In our recent market commentary, we addressed the potential implications the presidential election may have on the financial markets. This blog will take this concept into account and dive deeper into our analysis. Of course, historical results do not predict future performance, and every presidential election may have its unique outcome. We’ll explore maintaining a long-term investment perspective through the turbulence of election years.

Avoiding Emotional Investment Decisions

First, we want to address one of the main concerns we see revolving around presidential elections. Politics can tend to be a heated topic for some, and this high level of emotions can potentially cause irrational decision-making.

For example, die-hard voters might be overloaded with joy and excitement when their party wins the election. This extremely positive reaction can lead to excessive optimism about the markets and the overall future of the United States, which can lead to additional risk-taking with their investments. This increase in risk can potentially lead to financial distress and future uncertainty if the market ends up experiencing volatility and the overall risk of the investment blend is greater than the investor’s risk tolerance.

The other side of this can certainly be true as well. If an investor is passionate about politics and their party does not win the election, they may expect doom and gloom for the next four years. This extreme negative reaction could potentially lead to the investor decreasing risk within their investments. Their financial plan could be affected if the forecasts were run with a long-term risk tolerance in mind, and then the investor would deviate from that route. Reducing risk, especially moving to cash, could potentially hinder your financial outlook if the market performs well during the new president’s term.

Limited Impact of Politics on Long-Term Returns

Both of these examples are extremes that highlight how investors who are passionate about politics may potentially derail a financial plan by succumbing to the influence of their emotions. We construct our financial plans for a long-term trajectory to minimize the noise we hear from short-term catalysts potentially. The stock market has had positive returns over the very long-term and trying to predict the specific outcome of a 4-year window may prove to be a hinderance rather than a benefit.

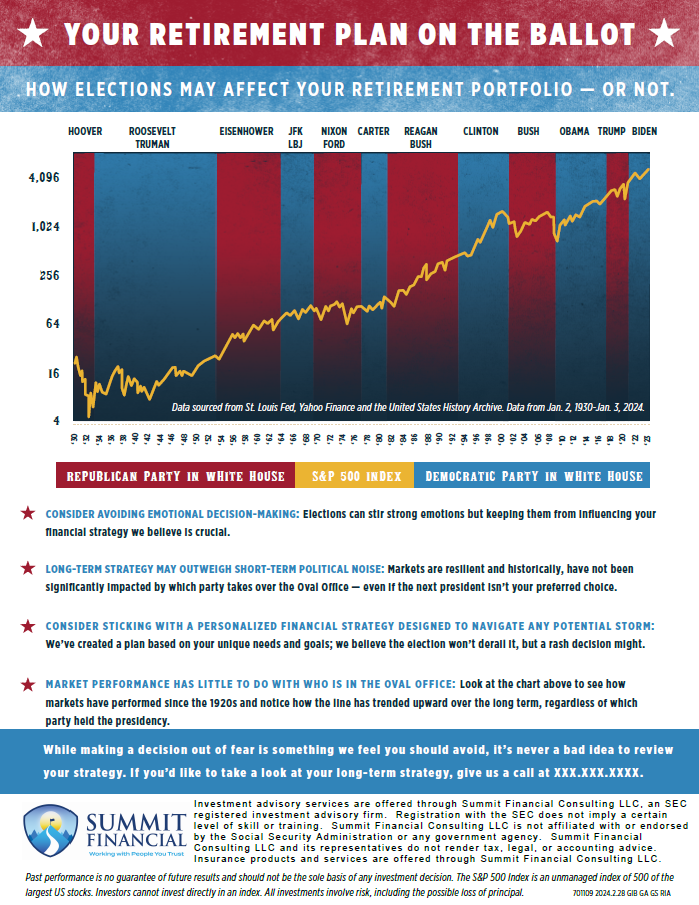

As you can see in the long-term chart, there is not a strong correlation between the market performance and the presidential party in office. This is evidence enough for us to bypass the emotional expectations of the election and focus on the long-term trajectory of the financial plans we create instead.

Politicians’ Economic Incentives Around Elections

However, with this being said, we do believe that politicians attempt to stand out from other candidates in the eyes of the voters. Politicians may potentially do more during the second half of their terms in order to hopefully raise their attractiveness to voters. The president and the party in office may strive to reduce unemployment and increase the economic GDP, and of course, they may try to do what they can to increase the stock market prices. We believe all of these would greatly benefit the nation and could cause some voters to opt for reelection rather than siding with a new president.

Once again, the opposite of this could be true. The non-presidential party may do what it can to make the current party in office look worse as we approach the election. If the stock market is dipping into the election or job cuts and layoffs are increasing, voters may decide not to reelect the current presidential party. There are certainly arguments and disagreements that occur during the presidential debates, but there are possibly similar discussions happening in D.C. behind the scenes as well to try to position their respective parties in the best light possible.

Navigating Election Uncertainty

All of these reasons are why we continue to use long-term forecasts for our client’s financial plans. Our actively managed portfolios are reviewed on a daily basis as we analyze the market reactions to various events. This combination allows us to be flexible with our investments in case we see an opportunity while also helping our clients block out the short-term noise. Politics can be a very emotional topic for some investors, and we do our best to try to help manage those emotions, especially as it relates to financial decisions.

Looking Beyond the Election- Considerations

- While the outcome of the presidential election may impact the overall economy, it is important to not allow personal emotions to influence your financial decisions.

- Based on market data since the 1920’s, there is not a significant correlation between market performance and the elected presidential party. (See graphic.)

- We do believe that politicians do their best as we approach elections to attempt to make their party look better than the others in the eyes of the voters.

Speak With a Trusted Advisor

If you have any questions about how the upcoming presidential election may impact your retirement planning, tax strategies, our 401(k)-recommendation service, or anything else in general, please call our office at (586) 226-2100. Please also reach out if you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation.

Feel free to forward this commentary to a friend, family member, or co-worker. We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

If you found this article helpful, consider reading:

- Understanding the Benefits of a Health Savings Account

- Estate Planning for Blended Households

- Flexible Side Hustles

Sources:

- https://www.investopedia.com/terms/p/presidentialelectioncycle.asp

- https://www.cnbc.com/2024/03/13/markets-dont-seem-to-care-about-the-presidential-election-but-that-could-change-soon.html

- https://summitfc.net/election-year-stock-market-performance/