It is important to address these concerns and plan your preferred route on how to cover the expenses should they arise.

Who Is Most Likely to Need Long-Term Care?

One of the toughest components of this type of planning is the fact that not everyone will need Long-Term Care services.

-

Family history can be used as a starting point. If your relatives tend to live longer than average, you may have a higher need for care.

-

Widows typically have a higher chance of needing LTC services since their spouse is no longer alive to help with the activities of daily living.

-

Adult children who live nearby may reduce the need for formal care if they can assist with daily tasks.

-

The desire for independence may influence whether care is pursued and whether it involves in-home services or moving into a facility.

Insurance-Based Strategies for LTC Coverage

There are a few different routes that can be utilized to plan for the potential long-term care expenses.

-

Traditional LTC insurance: A use-it-or-lose-it policy that provides benefits only if the care is needed; otherwise, the policy value is forfeited.

-

Life insurance or annuities with LTC riders: These provide long-term care benefits if needed, or a death benefit payout if not used. While more reassuring, these may have higher costs or require a large upfront premium.

Our clients tend to gravitate towards other policies instead, such as a life insurance policy with an LTC rider or an annuity solution with an LTC rider. These options will provide the LTC benefits if needed and an alternative death benefit payout if LTC is not needed.

This can be more assuring for clients, but the LTC rider may also make it a more expensive route, or a large upfront premium may be needed.

Using Personal Assets to Self-Insure

Clients who have a substantial amount of assets may prefer to simply pay out of pocket if they need LTC care.

This could be seen as “self-insuring,” since the client is assuming responsibility for future expenses.

-

An LTC policy may still help preserve the estate, but many clients in this position are more focused on growth and are willing to retain investment risk to potentially increase estate value.

Relying on Medicaid as a Backup Option

Lastly, the final option is to rely on Medicaid to pay for the LTC costs.

Medicaid is available when individuals do not have the assets required to pay for the care. In these cases:

-

They must “spend down” their assets to a Medicaid-qualifying level.

-

Medicaid will then garnish income sources in exchange for covering care costs.

While Medicaid offers a safety net, it’s important to note:

-

Facilities and services covered by Medicaid tend to be of lower quality, as they are publicly funded rather than privately paid for.

This is a key consideration when evaluating your long-term care planning options.

Budgeting for Long-Term Care Planning in Retirement- Highlights

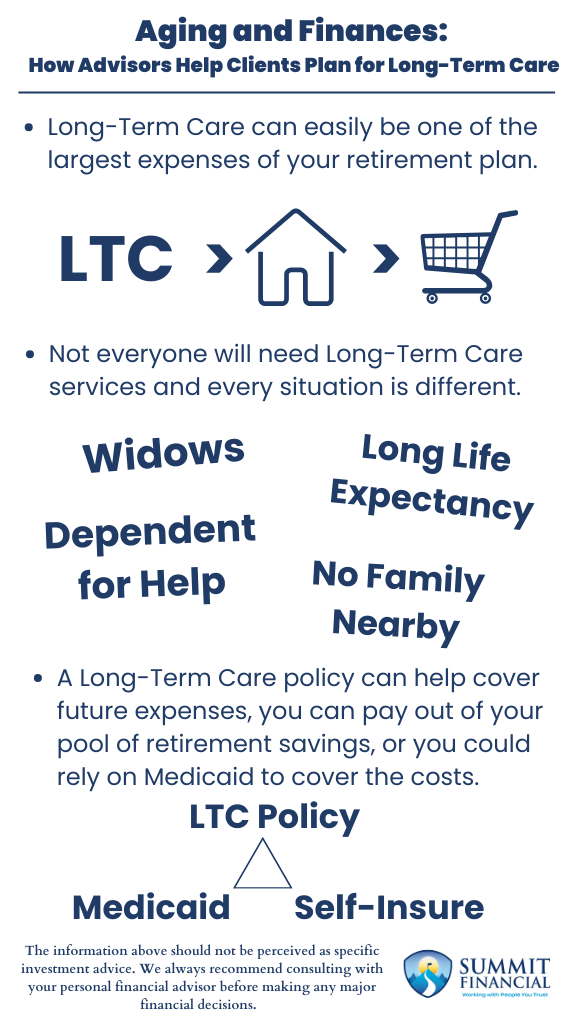

- Long-Term Care can easily be one of the largest expenses of your retirement plan.

- Not everyone will need Long-Term Care services and every situation is different.

- A Long-Term Care policy can help cover future expenses, you can pay out of your pool of retirement savings, or you could rely on Medicaid to cover the costs.

Speak With a Trusted Advisor

If you have any questions about budgeting for Long-Term Care, your investment portfolio, taxes, retirement planning, our 401(k)-recommendation service, or anything else in general, please call our office at (586) 226-2100. Please also reach out if you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation.

Feel free to forward this commentary to a friend, family member, or co-worker. We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink.

If you found this article helpful, consider reading:

- How Do Bull Markets and Bear Markets Differ

- Navigating College Funding

- Financial Planning Mistakes to Avoid

Sources: