In our experience, a credit score can be the first step an individual may take down the path of financial planning. A strong credit score can be an early financial goal when applying for a loan, whether it is applying for a credit card, student loans, or possibly a mortgage, because credit scores are important factors that could impact the terms of the financing you receive.

How Credit Scores Are Calculated

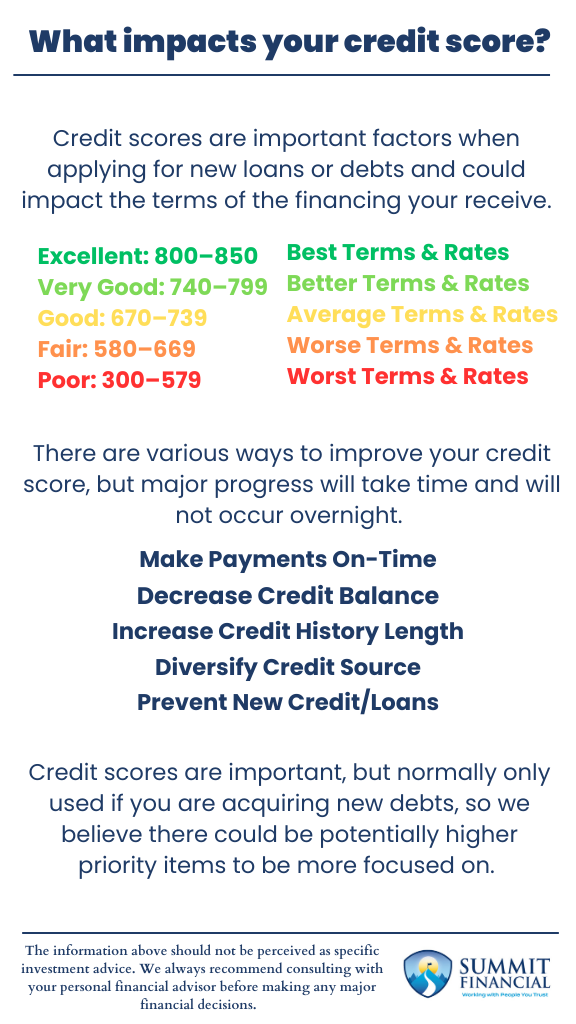

A credit score will fall within a range of numbers used to quantify the borrower’s financial strength. This classification may help the lender understand the risk of lending money to the individual and whether or not they should expect timely payments or possibly late or missed payments. The scale is as follows:

- Excellent: 800–850

- Very Good: 740–799

- Good: 670–739

- Fair: 580–669

- Poor: 300–579

Building Positive Payment History

One of the more accessible strategies is improving your payment history by making consistent, on-time payments for existing debts. We discussed how a low-limit credit card can support this goal in our previous blog: Credit Card Essentials: Strategies for Responsible Use.

Managing Credit Utilization

Another effective approach is to improve your credit utilization ratio, which is the percentage of available credit you’re currently using. To do this:

-

Keep credit card balances low

-

Avoid maxing out cards

-

Consider requesting a credit limit increase from your issuer

If approved and your spending remains steady, your utilization ratio may improve without increasing your actual debt.

The Value of Maintaining Long-Term Credit Accounts

If you do pay off the full balance of a credit card and do not plan on using the card anymore, it might be worth considering keeping the card open in order to help increase the length of your credit history.

By cancelling a credit card you have had for 10 years, you would no longer have those 10 years of payments on your credit history, which could cause your credit score to lower as less history may make your financial strength more of an unknown variable.

Why Credit Mix and New Credit Matter

A variety of credit types, such as installment loans, credit cards, and retail accounts, can demonstrate a borrower’s ability to manage different financial obligations. However, this only works in your favor if payments are made consistently.

Applying for new credit should be considered carefully. Each new inquiry typically:

-

Lowers your credit score temporarily

-

Introduces a new payment and balance

-

Starts a short credit history for that account

If improving your score is a priority, delaying new applications until your score is stronger may be beneficial.

When to Prioritize (or Deprioritize) Your Credit Score

Credit scores can be very important for those who are starting their financial planning journey. However, if you do not plan to take on new loans in the near future, focusing heavily on your credit score may not be the most important priority.

While striving for a good credit score implies a strong financial position, we also want our clients to be aware of other goals that may need their attention. Items such as setting aside funds for a long-term goal like retirement or finding a way to increase your income may be very beneficial to your overall plan.

It is one of our goals as advisors to make sure our clients are not too narrowly focused on a goal when they could be focused on other potential priorities.

What Impacts Your Credit Score- Key Takeaways

- Credit scores are important factors when applying for new loans or debts and could impact the terms of the financing your receive.

- There are various ways to improve your credit score, but major progress will take time and will not occur overnight.

- Credit scores are important, but normally only used if you are acquiring new debts, so we believe there could be potentially higher priority items to be more focused on.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Sincerely,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

Sources:

- https://www.investopedia.com/terms/c/credit_score.asp

- https://www.experian.com/blogs/ask-experian/credit-education/improving-credit/improve-credit-score/

- https://www.nerdwallet.com/article/finance/what-makes-up-credit-score

- https://summitfc.net/credit-card-essentials-strategies-for-responsible-use/