Now that we have finished discussing diversification, we will dive into the most popular and arguably one of the easiest ways to diversify. That is right. This month, we are comparing and contrasting Mutual Funds and Exchange-Traded Funds. (If you have not read the past few blog postings, we highly suggest you do. We covered diversification strategies for equities, bonds, and miscellaneous investments.)

The following details below can be verified directly from Charles Schwab at https://www.schwab.com/etfs/mutual-funds-vs-etfs or through an additional resource at https://www.investopedia.com/articles/exchangetradedfunds/08/etf-mutual-fund-difference.asp.

Mutual Funds and ETFs Comparisons

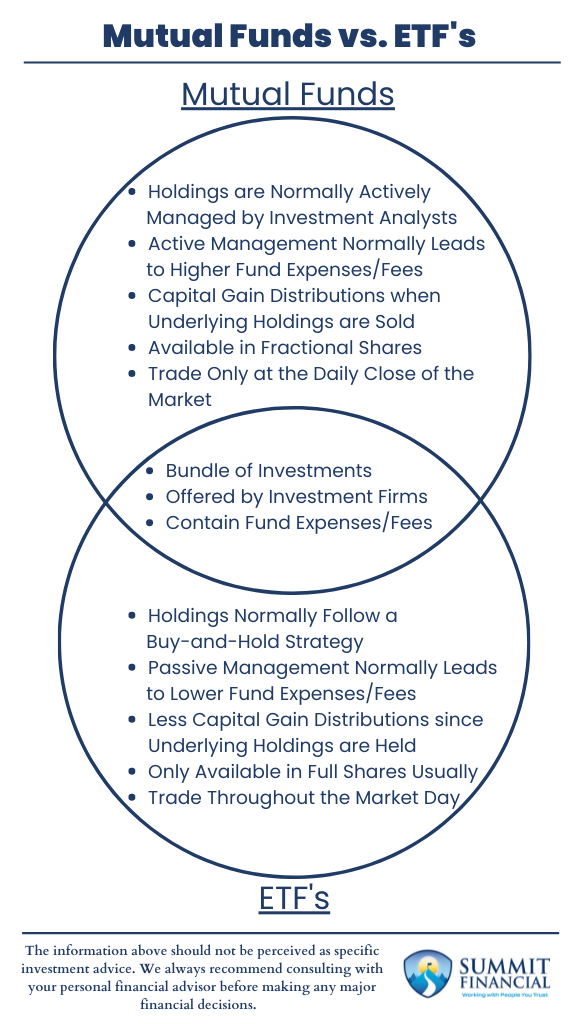

To begin, let us discuss the similarities between mutual funds and exchange-traded funds. First, both products can be considered a bundle of underlying investments. Instead of buying just Apple stock, you can buy a technology fund that will own Apple along with potentially hundreds of other tech companies.

Instead of buying a bond directly from one specific company, you may consider spreading out the risk by purchasing a fund comprised of various highly rated company bonds.

The differences in management approaches lead us to our next topic: expenses. Because mutual funds spend more time buying and selling, they normally charge a higher fee for their active management.

Since exchange-traded funds do not analyze their holdings as much and they try to align with a benchmark, these companies tend to have fewer overall analysts and a lower level of expenses. Because of this, exchange-traded funds tend to charge a lower fee for their products.

Mutual Funds vs. ETFs Contrasts

Next, we will be discussing the differences between mutual funds and exchange-traded funds. To start, let us focus on the underlying management of the funds. As mentioned above, we stated all these funds are typically allocated based on an analyst’s research. However, mutual funds tend to be more actively managed than exchange-traded funds.

This means that a mutual fund company is normally buying and selling more often within the underlying investments. They do this with the goal of outperforming their benchmark or outperforming the market via buying winners and selling losers.

Exchange-traded funds are more along the lines of buy-and-hold strategies when it comes to the underlying investments.

The differences in the management approach leads us to our next topic: Expenses. Because mutual funds spend more time buying and selling, they normally charge a higher fee for their active management.

Since exchange-traded funds do not analyze their holdings as much and they try to align with a benchmark, these companies tend to have fewer overall analysts and a lower level of expenses. Because of this, exchange-traded funds tend to charge a lower fee for their products.

Tax Considerations

Next, we will discuss the differences in taxation. While both products will cause investors to realize gains or losses when the fund is sold, mutual funds may have additional tax factors. Like we stated above, mutual funds often buy and sell underlying investments.

When one of the underlying holdings is sold, the investor technically realizes the gain or loss in that specific holding. However, these tax repercussions are usually released once per year via a capital gain distribution.

This is not usually an issue with an exchange-traded fund since the underlying positions are not frequently traded.

Lastly, each option has their advantage in terms of flexibility. Mutual funds win in terms of quantities since they usually allow investors to buy fractional shares. Exchange-traded funds may be harder to purchase in smaller accounts since they normally require full shares to be purchased.

However, exchange-traded funds have the advantage when it comes to timing. Mutual funds only trade at the close of the market at 4:00 p.m. EST, while exchange-traded funds allow investors to buy and sell at any point throughout the day.

Speak With a Trusted Advisor

If you have any questions about taxes, your 401(k) recommendation service, or other general questions, please call our office at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

Sources:

- https://www.schwab.com/etfs/mutual-funds-vs-etfs

- https://www.investopedia.com/articles/exchangetradedfunds/08/etf-mutual-fund-difference.asp