Choosing if/when to retire is one of the largest financial decisions someone will make during their lifetime. There are a lot of emotions and stress that can occur during this time, which can cause a change in risk tolerance.

When this behavioral change occurs, it is important for the advisor to identify the new risk tolerance for the client and to adjust their investments accordingly.

You can complete our risk questionnaire and receive your personal risk tolerance results. We ask clients to periodically complete this questionnaire to ensure there has been no change to their risk tolerance, but we also ask them to complete it when these major life changes occur.

This is a great way for us to confirm there has indeed been a change in a client’s risk tolerance and allows us to quantify the extent of that change.

Why Clients Tend to Become More Conservative at Retirement

When someone is working and has a steady income, they do not need to live on their savings, so the ups and downs within their accounts tend to not impact their emotional well-being as much.

However, once someone leaves their steady income and is heavily relying on their saved assets to provide them with cash flow, a mindset change is not uncommon. We have seen that clients tend to be much more focused and much more concerned with their investments at this point, and rightfully so.

This heightened concern is one of the reasons that we tend to see clients become more conservative as they retire. Overall, we see clients tend to be more aggressive as they are younger, and they shift to being more conservative as they approach retirement.

Part of this is due to the mindset of younger individuals, who tend to be more optimistic and hopeful for the long-time horizon ahead of them. Also, those who are younger have much more time to make up for any losses that occur in their accounts. Clients who are close to retirement may only have a few years left and may not have the time necessary to recover from big drawdowns in their accounts.

Avoiding Emotional Reactions to Market Movements

While it is important to acknowledge changes in risk tolerance, we also need to be able to advise clients against making changes due to emotional reactions to the markets movements.

Clients tend to become concerned when there is a drop in the market and, consequently, a drop in their investment accounts. This could cause them to stress or panic about their investments and believe they want to reduce risk in order to reduce volatility. However, this type of short-term emotional reaction is caused by market movements and may pass as the market recovers.

It is typically not wise for an investor to listen to these emotions and make rash investment decisions. This is an additional benefit for working with a trusted advisor as they should be able to know when the request for a risk reduction in investments is an emotional response to a recent market move or if it is an underlying risk tolerance change that should be addressed.

You can learn more about behavioral finance and the psychological factors that influence financial decisions.

Sequence of Returns Risk Explained

Your financial advisor should also be aware of the sequence of returns risk. We covered this topic in an earlier blog.

The sequence of returns risk is the possibility of the market providing poor or even negative returns during the early years of retirement and the overall impact these returns can have on a retirement plan.

If you are in the “accumulation” stage, then it does not matter when your good performing years are and when the bad years occur. The main factor during accumulation is the average rate of return per year and not the specific order or sequence of those returns. However, once withdrawals are needed from an account, the order of returns matters since poor returns in early years can deplete the investment account faster.

For example. If you have $100,000 and need to withdraw $4,000 per year, then you are at a 4% withdrawal rate. However, if the account experiences volatility and drops 20% down to $80,000, then the same $4,000 income needs to become a 5% withdrawal. You begin to withdraw larger percentages of the account since the account is at a lower balance.

Mitigating Sequence of Returns Risk with The Bucket Plan

Our primary solution to this risk is to implement The Bucket Plan.

The Bucket Plan is a strategy that involves splitting a client’s money into three separate buckets: Now, Soon, and Later.

- The Now Bucket is for immediate to short-term income needs and are kept in liquid and no-risk accounts such as checking & savings or money market accounts.

- The Soon Bucket is the income needed for the next handful of years, and these accounts should be invested more conservatively in order to help with the sequence of returns risk if the market performs poorly.

- The Later Bucket is longer-term funds that are not needed for income, so they can be invested according to the client’s standard risk tolerance. The sequence of returns risk is not a concern for the Later Bucket since withdrawals will not be taken from these accounts.

Tips for Adapting to Risk Tolerance Shifts During Retirement

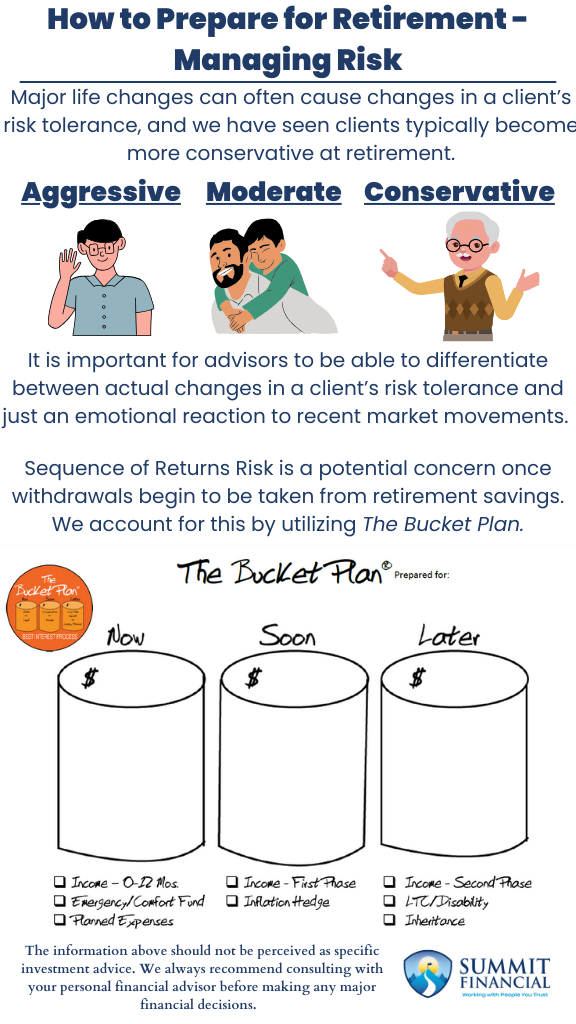

- Major life changes can often cause changes in a client’s risk tolerance, and we have seen clients typically become more conservative at retirement.

- It is important for advisors to be able to differentiate between actual changes in a client’s risk tolerance and just an emotional reaction to recent market movements.

- Sequence of Returns Risk is a potential concern once withdrawals begin to be taken from retirement savings. We account for this by utilizing The Bucket Plan.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

Sources: