Tax Benefits for Parents in the Big, Beautiful Bill

On Independence Day 2025, President Trump signed the Big, Beautiful Bill into law. This blog, among other content, will be used to help relay some of the important changes to our clients. This post will highlight some of the benefits that are geared towards parents and families that will be implemented due to the passing of the Big, Beautiful Bill.

Key Takeaways for Parents

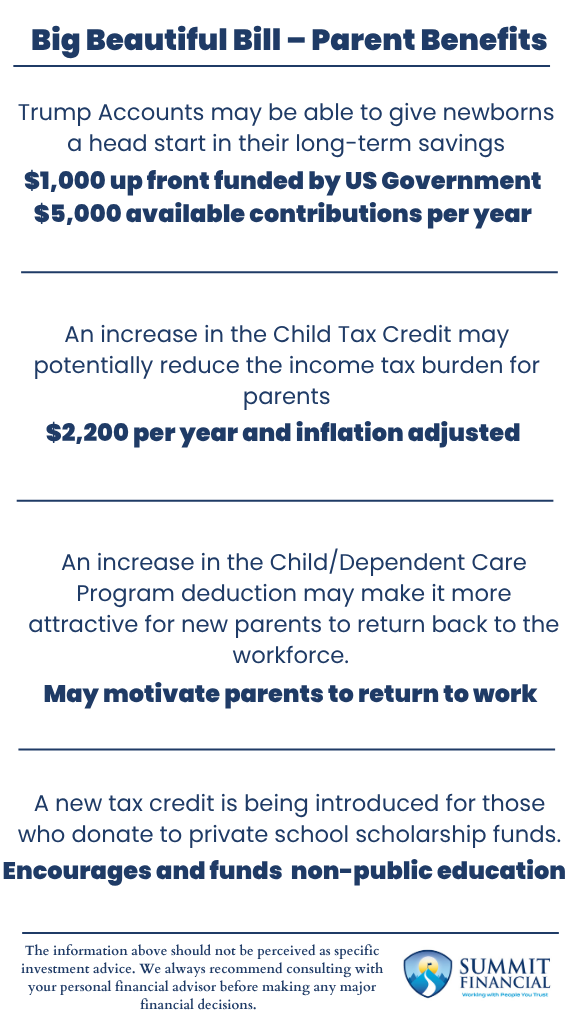

- Trump Accounts may offer newborns a head start in long-term savings with government seed funding and annual contribution options.

- The Child Tax Credit is increasing to potentially reduce income tax liability for qualifying families.

- The Child/Dependent Care Program deduction is expanding, which may encourage workforce reentry for new parents.

- A new tax credit is available for contributions to private school scholarship funds or qualifying homeschooling education programs.

Trump Accounts for Newborn Savings

First, we believe one of the most popular changes will be the introduction of Trump Accounts. These will be savings accounts that will be created for newborns starting in 2025 and will be initially funded with $1,000 from the U.S. Government.

Parents will then be able to fund $5,000 per year moving forward, with employers able to contribute 50% of that amount tax-free on the parent’s behalf. The money may be required to be invested in a broad market stock index, so we believe there could be limited investment options available.

At age 18, the child is likely to receive access to the funds as the account is converted into a Traditional IRA (New York Times).

While these accounts seem attractive at first, their overall goal is a bit confusing for us. While the $1,000 is certainly attractive and the $5,000 contribution does not have income requirements or restrictions, we do believe these accounts may not be the best savings options available.

Primarily, contributions are not tax-deductible and then IRA withdrawals may be subject to income tax and additional penalties unless the money is used for a qualifying exception. This means that potentially the contributions into the account will be taxed twice—when the parents first get paid the funds and then again when the child withdraws from the account.

This is why we believe a 529 plan may be a more suitable option, especially since the current tax code allows for a chunk to be converted to Roth IRA savings if not needed for schooling. And if your child has income, funding a Roth IRA directly may be an option to consider as well.

Child Tax Credit Increase

As we mentioned in our previous post, there will be an adjustment to the Child Tax Credit. This bill will increase the amount of the Child Tax Credit up to $2,200.

This is an increase over 2024, but also an extension of the current tax code that was set to be reverted soon (Bankrate). We believe one of President Trump’s goals is to increase birth rates in our country, and this enhanced tax credit could be one incentive to help with that goal.

Expanded Child/Dependent Care Deduction

Another tax benefit for parents is the potential to deduct more expenses related to dependent care programs. The amount for child/dependent care that can be deducted is increasing from 35% up to 50% and the maximum dollar amount is increasing from $5,000 to $7,500 (Investopedia).

There are some income restrictions for these deductions, but we believe the goal in this change is to encourage parents to return to work instead of staying at home with their children.

Child care is very expensive, and we have seen that some parents decide to stay home instead of paying for the care, so this tax change may make it more attractive to return to work.

New Tax Credit for Private School Scholarship Donations

Lastly, for those who donate to a school scholarship fund, there is a new potential tax credit that may be claimed. Up to $1,700 can be received as a credit for those who make qualifying contributions (Investopedia).

It is our understanding that these programs provide scholarships for students to attend a private school or even receive a homeschooling education. This may not be a broadly applicable credit, but it is nice to see the encouragement to help fund other education avenues besides public schools.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Sincerely,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

##

Zach Bachner

After graduating from Central Michigan University in 2017 with specialized degrees in Finance and Personal Financial Planning, Zachary “Zach” Bachner set himself apart by earning the CFP® designation and passing the Series 7, 63, 65 licensing exams early in his career. Zach gained valuable real-world experience with the team at Summit Financial Consulting, who treated him like family. Their guidance helped him refine his skills in practical, client-centered planning, where putting their needs first was non-negotiable. This focus on trust-building not only allowed him to cultivate strong relationships, but also allowed him to continue doing what he loves most: solving client problems through efficient financial planning strategies. Leveraging his experience, Zach now helps others navigate finances through clear, informative writing. His work has been published in major outlets like Yahoo Finance, MarketWatch, and Investment Business Daily, establishing him as a valued resource. By simplifying complex topics, Zach aims to empower everyday people to confidently pursue their financial goals