Estate Planning – Don’t Overlook it!

If you have been following our recent blog postings, you may have noticed we have been focusing heavily on the investment management side of our business. However, comprehensive financial planning involves a wide variety of topics. Our following few blogs will primarily target estate planning topics that the general public is typically unaware of. It is our personal opinion that estate planning is one of the most commonly overlooked areas of financial planning.

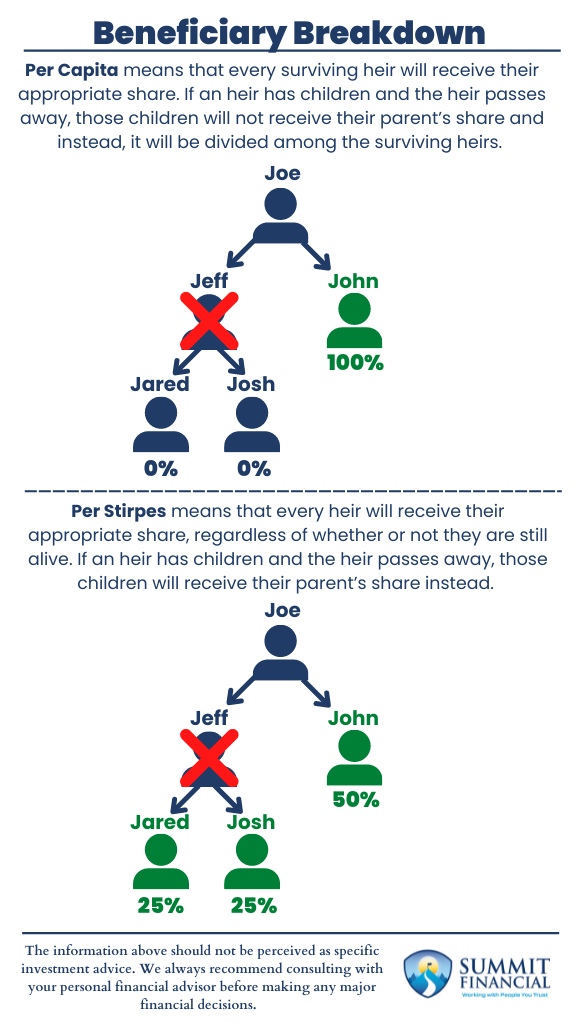

To start, we will be discussing the differences between Per Capita and Per Stirpes beneficiary designations. This is the first layer of estate planning that many individuals come across. These beneficiary designations are most commonly found within life insurance policies and retirement savings accounts.

Per Capita Designation – What’s it Mean?

Per Capita is derived from a Latin phrase meaning “by head.” In terms of estate planning, this means that every surviving heir will receive their appropriate share. If an heir has children and the heir passes away, those children will not receive their parent’s share and instead, it will be divided among the surviving heirs.

In the illustration below, Bob has three children and Alice and Charles also each have children of their own. If Alice passes away before Bob, her children will not receive anything. The inheritance will be split among Bob and Charles only. The major downside to Per Capita is that you may unintentionally disinherit your grandchildren should any of your children predecease you.

Per Stirpes Designation – How’s it Different?

On the other hand, Per Stirpes is derived from a Latin phrase meaning “by roots” or “or by class.” In terms of estate planning, this means that every heir will receive their appropriate share, regardless of whether or not they are still alive. If an heir has children and the heir passes away, those children will receive their parent’s share instead.

In the illustration below, Bob has three children and Alice and Charles also each have children of their own. If Alice passes away before Bob, her children will receive the share she was entitled to under a Per Stirpes designation. David, Kat, and Sadie will all split Alice’s 1/3 inheritance. The major downside to Per Stirpes is that assets may be passed to a younger generation unintentionally if a parent wants to focus on helping their children instead of grandchildren

Per Capita vs. Per Stirpes Beneficiary Designations – Conclusion

Lastly, we always urge individuals and families to ensure their beneficiary designations are up-to-date and labeled appropriately. If possible, contingent beneficiaries should be listed as well just in case the primary recipient predeceases or simultaneously deceases the original owner. It is always a great idea to have a backup beneficiary.

Per Capita focuses on the generation that is receiving the inheritance whereas Per Stirpes focuses on the bloodline that will receive the legacy. Per Capita will split the inheritance among your surviving children and, to prevent disinheriting your grandchildren, Per Stirpes will distribute the legacy along the bloodline of your children in the case one of your children predeceases you.

Have Any Questions?

If you have any questions about taxes, your individual investment portfolio, our 401(k)-recommendation service, or anything else, please call our office at (586) 226-2100.

Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please call us so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink