As the saying goes, do not place all your eggs in one basket. This is perhaps one of the most important lessons when discussing investment management and retirement planning. Before we dive into the various diversification options, please reference our post from last month if you need a refresher on diversification in general. (This post will solely cover diversifying bond or fixed income positions. Last month we discussed stocks, and next month will be regarding miscellaneous investments).

We do feel the need to address the concern of over-diversification. Having your investments spread too thin will severely hinder the potential for substantial growth. It is essential to focus on the companies and areas that will outperform and decrease exposure to those expected to underperform. Warren Buffet once said, “Wide diversification is only required when investors do not understand what they are doing.”

Issuer Diversification

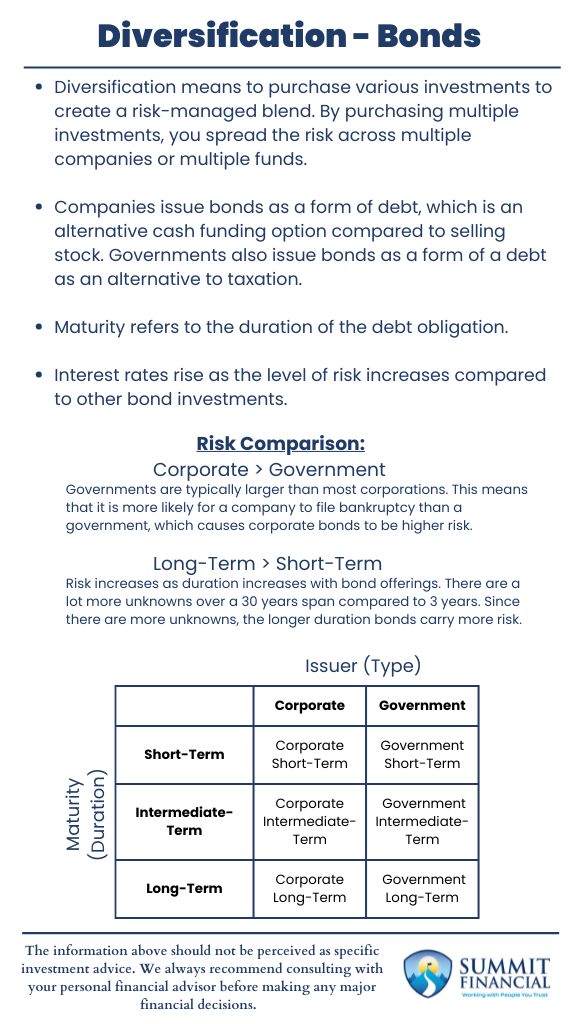

The issuer of a bond is the source of the bond itself. The two leading issuers we will be discussing today are corporations and governments. Companies issue bonds as a form of debt, an alternative cash funding option compared to selling stock. Governments also issue bonds as a form of obligation as an alternative to taxation. The issuer is the source of the debt, and they typically make the debt payments to the bondholders or the investor.

The interest rate associated with a bond is primarily based on the underlying risk associated with the issuer. If the underlying company goes bankrupt, you may only receive a portion of the bond value, if anything. The riskier the issuer, the higher the interest rate. Investors are paid more for buying the debt of more difficult companies. Ultra-risky companies are often referred to as Junk Bonds. Those with higher credit ratings are considered Investment Grade. The difference between these two is that Investment Grade companies are less likely to go bankrupt, so they issue debt with a lower interest rate.

Governments are typically more reliable, so treasury bonds usually carry a lower interest rate. However, the strength of the United States is much more dependable than any American company. As a result, foreign companies, especially smaller ones, often issue debt at higher interest rates. As interest rates continue to fall, this is usually a sign of a healthy economy. In recent years, many countries have been issuing debt at near or below zero percent. This is because the underlying government does not have the cash flow to pay its debt obligations.

Maturity Diversification

Next up, we will discuss the various maturity options for bonds. Maturity essentially refers to the duration of the debt obligation. There are short-term bonds, intermediate-term bonds, and long-term bond options. As we mentioned above, interest rates increase with a higher level of risk. Purchasing debt for 30 years is much riskier than buying debt for three years. There are many more unknowns and many more risk possibilities that can occur over 30 years than can happen in 3 years.

In summary, there are two primary ways that an investor can diversify their bond holdings. The first is a blend of corporate and government bonds, and the second includes a combination of varying maturities. This diversification aims to potentially reduce risk within your bond holdings while also maintaining a sufficient level of yield.

If you have any questions about taxes, your investment portfolio, our 401(k) recommendation service, or anything else, please call our office at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please give us a call to discuss it.

If you found our article helpful, consider reading our other recent posts on Record Inflation, Fiduciary vs. Financial Advisor, and Roth IRA Conversion.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them!

Best Regards,

Zachary A. Bachner, CFP®

Robert L. Wink

Kenneth R. Wink

James D. Wink

Summit Financial Consulting