Watch this Month’s Market Commentary on YouTube

Market Commentary November 2024 – Summit Financial Consulting LLC

Open Enrollment Update

If you have health insurance, either individually, for your business, or through Medicare, now is a great time to shop around and make sure you have the best benefits for the price. Call Summit Health today at (248) 779-1000 to receive some updated quotes. Remember the deadline is December 7, so call early to get an appointment to discuss it.

Social Security Cost of Living Adjustment (COLA)

On October 10, 2024, the Social Security Administration announced the 2025 Cost of Living Adjustment (COLA). Starting January 1, 2025, over 72.5 million Americans will receive a 2.5% increase in their Social Security benefits.

Why the Recent Fed Rate Cut Matters

Last month, we discussed how the Federal Reserve unexpectedly dropped the Fed rate to 0.5% rather than the traditional 0.25%.

The Fed Rate is what commercial banks use for overnight loans to each other, and it typically affects most interest rate-sensitive instruments. Most mortgages are based upon the US Government 10-year bond.

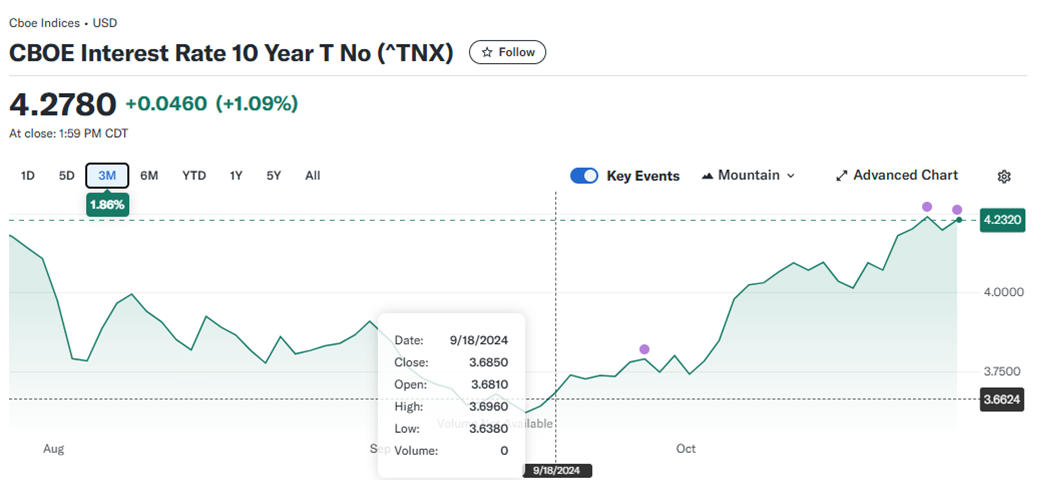

Unfortunately, the market is potentially showing some nervousness that inflation is not under control, and this has caused interest rates to increase from 3.68% on September 18 up to 4.27% on October 28 rather than decrease as the Fed intended.

Source: Yahoo Finance

Inflation Concerns Amid Rising Interest Rates

When spending increases, it has the potential to increase inflation.

For the past 18 months, we have mentioned in our market commentaries that we believed the stock market would have a good run leading up to the election because most incumbent Presidents will attempt to window-dress the economy, in our opinion, which may include extra government spending.

Government Spending and Its Influence on Inflation

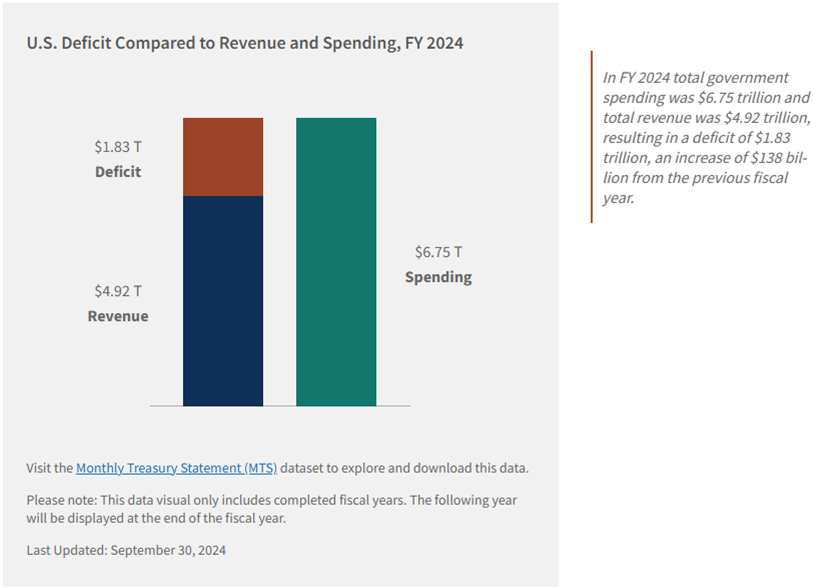

One reason investors may be worried about inflation, which is causing an increase in interest rates rather than a decrease, is recent government spending. This is a chart of year-to-date spending as of September 30, and the national debt is getting worse by the day, unfortunately:

Source: FiscalData

Long-Term Impact of Excessive Government Spending

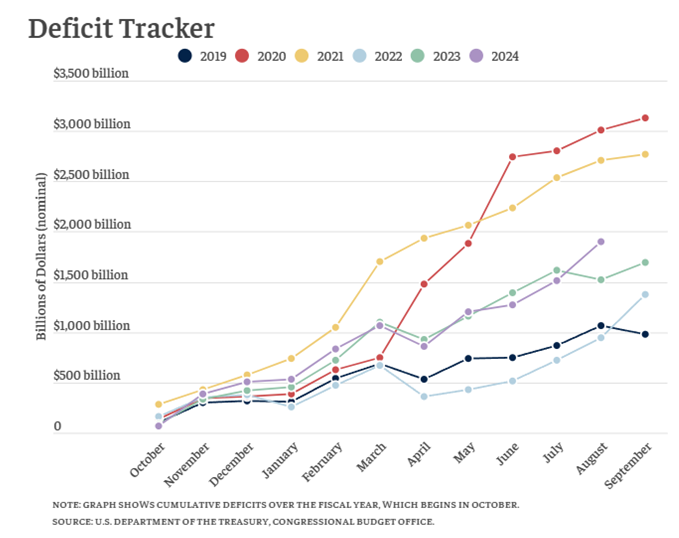

When Donald Trump was President, the numbers were bad as well. During Covid in 2020, President Trump created over a $3 Trillion deficit, and in 2019, before Covid, he had a $1 Trillion deficit. Trump has said that if he is elected, he will appoint Elon Musk to root out and stop wasteful government spending, but that may or may not be a big help.

In our opinion, if the politicians on both sides of the aisle continue the reckless, unchecked spending spree, it could dampen the economy for decades and continue to spike inflation.

Here is a chart of recent government spending by year:

Source: BPC

The election polling numbers are currently showing a 50/50 toss-up in many key swing states. Whoever is our next president will hopefully cut spending so our interest rates and US Government debt interest expense will drop.

Financial Planning and Review Meeting

If we haven’t spoken in a while, or you’ve had any changes to your beneficiaries, income, job status, marriage status, a new birth in the family, 401K options, address, risk tolerance, or any other financial changes, please contact us right away at (586) 226-2100 to schedule a review meeting.

Sincerely,

with contributions from Robert Wink, James Wink, Zachary Bachner, James Baldwin, and Daniel Ladzinski

Sources:

-

- https://faq.ssa.gov/en-us/Topic/article/KA-01951#:~:text=How%20much%20is%20the%20increase,%2Dliving%20adjustment%20(COLA)

- https://finance.yahoo.com/quote/%5ETN

- https://www.investopedia.com/ask/answers/111314/what-causes-inflation-and-does-anyone-gain-it.asp#:~:text=Expansionary%20Fiscal%20and%20Monetary%20Policy&text=The%20government%20could%20also%20stimulate,too%20can%20loose%20monetary%20policy

- https://fiscaldata.treasury.gov/americas-finance-guide/national-deficit/

- https://bipartisanpolicy.org/report/deficit-tracker/

Notes & Disclaimer: Investment advisory services are offered through Summit Financial Consulting LLC, an SEC registered investment advisory firm. Registration does not imply a certain level of skill or training. Summit Financial Consulting Investment Advisory Firm Representatives do not render tax, legal, or accounting advice. Life/Annuity Insurance products and services offered by the individual insurance agent. Health insurance is offered through Summit Health Services, LLC and Property/Casualty (P&C) Insurance is offered through Summit Insurance Services, LLC and our local P&C agency partners. Please update Summit Financial Consulting LLC, if your investment objectives have changed or if the personal or financial information previously provided has changed. The investment advisory disclosure document that describes Summit Financial Consulting investment advisory services account is provided to you annually, but additional copies are available upon request. Investing involves risk, including the risk of a total loss. Stock market indices, like the S&P 500 Index, are unmanaged groups of securities considered to be representative of the stock market in general or subsets of the market, and their performance is not reflective of the performance of any specific investment. Investments cannot be made directly into an index. Historical returns data are calculated using data provided by sources deemed to be reliable, but no representation or warranty, expressed or implied, is made as to their accuracy, completeness or correctness. Dividends are not included in index returns. This information is provided “AS IS” without any warranty of any kind. Past performance is no guarantee of future results. This communication is only intended for recipients who reside in states where our agents are licensed to sell these products. All guarantees are subject to the claims paying ability of the issuing insurance company. Past performance cannot predict future performance. It is not possible to invest directly in an index. Representatives of Summit Financial Consulting LLC offer tax preparation services through Summit Tax Services. Summit Tax Services is a DBA of Heemer Klein & Company and they are owned and operated independently.