One of the hottest conversations lately has been the Federal Reserve and its decisions toward monetary policy. This blog will be diving into how this may impact the overall economy along with bond investments. We will also touch on what expectations are for the next FED meeting in mid-September.

To learn more about monetary policy, read our previous post: Monetary Policy and the Federal Reserve Meeting

Understanding the Fed Funds Rate and Its Impact on Borrowing Costs

First, let’s discuss what monetary policy is and how interest rates are included. The Federal Reserve has the goal to bring stability to the economy in terms of unemployment and inflation data.

By tightening or easing policy, they can potentially impact these two data points. Higher interest rates cause a tightening economy and will see less spending by businesses and consumers. Under this type of environment, we are likely to see an increase in unemployment since businesses often do not have the cash flow available to hire or retain employees if their access to debt is more limited.

Also, since businesses and consumers are likely to spend less, there is potentially a decline in demand for goods overall, which could cause prices or the inflation rate to decline. An easing economy is partly the result of lower interest rates, which normally allows people to spend more since the cost of debt is cheaper in this type of environment. More spending means businesses can likely afford more employees, so unemployment can potentially go down, and also a higher demand for goods that may cause prices and inflation to rise in this scenario.

The Federal Reserve affects broad interest rates by setting the Fed Funds Rate, which is essentially the cost for banks to borrow or lend money to each other overnight.

The Fed Funds Rate is a super short-term cost for banks that is controlled by the Federal Reserve. The effect of adjusting the Fed Funds Rate is that it causes this borrowing by banks to have a new cost, which in turn gets passed on to their business and consumer clients who take on new loans. An increase in the Fed Funds Rate will broadly mean an increase in the interest rate associated with the cost of debt at that point in time, which will likely lead to tighter economic conditions. While a decrease in the Fed Funds Rate typically means a reduction in broad interest rates, so this tends to lead towards easing monetary policy.

Relationship Between Interest Rates and Bond Values

Besides the underlying economic impacts, it is important for investors to understand how interest rates may affect their investments. This is specifically important for bond investors. Bond values have an inverse correlation to interest rates, which means bond values will rise as interest rates drop, and bond values will drop as interest rates rise. Here is a quick example illustrating this concept.

Let’s say you currently hold a bond that is paying a 4% interest rate. If interest rates rise to 5%, your 4% bond is not as attractive since the new bond would be paying the holder more, so you will likely see a decline in the bond value.

However, if interest rates drop to 3%, then your 4% bond may increase in value since it is now paying more than newly issued bonds. There are many more factors that go into a bond valuation, but this is a very high-level example of how interest rates may affect a bond’s value.

Expectations for the September Federal Reserve Meeting

Lastly, we want to address expectations for what the Federal Reserve’s next steps may be. For awhile now, the FED has been on a tightening policy schedule since they are concerned about the high inflation we saw. Everyone is aware of how expensive goods have been lately – just look at your last grocery bill.

The Federal Reserve aggressively raised interest rates starting in March of 2022. However, since July of 2023, they have paused their interest rate hikes and have been monitoring conditions to determine their next steps. If inflation is still a concern, the FED may keep rates where they are or may even decide to increase them further. If they believe they are winning the battle against inflation, then they may decide to change their course of action and begin cutting interest rates.

Jackson Hole is one of the Federal Reserve’s largest conferences of the year, and Chairman Powell provided some insight into their current conversations and plans for moving forward. Based on recent inflation and economic data, Powell hinted at the idea that it may be time to adjust their policy. They believe the inflation risks have decreased and do not want to hinder the labor market more than they need to.

It is our belief that we are likely to see the first interest rate cut in the U.S since 2019 at their next meeting in mid-September. This does depend heavily on the economic data between now and then, but we believe the data, along with FED Chairman Powell’s recent comments, currently favors the decision to start easing policy.

We will be watching this event closely to determine the impact on our client’s investments so that we may respond with any changes if needed.

How Federal Reserve Policies Influence Bond Markets and Economic Conditions

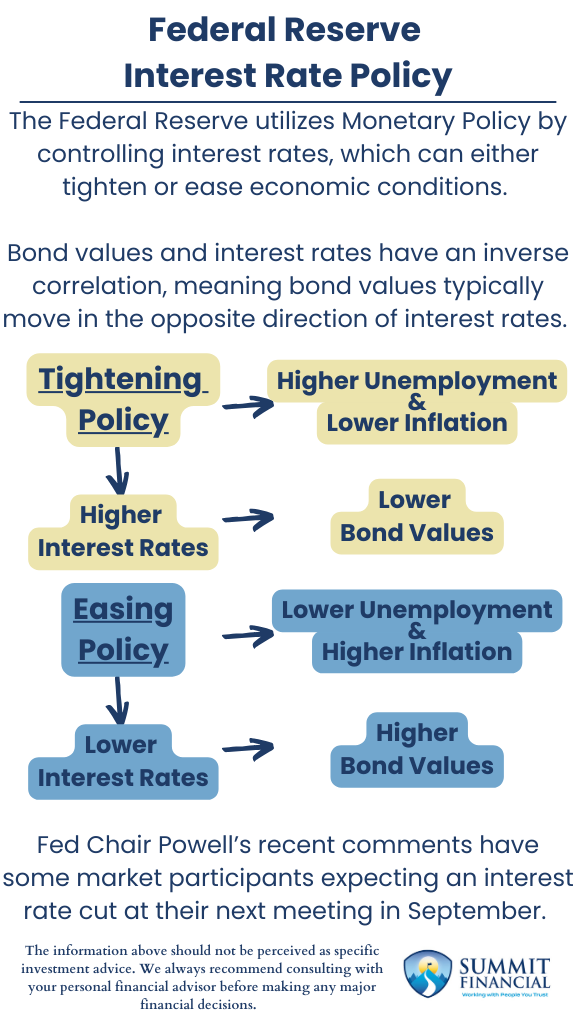

- The Federal Reserve utilizes Monetary Policy by controlling interest rates, which can either tighten or ease economic conditions.

- Bond values and interest rates have an inverse correlation, meaning bond values typically move in the opposite direction of interest rates.

- Fed Chair Powell’s recent comments have market some participants expecting an interest rate cut at their next meeting in September.

Financial Planning and Review Meeting

If you have any questions about interest rates, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

Sources:

- https://summitfc.net/monetary-policy/

- https://www.federalreserve.gov/monetarypolicy/monetary-policy-what-are-its-goals-how-does-it-work.htm

- https://www.nytimes.com/2024/08/23/business/economy/fed-rates-powell-jackson-hole.html#:~:text=Jerome%20H.%20Powell%20made%20it,in%20its%20fight%20against%20inflation.

- https://www.investopedia.com/terms/f/federalfundsrate.asp

- https://www.newyorkfed.org/markets/reference-rates/effr