Continuing our current discussion, we will be looking at various types of insurance over the next few months. Overall, insurance is a risk management process. Risk is managed by buying the insurance policy to protect against a financial loss event.

We will cover the basics of life, health, disability, and then, finally, home and auto insurance. This month, we will be focusing on health insurance, including common policy benefits and a comparison of the different types of network coverages.

Understanding Health Insurance Policy Benefits

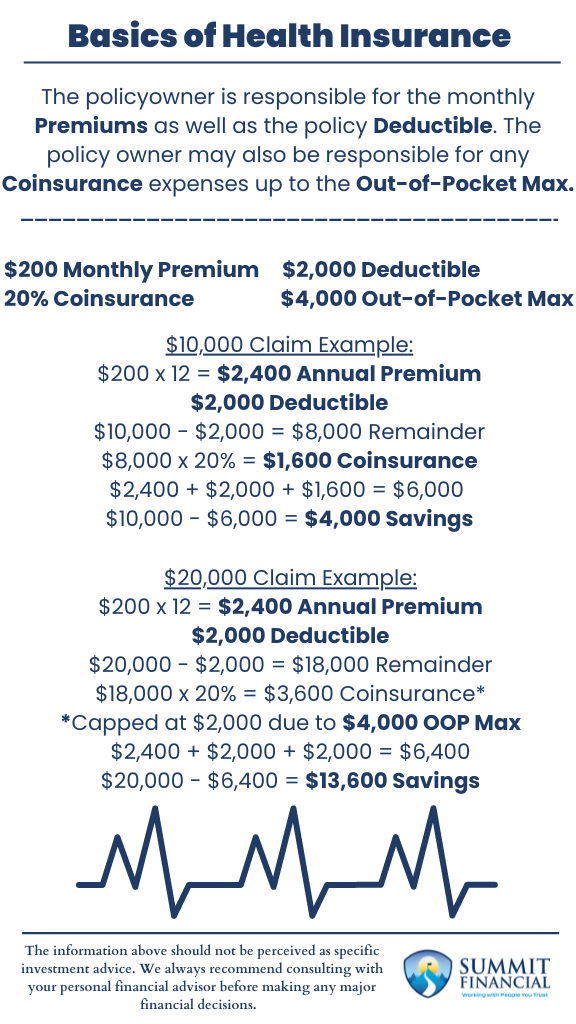

To begin, we will be reviewing the different policy details included in health insurance. To prevent abuse of the insurance, most policies include a deductible that must be met before benefits are covered. The policyowner is responsible for the monthly premiums as well as the policy deductible. Better policies will have a lower deductible so the insurance policy would start providing benefits sooner.

Any claims submitted above the deductible are typically covered via coinsurance or copay benefits detailed below. Coinsurance refers to the cost splitting of claims between the insurance provider and the policyowner. For example, a policy with 20% coinsurance would cover $80 of a $100 bill. The 20% is what the insured is responsible for paying for covered claims above the deductible.

A Copay benefit is a flat fee for services. For example, a primary care visit may be a flat $30 regardless of the total cost rather than being covered by the 20% coinsurance benefit. There are some policies that offer copay or coinsurance benefits before the deductible, but this is not overly common, so it is always a good idea to double check what benefits are covered before the deductible.

Deductibles and Out-of-Pocket Maximums

Most policies also include an Out-of-Pocket Maximum. This is the total amount that the insured will pay for covered services. The policyowner is responsible for the monthly premiums, deductible, and the out-of-pocket expenses up to the maximum amount. Above this limit, the insurance provider will cover 100% of all covered claims. Much like the deductible, the lower the OOP Max, the better the policy will be, and the more expensive it will be.

HMO: Health Maintenance Organization

The first type of network we will be summarizing is the HMO network. An HMO, Health Maintenance Organization is usually more restricted than other network options. As a result, these policies are usually offered at a lower monthly premium. HMO’s do not provide out-of-network benefits and usually offer less in-network options to begin with. Also, an HMO requires a referral from the primary care physician before the insured can go see a specialist. This referral hurdle is also a reason why these policies tend to be cheaper.

PPO: Preferred Provider Organization

A PPO, Preferred Provider Organization, is usually the most extensive network option available. The in-network options are very broad compared to an HMO, and these policies offer out-of-network benefits, even though the out-of-network coverage usually contains fewer benefits. This difference in benefits is why you should still focus on seeing an in-network doctor. Also, PPO plans do not require a referral to see a specialist. Because of this, PPO plans cost more than comparable HMO plans.

EPO: Exclusive Provider Organization

Lastly, an EPO, Exclusive Provider Organization, is a hybrid of the two network options described above. An EPO has in-network benefits like a PPO plan. The network options are usually very broad. However, an EPO does not offer out-of-network benefits similar to an HMO. Regarding a referral for a specialist, an EPO typically does not require a referral, similar to a PPO plan.

Choosing the Right Health Insurance for Your Needs

Every individual or every family has different health insurance needs. We always recommend consulting with a health insurance professional when making any important decisions. If the family is very, very healthy, then it may be best to focus on lower benefits and a lower monthly premium, assuming not many claims will occur. If the family is older and unhealthy, then paying more per month may make sense since it should provide better benefits when claims do arise.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Sincerely,

Zachary A. Bachner, CFP®

In coordination with Summit Health Services, LLC