.

When you get a chance, please log in to: www.advisorclient.com

You’ll need your full account number to log in if you haven’t registered before. If you have registered and forgot your password, please click on forgot my password.

After you have logged in, at the top, you’ll see three options: Accounts, Documents, and My Profile. Please click on My Profile and then Communication Preferences. From there, you’ll be able to choose electronic delivery of documents if you’d like. If we can help in any way, give us a call, or contact TD Ameritrade tech support at 800-431-3500.

After you have logged in, at the top, you’ll see three options: Accounts, Documents, and My Profile. Please click on My Profile, and then Communication Preferences. From there, you’ll be able to choose electronic delivery of documents if you’d like. If we can help in any way, just give us a call, or contact TD Ameritrade tech support at 800-431-3500.

Our Conservative Stance Helped Again

August was a rough ride for the markets. The S&P 500 dropped 4.24%, and the Nasdaq was down 4.64%. The Bond index fund AGG also lost 3.23%, so it was another month where stocks and bonds lost simultaneously, which is unusual. September was, unfortunately, a rough ride as well and ended a terrible month and quarter on a sour note. The S&P 500 dropped 9.3% in September, and the Nasdaq dropped 10.5% this month. The Bond index AGG lost 4.3%.

As we said in our last market commentary, we added some positions to our portfolio that make money when the stock market goes down (Inverses) in August and September. We did not load up our entire portfolio into those types of investments because if we were wrong and the market shot up, we would lose big. We sold one of those inverse positions this month for a nice profit. That helped us to reduce losses in August and September that the market experienced.

Overall, we had losses in August and September, but they were much smaller than the market experienced. Again, please review your own statements to see your individual performance and give us a call if you’d like to discuss it further.

Fear vs. Greed Index

The S&P 500 is down over 25%, the tech-heavy Nasdaq is down over 33%, and the bond index fund AGG is down over 14% from the January highs. Meta (Facebook parent) is down 60%. Netflix is down 61%. Nike is down 50%. Amazon is down 34%, and Apple is down 24%. Over 90% of technology stocks are down over 20%.

The goal of investing is to buy low and sell high. Sir John Templeton, considered one of the best investors of all time, famously said: “The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.”

Could We See a Recovery Before Year End?

We are cautiously optimistic that we’ll have a bounce in the short term, and we intend to ride it up if we can. We may have a solid 4th quarter since the market seems to be so oversold right now, but that’s why we manage the portfolio daily: Things can change quickly for better or worse. While past performance cannot necessarily predict future performance, October is the 4th strongest month of the year on average, and it is the best month historically over the past 70 years during a mid-term election year.

Of course, if we see signs that a rally will not occur, we’ll move back to neutral, sell stocks, and buy more inverses, but we hope the market can recover from these levels by year-end.

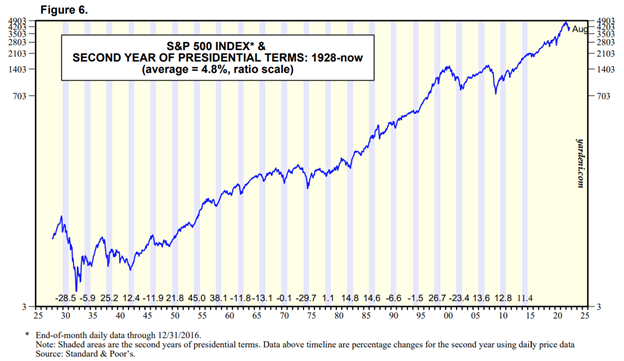

Historically, there is a rally into the midterm election when a president is in the second year of his first term. Some would say there is a lot of “window dressing” to try to stimulate the economy, so the election goes well for the party currently in power. In our opinion, the recent student loan forgiveness and student loan payment delays are both examples of this. While past performance cannot predict future performance, if you’d like more information about how politics have matched up with the stock market historically, this report may be interesting to you: https://www.yardeni.com/pub/stmktprescycle.pdf

Status of Inflation and Oil

Like last month, the most critical data point this month is the inflation CPI (Consumer Price Index) report on October 13th at 8:30 am. If the inflation number comes in lower than last month, that may cause a robust rally, even if it’s short-term. September was a massive disappointment as core inflation was positive when expected to be flat or negative.

Because the cost of Oil has dropped from a peak of $120 per barrel down for four straight months to $79 per barrel currently, that 34% decline in prices could potentially help make the latest inflation data still bad, but less harmful than it was previously, which the market may view as a positive.

Remember, the stock market typically looks six months into the future when analyzing current stock values. Hence, an incremental improvement in the right direction from the inflation numbers is a big win. The last time we had runaway inflation was in the 1980s. The Federal Reserve chairman at the time, Paul Volcker, used Fed policy tools to reduce inflation. As a result, the stock market responded positively, erased all losses within four months, and then had an excellent run-up for years. We’re hopeful the same thing will happen now in 2022-2023 as the Fed is aggressively using its tools to reduce inflation. However, in the short term, raising interest rates does slow down the economy, so we’ll keep a close eye on GDP, employment, and corporate earnings reports.

As you know, we have many tools in our toolbox, including the ability to purchase investments that profit when the stock market goes down. This is called hedging. There is still a chance the stock market will take another trip down before it ultimately heads higher again. Our ultimate goal is to make money, so we’re using what we believe to be all the appropriate tools in our toolbox to potentially accomplish that goal. This is why we manage our active portfolios daily.

Anything is possible in the short term, but we believe that by year-end, stocks will rebound for many reasons.

We Are Here to Help

We’d love to have a review meeting with you to discuss investments, retirement income planning, college planning for kids or grandkids, retirement planning, tax preparation, health insurance, including Medicare supplemental and prescription drug plans, and a variety of other financial planning topics. Please get in touch with our office at (586) 226-2100 to schedule a meeting today!

Please contact us immediately if you’ve had any changes to your income, job status, marriage status, 401K options, address, or any other financial changes. We hope you and your family have a fantastic, safe, and healthy start to the fall!

Kindest regards,

Bob, Ken, Jim, Zach, and James

Set Up A Time to Chat

Notes & Disclaimer: Stock market indices, like the S&P 500 Index, are unmanaged groups of securities considered to be representative of the stock market in general or subsets of the market, and their performance is not reflective of the performance of any specific investment. Investments cannot be made directly into an index. Historical returns data are calculated using data provided by sources deemed to be reliable, but no representation or warranty, expressed or implied, is made as to their accuracy, completeness, or correctness. This information is provided “AS IS” without any warranty of any kind. All historical returns data should be considered hypothetical. Past performance is no guarantee of future results.

This communication is only intended for recipients who reside in states where our agents are licensed to sell these products. Investment advisory services are offered through Summit Financial Consulting, LLC, an SEC registered investment advisor. Registration does not imply a certain level of skill or training. Summit Financial Consulting Investment Advisor Representatives do not render tax, legal, or accounting advice. Insurance products and services are offered through Summit Financial Consulting, LLC. Note: Please update Summit Financial Consulting, LLC, if your investment objectives have changed or if the personal or financial information previously provided has changed. The investment advisory disclosure document that describes Summit Financial Consulting investment advisory services account is provided to you annually. Please consult Summit Financial Consulting for a copy of this document should you need an additional copy. All guarantees are subject to the claims paying ability of the issuing insurance company. Past performance cannot predict future performance. It is not possible to invest directly in an index. The Sherman Group, LLC is not associated with Summit Financial Consulting, LLC in any way, other than a research sharing partnership. Back testing is more heavily scrutinized than any other type of investment analysis because it can be updated to take advantage of past data. The algorithms and trading signals that we receive from the Sherman Group, LLC were created using back testing with the goal of creating a sustainable research process. We have reviewed data from the entire 20 year period which was mostly back tested, and have also personally reviewed the live data for the past 5 years and feel comfortable with it, but we encourage you to meet with us and ask questions so you are fully informed on what we plan to do with your investment assets at TD Ameritrade. It is important to look at fees, taxable repercussions, and trading frequency when looking at a rate of return number. There is no perfect system or research feed, and Sherman Group, LLC has had both longer term and short-term periods where they lost money. Investing involves risk, and these portfolios are no exception.