Continuing our current discussion, we have been looking at various types of insurance over the past couple months. Overall, insurance is a risk management process. Risk is managed by buying the insurance policy to protect against a financial loss event. We will cover the basics of life, health, disability, and home and auto insurance. This month, we will be focusing on disability insurance, including the different types of policies and the associated benefits.

The Definition of Disability

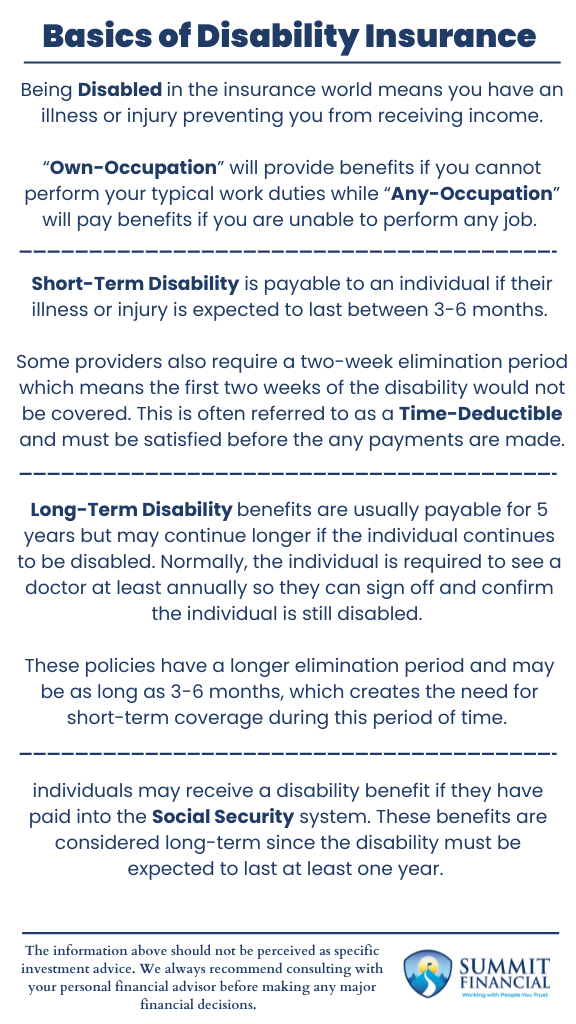

Before we begin diving into the different types of policies, it is important to understand exactly what it means to be disabled. Being disabled in the insurance world means you have an illness or injury preventing you from receiving your ordinary income.

This type of insurance protects an individual by providing an income stream if they are no longer able to work. However, there is a difference between being able to work your normal job versus being able to work any job.

This specific detail should be considered when purchasing disability insurance. “Own-Occupation” will provide benefits if you cannot perform your typical work duties while “Any-Occupation” will pay benefits if you are unable to perform any job.

For example, a brain surgeon heavily relies on their hands in their typical work duties. Under the “Own-Occupation” policy, the doctor will be paid disability benefits if they lost movement in either of their hands. However, under “Any-Occupation” it could be reasoned that the surgeon could work as a mentor to new surgeons instead of continuing to perform complex surgeries. Under the “Any-Occupation” the individual would only receive a benefit for the decrease in income experienced from transitioning from a surgeon to a mentor.

How Does Short-Term Disability Insurance Work?

Short-term disability is payable to an individual if their illness or injury is expected to last between 3-6 months normally. The exact duration of the policy may vary from case to case. However, the concept remains the same.

Short-term disability insurance only provides a temporary benefit. Because the benefits timeframes are limited, these policies typically payout larger amounts. Benefits are payable once a doctor confirms that you are technically disabled, and this confirmation is sent to the disability insurance provider.

Some providers also require a two-week elimination period which means the first two weeks of the disability would not be covered. This is often referred to as a time-deductible and must be satisfied before any payments are made.

How Does Long-Term Disability Insurance Work?

We believe Long-term disability is much more important since these disabilities can last forever. We strongly recommend an emergency fund for every individual and family, so short-term disabilities may be supported by this emergency fund.

For long-term disability though, this risk can last a lifetime and may occur before the individual is able to save enough funds to provide income forever.

Long-term disability benefits are usually payable for 5 years but may continue longer if the individual continues to be disabled. Normally the individual is required to see a doctor at least annually so they can sign off and confirm the individual is still disabled.

These policies typically payout a lesser amount than short-term coverage, but the benefits may last as long as the individual is disabled. These policies also have a longer elimination period and may be as long as 3-6 months. (This explains the potential need for short-term coverage until the long-term benefits begin.)

How Does Social Security Disability Work?

As part of the Social Security program, individuals may receive a disability benefit if they have paid into the Social Security system. These benefits are considered long-term since the disability must be expected to last at least one year. These benefits are limited by the amount that was paid into social security by the individual.

Since this benefit is provided at no cost for those who paid into the system, this should be accounted for when purchasing additional coverage. It is not common to get a 100% income replacement policy, but you most likely will receive the social security benefits as well.

We see that most disability policies target 60-70% income replacement but may be increased for additional premiums. Social Security Disability can be used to fill the remaining income gap.

How to Choose the Right Disability Insurance Coverage

We recommend all of our employed clients check with their employer to see what disability benefits they may have through work. We do provide this coverage, so please let us know if you would like a quote on a personal policy.

Financial Planning and Review Meeting

If you have any questions about your investment portfolio, taxes, retirement planning, our 401(k)-recommendation service, or anything else in general, please call our office at (586) 226-2100. Please also reach out if you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation.

Feel free to forward this commentary to a friend, family member, or co-worker. We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink