As the saying goes, do not place all your eggs in one basket. We believe this is perhaps one of the most important lessons when discussing investment management and retirement planning. Before we dive into the various diversification options, if you need a refresher on diversification in general, please reference our posts from the previous two months. (This post will solely cover miscellaneous positions. In the first month, we discussed stocks, and in the second month, we covered bonds.)

We do feel the need to address the concern of over-diversification. Having your investments spread too thin may hinder the potential for investment growth. We believe it is important to focus on the companies and areas that will outperform and decrease exposure to those that are expected to underperform. As Warren Buffet once said, “Wide diversification is only required when investors do not understand what they are doing.”

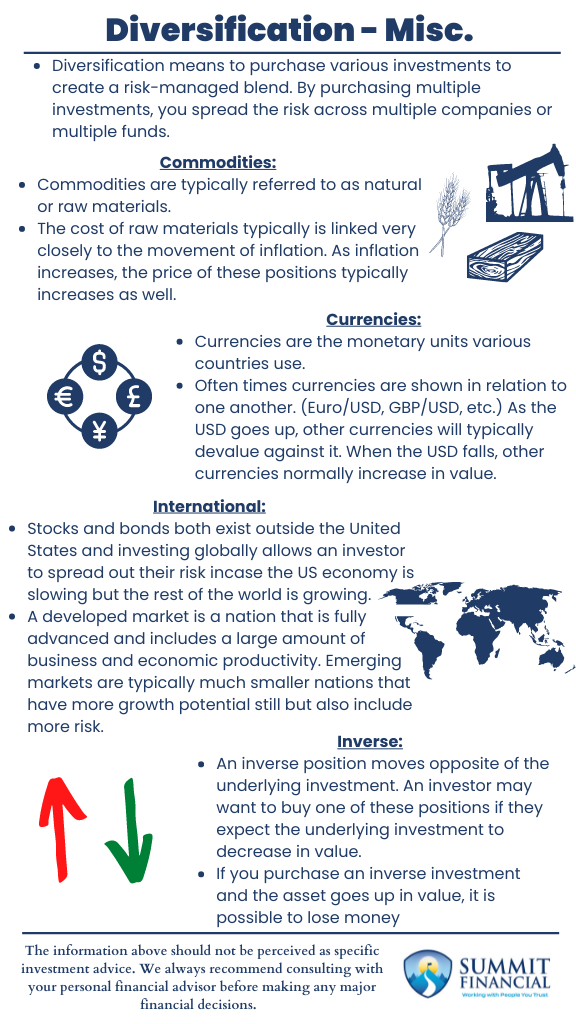

Commodities: Understanding Raw Material Investments

Commodities are typically referred to as natural or raw materials. This would include positions such as Gold, Oil, Sugar, Lumber, etc. The cost of raw materials typically is linked very closely to the movement of inflation. As inflation increases, the price of these positions typically increases as well. This creates and increased expense for many companies and may tighten their margins resulting in less profitability.

These commodities are also influenced by supply and demand. As supply increases and demand decreases, the price will typically go down. If supply decreases and demand increases, prices will normally go up. If there is less production in the economy, oil and gas are not as desirable so the price will usually go down. If there is a lot of volatility in equity markets, people will demand gold as a safe haven so the price may increase (www.investopedia.com).

Currencies: How Exchange Rates Impact Investment Portfolios

Currencies are the monetary units various countries use. For example, in the United States, we use the US Dollar. The Euro, British Pound, Japanese Yen, and Mexican Peso are other examples. Often currencies are shown about one another. (Euro/USD, GBP/USD, etc.) This is because currencies are typically exchanged for one another. As a result, the best way to show the pricing is the relative strength between each other.

As the USD goes up, other currencies will typically devalue against it. When the USD falls, other currencies normally increase in value. Everything from GDP to interest rates and supply/demand for the currency can affect the pricing. Also, fiscal and monetary policy can influence currency prices since the underlying government is affecting the money supply.

International Investments: Exposure to Global Markets

Currencies are the monetary units various countries use. In the United States, we use the US Dollar. Other examples are the Euro, British Pound, Japanese Yen, Mexican Peso. Often times currencies are shown in relation to one another. (Euro/USD, GBP/USD, etc.) This is due to the fact that currencies are typically exchanged for one another. As a result, the best way to show the pricing is the relative strength between each other.

As the USD goes up, other currencies will typically devalue against it. When the USD falls, other currencies normally increase in value. Everything from GDP, to interest rates, and supply/demand for the currency is able to affect the pricing. Also, fiscal and monetary policy are able to influence currency prices since the underlying government is affecting the money supply.

Inverse Investments: Profiting from Market Declines

An inverse position moves opposite of the underlying investment. An investor may want to buy one of these positions if they expect the underlying investment to decrease in value. If that were to happen, the inverse would increase in value. If you purchase an inverse investment and the asset goes up in value, it is possible to lose money accordingly. Inverse funds include bonds, equities, currencies, and commodities.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Sincerely,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

Sources:

- https://www.schwab.com/etfs/mutual-funds-vs-etfs

- https://www.investopedia.com/articles/exchangetradedfunds/08/etf-mutual-fund-difference.asp