It can be a stressful time when you decide if/when you are going to retire. Shifting from a consistent working income to relying on investments, social security, and other retirement benefits can be difficult to adjust to. This transition highlights the importance of efficient tax planning.

We have seen that many retirees want to pay as little in taxes as possible since this potentially would require fewer withdrawals from their retirement savings. This can be an efficient goal for many retirees; however, we do not believe it is the best strategy in all cases.

Evaluating Your Unique Retirement Situation

Of course, everyone has a unique situation, so it is important to talk with your tax advisor before implementing a retirement withdrawal strategy. One important factor that may vary from case to case is the tax diversification of their assets.

For example, does the client have a lot of savings in pre-tax retirement accounts such as a 401(k) or IRA? Or does the client have some after-tax savings in a Roth IRA along with a majority of their assets in a taxable, non-qualified brokerage account? The tax diversification in a client’s asset sheet may impact their tax plan for retirement.

Role of Roth Conversions in Retirement Tax Strategy

One strategy that we see many clients are not aware of when we meet for the first time is the concept of Roth Conversions. We discussed this topic in-depth in a previous blog post: Roth IRA Conversions.

The strategy involves paying the associated income taxes and then shifting assets from Pre-Tax retirement accounts to Post-Tax Roth retirement accounts. We commonly perform these conversions from a Traditional IRA to a Roth IRA.

The benefit in doing this is to potentially minimize the overall taxes paid from the client’s retirement savings. The conversions are ideal for a case if we can utilize a client’s lower tax bracket to prevent required minimum distributions and other withdrawals occurring in a higher bracket later in life.

It is important to consider the beneficiary’s tax bracket, too, and whether or not they would be paying more to fulfill their Inherited IRA RMDs. Instead of kicking the “tax” can down the road, it could potentially be worth paying the tax now and allowing the money to be tax-free from that point forward.

Understanding Tax Implications for Surviving Spouses

Having a spouse pass away is often stressful. Next, we want to mention a situation that will, unfortunately, often surprise a widow. In our experience, income taxes tend to rise after the first spouse passes away.

The surviving spouse may be able to file as a Widow initially, but they will revert back to the single tax status within a few years. If the surviving spouse lives for another decade, that is a handful of years that they will be using the single tax brackets rather than their previous married filing jointly.

Also, there will be a reduction in Social Security benefits after the first spouse passes away. So, the surviving spouse has to balance a lower guaranteed income stream along with a potentially less favorable tax status. This situation is more of a concern for clients who have a larger gap in ages since potentially one of them will live a longer period as a widow.

Conclusion: Tax Planning for Retirement

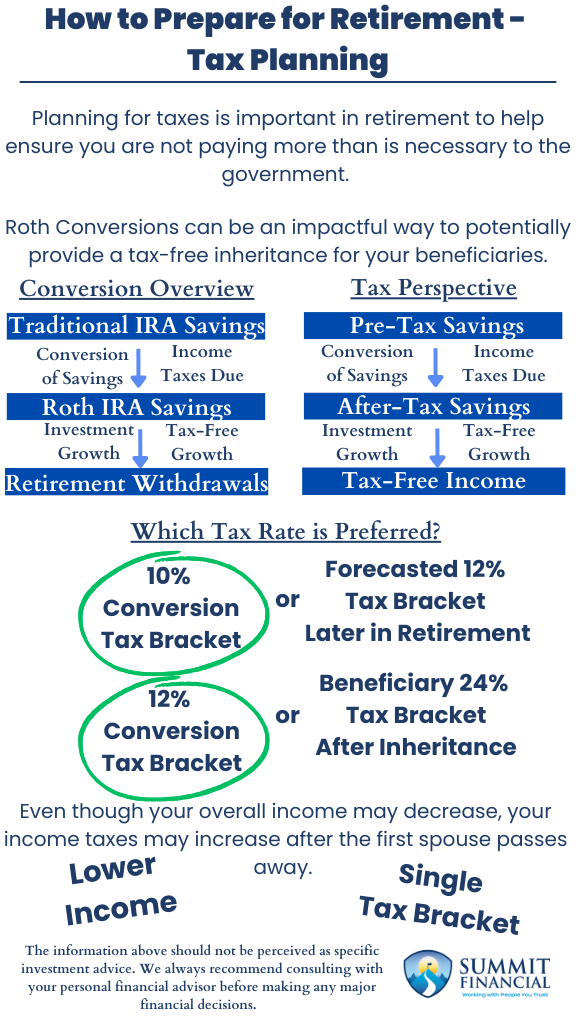

- Planning for taxes is important in retirement to help ensure you are not paying more than is necessary to the government.

- Roth Conversions can be an impactful way to potentially provide a tax-free inheritance for your beneficiaries.

- Even though your overall income may decrease, your income taxes may increase after the first spouse passes away.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, James Wink, and James Baldwin

Sources: