Capital gains taxes are all over the news in recent days, but not all capital gains are taxed equally. To better understand capital gains tax, it is essential to consider the variables. If you have been following our recent blog postings, you may have noticed we have focused on providing clarity on Meme Stocks & the US Inflation Rate. As part of our Personal Financial Planning 101 series, this article will cover understanding capital gains tax.

What Are Capital Gains Taxes?

It is important to consider the tax implications when analyzing an investment’s performance since it can drastically affect the amount of profit the investor will receive. These tax repercussions are referred to as capital gains.

When a stock is bought for $100 and sold for $150, there is a $50 gain that will be taxed. This gain is “unrealized” while the stock is owned and does not become a taxable “realized” gain until the investment is sold. Even if the funds are not withdrawn from the account, taxes are still owed on any gains that are “realized” within the account.

Short-Term Vs. Long-Term Capital Gains Tax

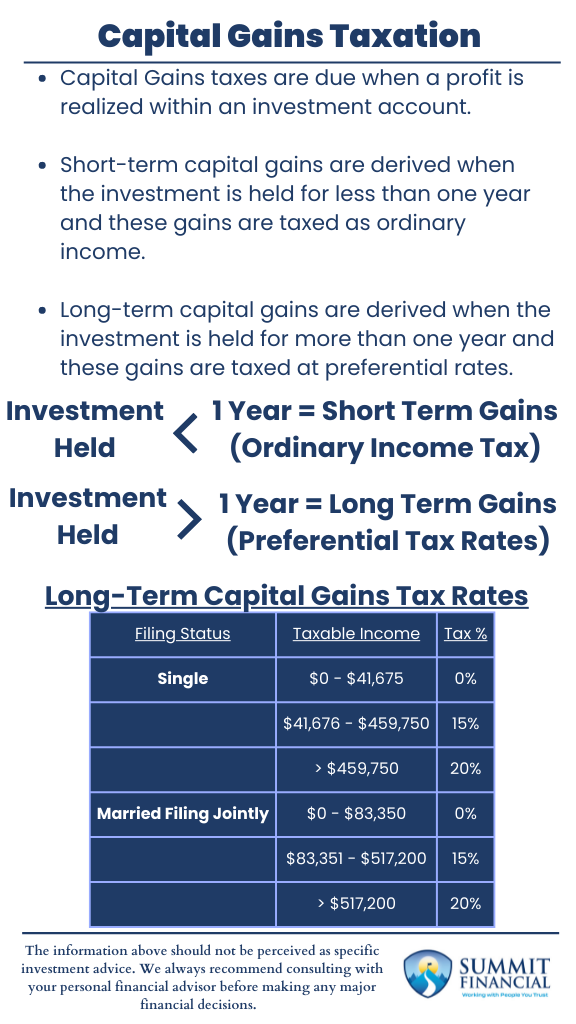

If the stock was held for less than one year then the gains will be considered short-term. This means that the gains will be taxed as ordinary income when you file taxes. The $50 gain in the example above would be subject to whatever tax bracket you fall into.

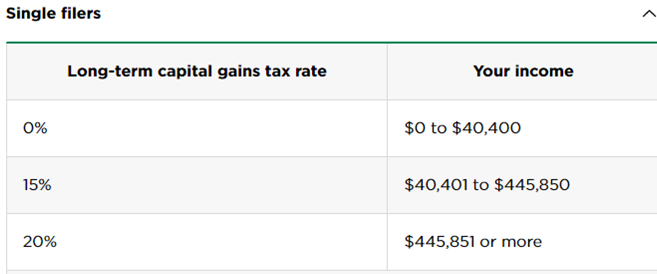

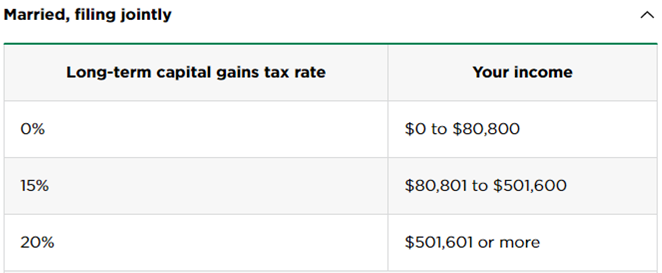

This means it can be taxed up to a maximum of 37% in 2021! If the stock is held for more than one year, the gain is considered long-term and will be taxed at a preferential rate. The maximum long-term capital gains rate is 20% for high-income individuals/couples.

See below from Nerd Wallet for an overview of these preferential tax rates.

Calculating Your Capital Gains

When you file your taxes, you only report the net gain or loss for the year. If you make $50 on one stock but lose $100 on another, you have a net $50 loss. This loss will directly reduce your taxable income. However, only $3,000 worth of losses can be deducted in a single year. Any losses above $3,000 will be carried forward and can be applied to next year’s tax returns.

Summary: Capital Gains Tax

In summary, understanding how to calculate your capital gains tax rate is an essential step for most investors. There are a few key factors to consider:

- Capital Gains taxes are due when a profit is realized within an investment account.

- Short-term capital gains are derived when the investment is held for less than one year, and these gains are taxed as ordinary income.

- Long-term capital gains are derived when the investment is held for more than one year, and these gains are taxed at preferential rates.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

Sources: