The future financial status of the Social Security program is a popular topic of debate. Each year, the Trustees of the Social Security trust report on the programs’ current and projected financial status. The annual report has some questions about how the program will last.

Social Security Things to Know

- Each year, the Social Security Trustees report is released, and it provides insight into how long the money will last.

- Covid negatively affected the numbers

- Tough decisions need to be made between now and 2033.

Evolution of Social Security and Life Expectancy

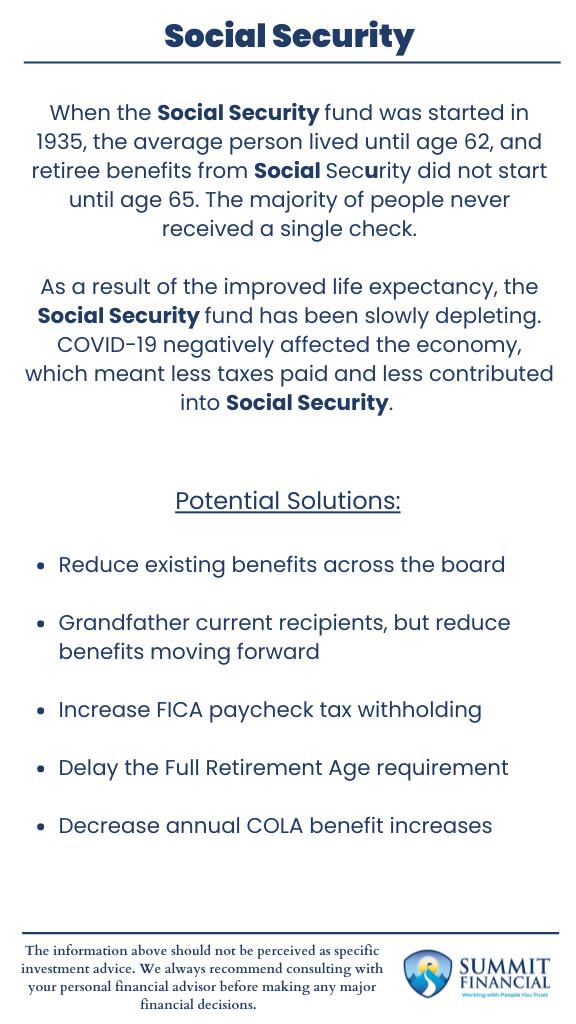

When the Social Security fund was started in 1935, the average person lived until age 62, and retiree benefits from Social Security did not start until age 65. The majority of people never received a single check. In 2021, the average person signs up for Social Security at the youngest age possible, age 62, but life expectancy has increased to age 79, so the average person now draws on it for 17 years.

Covid’s Impact on Social Security

As a result of the improved life expectancy, the Social Security fund has been slowly depleting, and according to the latest report, it will run out of money in 2033. Covid has devastated the economy, which reduced the taxes that were received.

Over 400,000 people died of Covid that were receiving Social Security benefits, but that was outweighed by the economic shortfalls. Before Covid, Social Security was expected to last until 2034, but some feared that it might run out of money as soon as 2029 because of Covid, so it actually turned out better than the worst-case scenarios.

Fixing Social Security

To fix the problem, we believe there are three primary solutions:

- Reduce all benefits across the board.

- Increase FICA paycheck withholding taxes.

- Grandfather all current recipients, but reduce benefits moving forward.

There are additional options that may help when combined with the above options, including pushing out Full Retirement Age for younger workers and reducing the annual “raises” retirees receive (COLA).

Will the politicians proactively plan to save Social Security, or will they wait until the last minute when it is a crisis which will further hurt benefits? Time will tell.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100.

Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Sincerely,

with contributions from Robert Wink, James Wink, and Zachary Bachner

Sources: