Many people decide to donate to charities out of the kindness of their heart, while some decide to donate in order to receive certain financial benefits. The most common benefit is the income tax deduction associated with charitable donations.

However, there may be confusion surrounding what can actually be deducted. Charitable contributions should only be deducted if you have enough itemized deductions that exceed the standard deduction option.

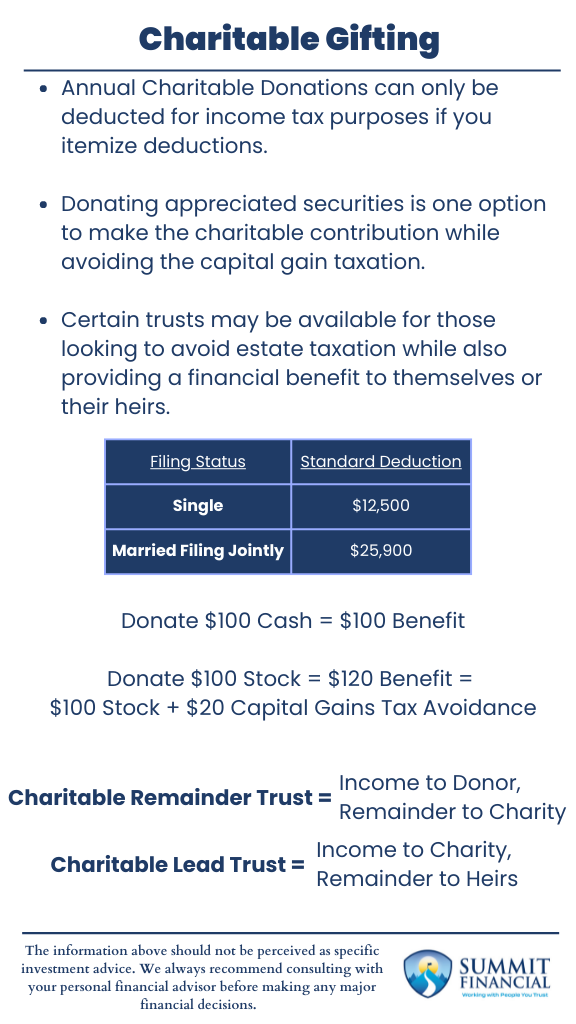

This means that your mortgage interest, local taxes, real estate, taxes, etc. and including your charitable contributions need to exceed the standard amount. The standard deduction amount is $12,950 for single and $25,900 for married filing jointly for 2022. This means that there is no taxable benefit for charitable contributions unless your total itemized deductions exceed these limits.

Donating Stock to Non-Profit Organizations

One strategy to enhance your charitable contribution strategy is to donate appreciated assets. Normally, capital taxes would be due on a stock that has appreciated over time. You can bypass these taxes if you donate the stock directly to the charity rather than first converting it to cash.

Also, as a non-profit organization, the charity will not have to pay capital gains taxes on the asset either. This strategy provides flexibility by donating assets other than cash and also increase the taxable benefits since you are able to avoid the capital gains taxation.

You may also be able to donate tangible property such as collectibles or fine art, but these assets may require an appraisal to accurately record the donation and associated tax benefits.

Reducing Estate Tax with Charitable Gifting

Charitable gifting is also a common strategy for those looking to reduce their estate tax liability. Individuals and couples can reduce the amount subject to estate taxation by removing assets from their estate. The most popular strategies are Charitable Lead Trust and a Charitable Remainder Trust.

A CLT is a charitable donation in which the designation charity would receive a stream of income during the donor’s life, but the remaining balance is passed onto the donor’s heirs at the trust’s expiration. A CRT is the opposite, so the donor receives an income stream for their lifetime and the remainder is passed on to the charity at their passing.

Both trust options are very similar, and both are irrevocable trusts which allow the assets to bypass estate taxation. The key difference is whether the charity receives the temporary income stream or if they receive the remaining lump sum. The decision comes down to the specific financial situation of the donor and the exact goals they are trying to accomplish with the charitable gift.

Get Help From a Tax Professional

Lastly, we would like to clarify that some guidelines and limits may change depending on your situation and the charity receiving the donation. We recommend meeting with a tax professional to specify the potential tax benefits of your gifting strategy and to identify the amount that may be offset for tax purposes.

We also recommend meeting with an estate planning attorney as it relates to any estate tax strategies and developing an efficient legacy plan. The information above should be perceived as general information and should not be portrayed as specific financial advice.

Charitable Gifting – Key Takeaways

- Annual Charitable Donations can only be deducted for income tax purposes if you itemize deductions.

- Donating appreciated securities is one option to make the charitable contribution while avoiding the capital gain taxation.

- Certain trusts may be available for those looking to avoid estate taxation while also providing a financial benefit to themselves or their heirs.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, James Wink and James Baldwin

Sources:

- https://www.tiaa.org/public/retire/services/preparing-for-retirement/giving/charitable-giving

- https://www.irs.gov/charities-non-profits/charitable-organizations/charitable-contribution-deductions

- https://www.investopedia.com/terms/c/charitabledonation.asp

- https://www.bankrate.com/retirement/what-is-a-charitable-trust/

- https://www.wsj.com/articles/what-is-standard-deduction-2021-2022-how-much-11646425372