Long-Term Care is the need of professional assistance to perform regular activities of daily living.

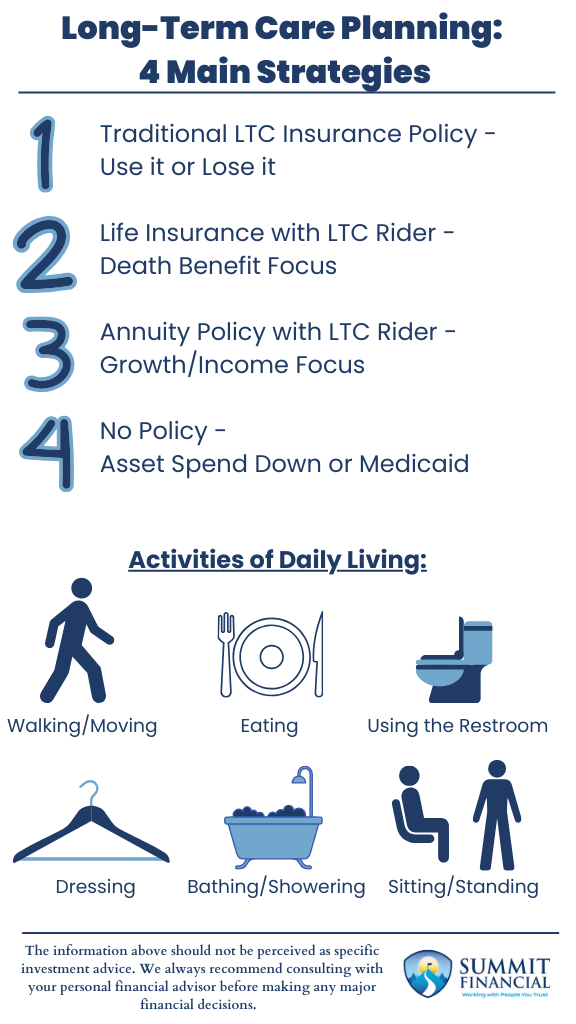

There are six activities of daily living (ADLs) that could qualify an individual for Long-Term Care (LTC) services, including needing assistance with eating, walking/moving, bathing/showering, dressing, standing/sitting, and using the restroom.

The type of care required can range from in-home care to a specialized facility such as a nursing home, depending on the severity of the situation.

Why Long-Term Care Planning Should Be A Priority

Long-Term Care Planning is typically one of the lower priorities for most people. Many individuals and families are much more worried about saving enough for retirement or setting aside extra savings for college.

However, similar to college expenses, the cost of long-term care services tends to inflate at a higher rate than the average consumer goods. This means it may be difficult to have the funds available to cover the costs without effective planning.

Who Should Consider Long-Term Care Planning?

Who should be concerned about future long-term care needs? We believe that everyone should have some sort of plan to tackle these expenses since no one knows what the future will hold.

You may be more likely to need long-term care if you:

-

Have a family history of longevity

-

Are single or widowed

-

Don’t have nearby family to help with care

Anyone could possibly find themselves in a long-term care situation in the future, but the criteria above can make the need more likely than others.

Traditional Long-Term Care Insurance: “Use It or Lose It”

Traditional Long-Term Care Insurance is typically what people think of when the topic is discussed. These contracts are similar to the benefits within a disability policy.

Premiums are paid over time to insure you against the potential need in the future. If you have a qualified claim, the insurance company will pay you a set amount based on the details of the contract you have been paying for.

If you decide to stop paying or if you pass away without ever using the benefits, then the contract is surrendered, and normally, no value can be recouped. We refer to these types of policies as “Use it or Lose it” since those are two outcomes that may occur.

Someone who buys this type of policy typically knows for certain that they will have an LTC need in the future, and if not, then they may even hope for the need because they do not want to waste all the premium dollars that were spent on the policy.

Life Insurance with Long-Term Care Rider

The next type of policy to consider is a Life Insurance policy with an LTC Rider. The primary goal of these policies is to purchase a death benefit for when the individual passes away, and this amount would be tax-free to the beneficiaries.

However, a Long-Term Care rider can be added to the policy in case the need arises, and the care payments will erode the remaining death benefit in the contract. This feature typically will also reduce the overall amount of the death benefit in the policy, but is offset by the potential coverage for LTC needs.

However, if you do not use the LTC benefit, the beneficiaries will still receive the death benefit. This option is ideal for those who will not need the savings for their retirement and want to potentially provide a legacy to the beneficiaries while also protecting themselves against a potential need for care.

Annuity Policy with Long-Term Care Rider

A similar option would be purchasing an Annuity policy with a LTC Rider. Instead of providing a death benefit, the purpose of the annuity policy would be to grow the assets within the contract or to provide an income stream for the annuitant.

There are some products that will enhance the growth within the contract or increase the income benefit of the contract once you become eligible for LTC services. The growth or income of the underlying contract may not be the most attractive benefit, but the addition of the long-term care rider offsets that.

The beneficiaries on the contract will still receive a legacy if there is an account value remaining at death. Still, any gains in the contract may be subject to taxes, unlike the tax-free benefit of the life insurance policy. This type of policy still avoids the “Use it or Lose it” concern and allows the owner to fund their retirement needs while also purchasing protection for future LTC services.

Choosing “No Plan” as a Viable Strategy

Lastly, we do consider “No Plan” to still be a plan. We review long-term care with all of our clients, so if someone opts not to pursue one of the options above, then the agreed-upon strategy is simply no plan. This is alright and is sometimes the best option too.

Some individuals who have an abundance of wealth will be able to pay for their long-term care needs out of pocket while still having assets left to provide for themselves and leave a legacy to their beneficiaries. Some individuals do not have enough assets to be able to sacrifice setting some aside for LTC and prefer to solely focus on their retirement needs instead.

It is important to note that if you have an LTC need and have to pay out of pocket, you will be forced to spend down all of your assets to cover the costs. Once this has happened, Medicaid will step in and begin to cover the cost of care moving forward.

Medicaid imposes more restrictions on the type of care it will pay for, but it is a fallback safety net for those who have a low level of assets. It may not be ideal since the facilities are usually of lower quality, but at least it is comforting to know that you will be able to access some sort of care even if you have not purchased protection yourself.

Long-Term Care Highlights: 4 Main Considerations

- Traditional Long-Term Care Insurance Policy – Use it or Lose it

- Life Insurance with LTC Rider – Death Benefit Focus

- Annuity Policy with LTC Rider – Growth/Income Focus

- No Policy – Asset Spend Down or Medicaid

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink.

If you found this article helpful, consider reading:

Sources: