We recently discussed Monetary Policy in our previous blog post, and this time around, we will be discussing Fiscal Policy.

These two policy efforts are implemented by different parts of the government, with Monetary Policy being controlled by the Federal Reserve and Fiscal Policy being controlled by Congress. However, they both have the same goals: to either expand or contract the current economic environment.

The Role of Fiscal Policy in the Economy

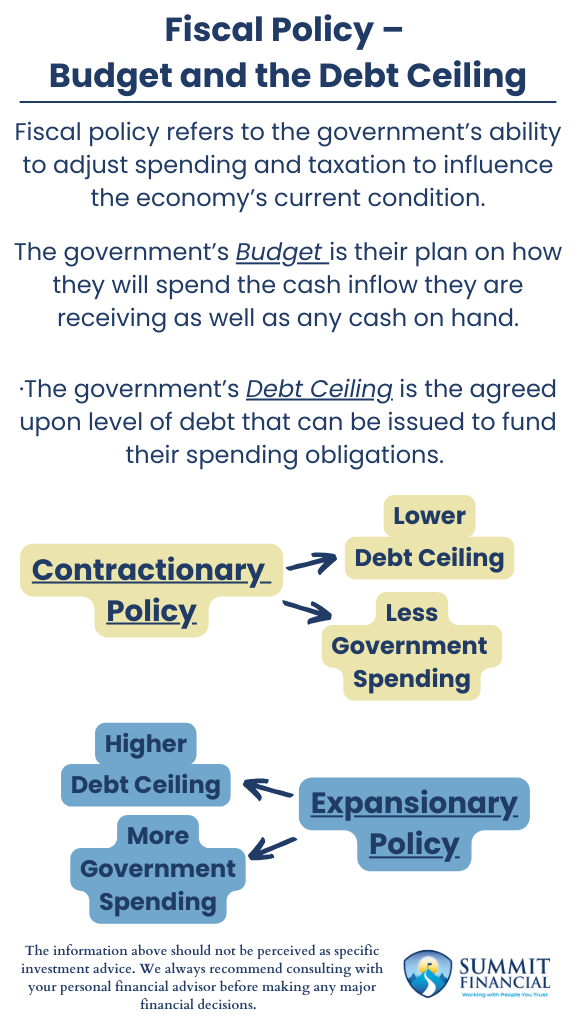

Fiscal policy refers to the government’s ability to adjust spending and taxation to influence the economy’s current condition.

These are both very important measures for the government to consider, so we will tackle them in separate blog entries. This post will focus on fiscal policy’s spending portion, and the next blog will focus on the taxation side of policy.

As it relates to government spending, there are two main factors that we want to discuss: Budget & Debt Ceiling. Spending can be contractionary when fewer funds are used to reinvest in the country, and policy becomes expansionary when the government increases spending to bolster different areas of the economy.

Government Budget: A Spending Plan

The government’s Budget is their plan on how they will spend the cash inflow they are receiving as well as any cash on hand. Like a household or business, the government has a budget that they attempt to follow, and this plan is proposed and agreed upon through a congress voting process.

The government’s expenses are typically divided into either mandatory or discretionary expenses. Much like a household has its required expenses, such as food and utilities, the government has necessities, such as Medicare and Social Security.

Households may have discretionary expenses like entertainment and travel, but the government has discretionary expenses of national defense and scientific research agencies. Different political parties have different priorities and where they allocate their budget can highlight their main concerns. A proposed budget plan can be very insightful as we are approaching the upcoming presidential election.

Budget Deficits and the Debt Ceiling

Also, just like a household, there are times (unfortunately too often) when the government cannot fulfill their budget with their incoming cash flow. When outflows exceed inflows, this creates a budget deficit. And just like a household, the government can utilize debt in order to fund the remaining expenses. Instead of running expenses through a credit card, the government will issue debt in the form of treasury bonds or bills.

The government’s Debt Ceiling is the agreed-upon level of debt that can be issued to fund their spending obligations. Government shutdowns have happened in the past when Congress cannot agree on the debt ceiling and can cause further delays or disruptions in the economy. Once again, proposed debt plans can be insightful when evaluating the political parties for the upcoming presidential election.

Understanding U.S. National Debt

The U.S. National Debt currently sits at roughly $35.5 trillion and has been on a constant upwards trend. It is not necessarily a bad thing that the government has taken on so much debt. Utilizing leverage can be an efficient way to fund expenditures, much like how a household may take on a mortgage to pay for a home.

However, a healthy balance sheet does require a large amount of assets to counterbalance the large amount of debt and the total US assets does exceed the total US debt by a fair margin. Also, with more debt comes more interest payments. The U.S. is hitting records for outstanding debt, and we are also seeing records of the total interest payments that are being made. It is up to Congress to ensure our nation’s debt does not balloon out of control and continue to prevent the major concern of government bankruptcy.

Fiscal Policy – Budget and the Debt Ceiling

- Fiscal policy refers to the government’s ability to adjust spending and taxation to influence the economy’s current condition.

- The government’s Budget is their plan on how they will spend the cash inflow they are receiving as well as any cash on hand.

- The government’s Debt Ceiling is the agreed upon level of debt that can be issued to fund their spending obligations.

Financial Planning and Review Meeting

If you have any questions about interest rates, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

Sources:

- https://www.investopedia.com/terms/d/debt-ceiling.asp

- https://www.investopedia.com/terms/f/fiscalpolicy.asp

- https://www.usdebtclock.org/

- https://www.federalreserve.gov/faqs/money_12855.htm#:~:text=Monetary%20policy%20refers%20to%20the,policies%20of%20a%20national%20government.

- https://fiscaldata.treasury.gov/americas-finance-guide/federal-spending/