Inflation is a popular conversation these days as we have seen a gallon of gas rise from sub $2 levels to above $3 in some areas of the state (AAA). Lumber prices have also been a hot topic as some COVID-19 home projects had to be put on hold due to lumber prices doubling in just a year (CNBC). But what is inflation and how is it measured?

The Basics of Inflation

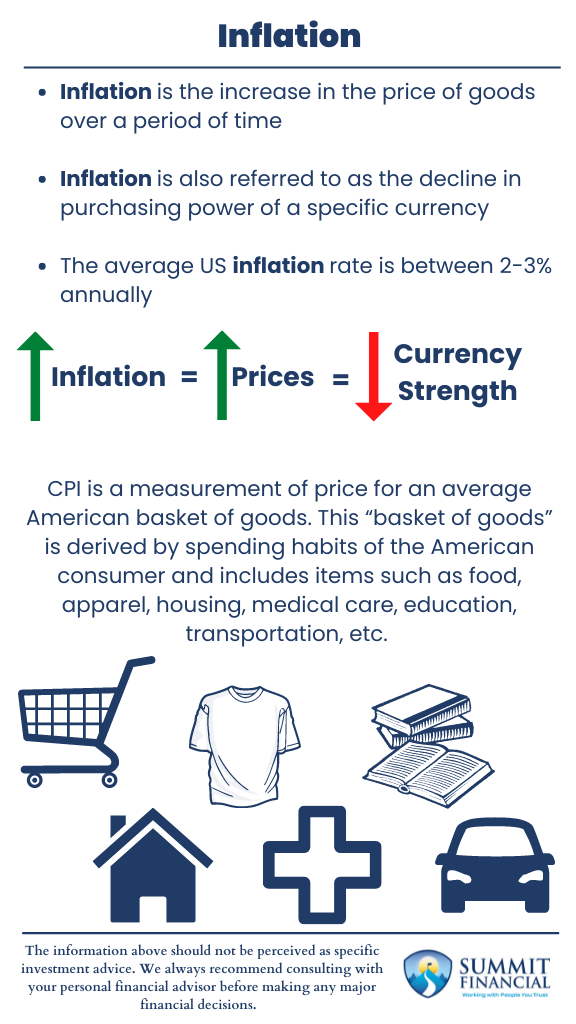

Inflation can be defined in two ways, depending on which side of the coin you look at. Inflation is most thought of as the increase in the price of goods over a period of time. It can also be referred to as the decline in purchasing power of a specific currency.

When prices rise, your dollar does not buy as many goods. This is because the dollar is weakening against the cost of goods. If the dollar weakens, the price of goods increases. If the dollar strengthens, the price of goods decreases. These events happen simultaneously, and one does not cause the other.

Average Inflation Rates in the US

The average rate of inflation in the US is between 2-3% annually. This is calculated by measuring the change in the Consumer Price Index. CPI is a measurement of price for an average American basket of goods. This “basket of goods” is derived by spending habits of the American consumer and includes items such as food, apparel, housing, medical care, education, transportation, etc.

Measuring Inflation Through the Consumer Price Index (CPI)

Every month, the cost of these goods is examined by the government, and the change in CPI results in the recorded monthly inflation. While average inflation ranges from 2-3% annually, this number can be skewed for certain expenses. Medical care and education costs have some of the highest inflation historically.

US Inflation Rate – Summarized

- Inflation is the increase in the price of goods over a period of time

- Inflation is also referred to as the decline in purchasing power of a specific currency

- The average US inflation rate is between 2-3% annually

Financial Planning and Review Meeting

If you have any questions about taxes, your investment portfolio, our 401(k)-recommendation service, or anything else, please get in touch with us or call our office at (586) 226-2100.

Please feel free to forward this commentary to a friend, family member, or co-worker. Also, if you have changed your income, job, family, health insurance, risk tolerance, or overall financial situation, please call us to discuss it. We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

Sources:

- https://gasprices.aaa.com/

- https://www.cnbc.com/2021/02/10/lumber-prices-skyrocket-pushing-up-housing-costs.html