We believe debt can have a strong negative influence on your financial plan for two main reasons.

- First, the money that is being charged in the form of interest is being paid to the lender rather than being kept for another potential financial goal. The more debt you have, the more interest you are likely paying, and the more money that is possibly leaving your fingertips every month.

- Second, we believe debt can have a negative psychological impact as well. Taking on a loan to buy that new car may not be a stressful decision, but making those monthly payments for years ahead could take an emotional toll on anyone.

We have seen that psychological hindrances can sometimes lead people away from personal finance in general as they are hesitant to face their debt head-on.

We also put together a blog about different types of debt, which ties in well with this topic of Understanding Secured vs. Unsecured Debt.

Not All Debt Is Created Equal

We briefly want to mention that some debts may be better than others because they offer a tax deductibility benefit.

For example, mortgage and student loan interest may be deductible from your income and result in a lower tax bill. Because of this, and depending on the specific details, non-deductible debt could be prioritized last and not strictly follow the rules of the strategies discussed below.

Understanding the Debt Snowball Method

One of the most common debt repayment strategies is the Debt Snowball method. This strategy would instruct individuals to make the minimum payments on their debt and then allocate any additional monthly cash flow to the smallest loan balance.

Once that balance is paid off, the payments are redirected to the next smallest balance. Rinse and repeat. As debt is paid off, the amount that gets redirected will continue to increase by the minimum payment that was absorbed.

Just as a snowball gets larger and larger as it rolls, the redirected payments get larger and larger as more debt is paid off.

We think this strategy is great because you can see your efforts growing over time, and that can sometimes be the motivation needed to continue working hard toward your financial goals.

Exploring the Debt Avalanche Strategy

However, the debt snowball may not be the most mathematically advantageous option. The Debt Avalanche strategy suggests you should make the minimum payments on your debts and then allocate any additional monthly cash flow to the loan with the highest interest rate.

If the goal is to reduce the total amount of interest paid, then the avalanche method should be considered. The obvious downside to this strategy is that you may not get the same type of snowball effect.

The avalanche may be slower at the start but will be a considerable force by the end. This may make it a tougher psychological task since you may not see that first win or first debt paid off as soon as possible.

Realistic Comparison: Snowball vs. Avalanche in Action

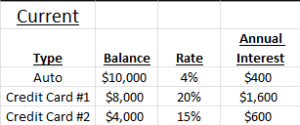

Below is a table of a few examples of debt, along with balances, interest rates, and annual interest owed. Let’s say that this individual was gifted a $1,000 bonus at work for hitting a performance benchmark. Which debt should they consider allocating the money towards?

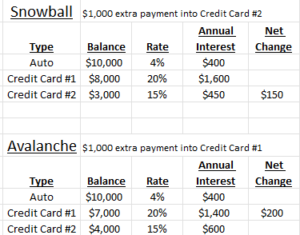

The Snowball strategy would suggest using the $1,000 to pay down credit card #2 because it is the smallest balance. The Avalanche strategy would suggest paying down Credit Card #1 since it includes the highest interest rate.

The graphic below shows the result of each strategy. As you can see, the Avalanche was able to reduce the monthly interest by $200 compared to the $150 in savings of the Snowball strategy.

This hypothetical example is for illustrative purposes only.

Debt Repayment Strategies – Key Takeaways

- We believe debt can have a crippling effect on a financial plan, so it is important to identify the wrong types of debt and consider paying them off quickly.

- The Debt Snowball method focuses on paying off your smallest debt first then adding those payment amounts to the next smallest debts.

- The Debt Avalanche method guides you towards paying down the highest interest rate debt first then allocating those payment amounts to the next highest rate.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100.

Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink.

If you found this article helpful, consider reading:

- How to Negotiate a Raise

- Qualified vs. Non-Qualified Dividends

- Recommended Books on Personal Finance

Sources: