We have continued to see a drastic increase in prices over the past couple of months, as the March Consumer Price Index report showed an annual increase of 8.50% and we just received April’s 8.30% report.

Is Inflation Peaking, or Could It Rebound?

This slight slowdown could potentially signal that the worst is behind us and that March was the peak in inflation for the current cycle. However, the inflation rate fell only slightly and could very well bounce back above the March levels based on several reasons.

Our biggest concern is the ongoing geopolitical issues in Russia-Ukraine and the impact these tensions will have on the price of oil and gas. Energy components account for a large portion of inflation data so increased pressures on these commodities could cause inflation to ascend to a new high.

Rising Costs and Household Budgeting

We recently discussed the current inflationary environment in our article on Gas Prices and the importance of household budgeting. Households are seeing the impact of inflation at the pump and inside of grocery stores.

These increased prices should be accounted for in your monthly budget to ensure that you remain on track for your spending and saving goals. Companies are struggling with their profit margins due to the increasing cost of goods sold.

Increased prices for raw materials, shipping costs, etc., continue to shrink corporate margins and reduce profitability. Many companies will pass on these increased costs to the consumer through a price increase of the end product or service.

And in turn, employees will be looking for pay increases to cover the increased costs in their household budgets. This vicious cycle between wage inflation and end-product inflation will result in higher and higher prices as corporations try to maintain control over their profit margins.

How Inflation Affects the Stock Market

High inflation is obviously great for investors allocated to raw materials and associated companies. We believe energy has been a top performing sector this year as oil has benefited enormously from the record levels of inflation.

These energy companies typically yield higher profits as the raw material price increases. Many corporations will struggle with the inflationary effect on their profit margins, but energy companies will benefit from this factor.

Consumer discretionary spending is likely to decline to while the stock price of sectors such as consumer staples and utilities should benefit from their consistent track record. Consumers will still need to buy grocery and household items along with paying their monthly gas and electric bills.

Small and Growth focused companies typically struggle the most with inflation since they do not have the pricing power of their larger competitors.

It is important that we note the above information should not be portrayed as investment advice. We mentioned that inflation data has potentially peaked in March, which means the investment performance moving forward may also be shifting.

We always recommend consulting with your personal financial advisor before making any major financial decisions.

Preparing for Rising Costs: Key Takeaways

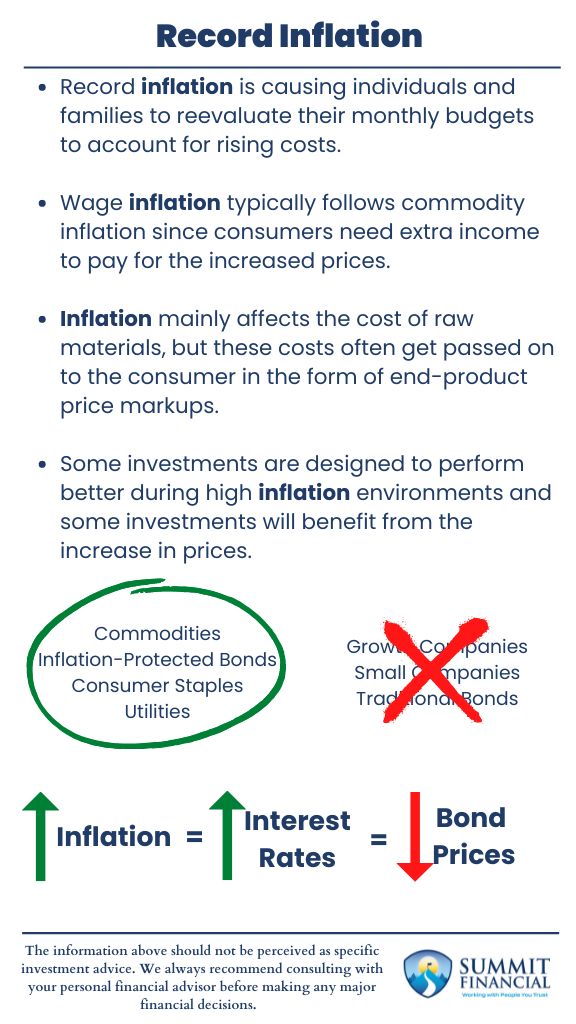

- Record inflation is causing individuals and families to reevaluate their monthly budgets to account for rising costs.

- Wage inflation typically follows commodity inflation since consumers need extra income to pay for the increased prices.

- Inflation mainly affects the cost of raw materials, but these costs often get passed on to the consumer in the form of end-product price markups.

- Some investments are designed to perform better during high inflation environments and some investments will benefit from the increase in prices.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

If you found this article helpful, consider reading:

- Navigating College Funding

- Financial Planning Mistakes to Avoid

- Debt Repayment Strategies

- How to Negotiate a Raise

Sources: