We recently discussed Monetary Policy in our previous blog post, and this time around, we will be discussing Fiscal Policy.

These two policy efforts are implemented by various parts of the government, with Monetary Policy being controlled by the Federal Reserve and Fiscal Policy being controlled by Congress. However, they both have the same goals: to either expand or contract the current economic environment.

How Taxation Funds the U.S. Government

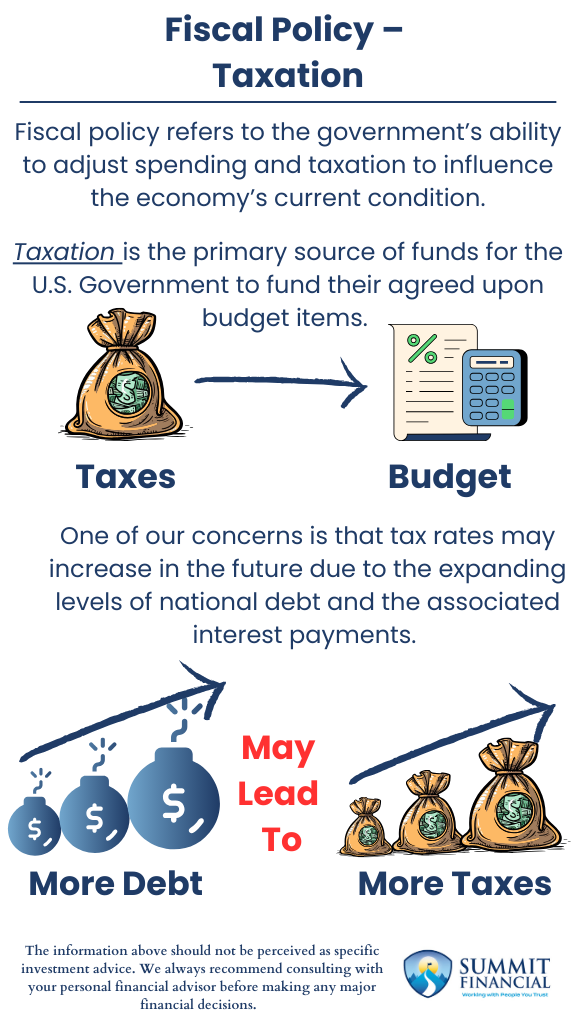

Fiscal policy refers to the government’s ability to adjust spending and taxation to influence the economy’s current condition. These are both very important measures for the government to consider, so we will be tackling these in separate blog entries. This post will be focused on the Taxation portion of Fiscal Policy, and the previous blog will focus on the Spending side of the policy.

Taxation is the primary source of funds for the U.S. Government to fund their agreed-upon budget items. In 2024, the total amount of collected taxes could be near $5 trillion! Almost half of this amount came from income taxes of US citizens, and other large sources were Social Security and Medicare taxes, as well as corporate income taxes. However, the U.S. government still had a budget that exceeded the revenues they collected,

Future Tax Concerns Amid Rising National Debt

One of our concerns is that tax rates may increase in the future due to the expanding levels of national debt and the associated interest payments. If the government ever plans to operate on a budget surplus in the future, it will need to either drastically reduce its budget, or they will need to increase revenues by generating tax dollars.

Tax Revenue in the U.S. vs. Other Nations

Current taxes may already seem high, but the U.S. actually collects less taxes per Gross Domestic Product than other developed nations. The US tax revenue was roughly 27% of GDP, while the average of other developed nations is closer to 34%. This means that our country collects less tax dollars per produced good/service compared to other countries.

However, specifically, income taxes made up a larger portion of the United States’ total revenues compared to the average, which means that our additional tax sources, such as property or sales taxes, contributed less than the average.

Balancing Taxation Levels: Pros and Cons

Deciding on the appropriate level of taxation is a balancing act for the government. They need to weigh the pros and cons of increasing or decreasing taxes. If they increase taxes, then they could fund a higher national budget, but then there is likely less consumption by the citizens. With decreasing taxes, they can achieve higher consumption levels, but they would receive less revenue in return.

Summary: Fiscal Policy Taxation

- Fiscal policy refers to the government’s ability to adjust spending and taxation to influence the economy’s current condition.

- Taxation is the primary source of funds for the U.S. Government to fund their agreed-upon budget items.

- One of our concerns is that tax rates may increase in the future due to the expanding levels of national debt and the associated interest payments.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Sincerely,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

Sources:

- https://www.federalreserve.gov/faqs/money_12855.htm#:~:text=Monetary%20policy%20refers%20to%20the,policies%20of%20a%20national%20government

- https://www.investopedia.com/terms/f/fiscalpolicy.asp

- https://fiscaldata.treasury.gov/americas-finance-guide/government-revenue/#:~:text=Key%20Takeaways,pay%20interest%20incurred%20from%20borrowing.

- https://taxpolicycenter.org/briefing-book/how-do-us-taxes-compare-internationally