If you have ever been to New York City, specifically the financial district, you probably saw the iconic Bull vs. Bear statue.

This Wall Street symbol categorizes the two extremes of market trends known as Bull Markets vs. Bear Markets.

Bull vs. Bear Market Characteristics

The term Bull Market is used to describe a market environment where an asset sees a positive trend in pricing.

On the other hand, a Bear Market is used to illustrate an asset class that has seen a drawdown or negative trend in price movement. These trends usually refer to a 20% move in either direction.

For example, a 20% bounce from the cycle lows in market prices will usually be referred to as a Bull Market while a 20% drop from the all-time-high is going to be referred to as a Bear Market.

It is important to note that these terms are simply used for illustrative purposes, and different investors/analysts may use them at their discretion. The 20% move is not a requirement but more of a guideline on when the term becomes applicable.

Symbolism of the Bull and Bear

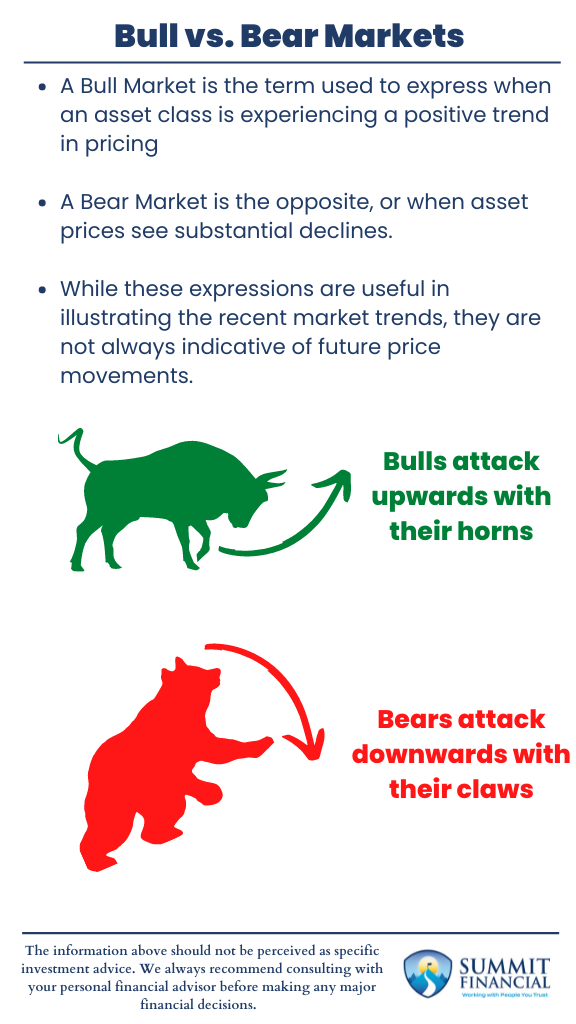

But why these two animals? Well, the answer lies in their natural behaviors as predators. A bull typically attacks its’ prey by lowering its’ head and striking upwards with the horns.

A bear attack usually involves the bear standing on the hind two legs to strike downwards using the front claws. So, a bull attacks upwards, and a bear attacks downwards. A bull market is heading upward,s and a bear market is heading downward.

How Do Market Trends Impact Investing?

These expressions are used to illustrate the previous performance of an asset class. Market trends are very important because they can provide guidance of future market prices, but trends do not last forever.

Eventually, that bear market will bottom and will begin to rise, resulting in a new bull market. Just because somebody claims the asset is in a bear market, it does not mean that the asset cannot pivot and move higher instead.

The timeframe of such a trend is also challenging to forecast. When did the downturn last 3 months or 3 years? It is hard to estimate these types of factors, so we always recommend using a multi-factor approach to investing.

Do not simply rely on the recent market performance to guesstimate where the market may be heading next.

Bull vs. Bear Market – Key Takeaways

- A Bull Market is a term used to express when an asset class is experiencing a positive trend in pricing.

- A Bear Market is the opposite, or when asset prices substantially decline.

- While these expressions are useful in illustrating the recent market trends, they are not always indicative of futurprice movements.

Speak With a Trusted Advisor

If you have any questions about Market Seasonality, your investment portfolio, taxes, retirement planning, our 401(k)-recommendation service, or anything else in general, please call our office at (586) 226-2100. Please also reach out if you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation.

Feel free to forward this commentary to a friend, family member, or co-worker. We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

If you found this article helpful, consider reading:

- Navigating College Funding

- Financial Planning Mistakes to Avoid

- Debt Repayment Strategies

- How to Negotiate a Raise

Sources:

https://www.investopedia.com/insights/digging-deeper-bull-and-bear-markets/

https://www.fool.com/investing/how-to-invest/bull-vs-bear-market/

https://time.com/nextadvisor/investing/bull-bear-markets-explained/