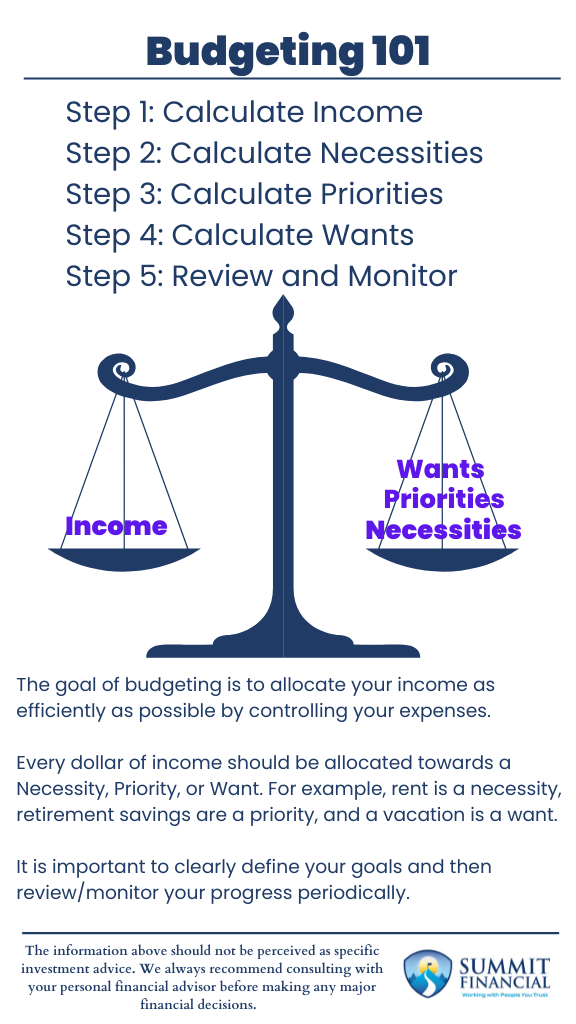

The first step towards a successful financial future is creating a budget. Without a budget, there is no foundation for a financial plan. This article is going to discuss our 5-step budgeting process as well as highlighting some of the common issues we see.

Step 1: Calculate Income

In order to plan how much money can be allocated where, we must first know how much income we are budgeting. This can be done on either a monthly or an annual basis. For those with more severe budgeting issues, we recommend focusing on monthly amounts.

We recommend looking at your after-tax income. If we are budgeting household expenses and goals, we want to look at how much money hits the bank account every month. If we are focusing on tax planning, then it would also be beneficial to focus on the before-tax amount.

This is helpful because sometimes we can discover if an employer is withholding too much for state and federal taxes.

Step 2: Calculate Necessities

The first expenses we are going to look are the necessities. These are the day-to-day items we need to survive. This includes, but is not limited to groceries, rent, electricity, gas, car payments, diapers, medications, etc. Essentially, if you need the item to survive then it is a top concern and is considered a necessity.

However, this does not mean that a single individual renting a 5-bedroom apartment is budgeting correctly. Even necessities should have limitations. Downsizing a home, leasing a cheaper car, buying store brand rather than name brand, and reducing utility usage are all great places to start to minimize the amount of necessity expenses.

Step 3: Calculate Priorities

The next set of expenses we will discuss are what we consider to be priorities. You do not necessarily need these priority items to survive, but you would like to have them if possible. These are items such as cellphones, internet/tv, dining out, entertainment, new clothing, etc.

Once again, even with priorities, there are ways to decrease expenses. This part of the budgeting process begins to lean more towards your personal preference. A lot of priority expenses are based on quantity. How many times to do you want to eat out each week? How many TV channels do you want to pay for? How often do you want to buy new clothes or buy a new phone? The best way to reduce priority expenses is to reduce their frequency.

Once your necessities are covered, you can decide if you want to allocate towards your priorities or if you want to raise the quality of your necessities. For example, maybe you decide to buy a nicer car, but you sacrifice new clothes and movie tickets every month.

In budgeting, there is an opportunity cost to every decision. If you pursue one goal, you sacrifice another. However, these kinds of decisions are very opinion based and will vary from person to person.

Step 4: Calculate Wants

It is very common for someone to confuse a priority with a want. Overall, a want is just a lower ranked priority. You would like to fund these goals if possible, but they do not matter as much as the priorities above. The most common wants include saving for retirement, charitable giving, debt repayment, college savings, travel, etc.

Wants can also include savings for future expenses such as a new car, new home, wedding, etc. Wants are more commonly long-term priorities that takes much more time to achieve the desired goal.

Once again, this is also opinion based and a priority to someone may be a want to someone else. Some people might really care about retirement savings and they will sacrifice entertainment in order to save more. Some people might be more charitably inclined and would rather donate their money than spend it on fast food.

Step 5: Review and Monitor

The first half of this step is performed as soon as the initial budget is completed. You will either have a cashflow surplus or deficit. You will either have income remaining that can be allocated further, or your expenses will be too high, and you do not have enough income to cover all of your goals. At this point, it is time to reflect on your personal opinion and decide how to adjust your budget.

If you have a cashflow deficit, are there any unnecessary expenses that you can reduce or eliminate? Is your car payment too expensive or do you find yourself eating out too much and not cooking at home? If you have a surplus, should you save more for retirement? Should you donate more per month or should you go out with friends more often?

Lastly, the budget needs to be monitored and updated moving forward. The income information should be updated every time there is a change such as a raise, job loss, job change, etc. The recurring expenses should be updated whenever you notice a change in the amount paid on a consistent basis. At the very least, we recommend reviewing your budget every 3 months to ensure that all of your numbers are still accurate.

If needed, we do have an excellent in-house document that can be used to help construct a budget. Please go to http://summitfc.net/contact-us/ and request our budgeting template. Someone from our team will be more than happy to send it over and help you complete it.

Financial Planning and Review Meeting

If you have any questions about interest rates, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

If you found this article helpful, consider reading:

- Navigating College Funding

- Financial Planning Mistakes to Avoid

- Debt Repayment Strategies

- How to Negotiate a Raise

Disclosures regarding our performance reporting: Because some clients are in the 10% tax bracket and others are in the 37% Federal tax bracket, we have decided to report performance before taxes. If you have a non-qualified account, please feel free to contact us to determine your individualized rate of return after tax. All of Summit’s performance is after our 1.25% advisory fee deducted monthly. Your fees may be higher or lower depending upon the amount of assets invested with our firm. Feel free to contact us to receive online access so you can see your personalized rate of return. The Aggregate bond index we use is ticker: AGG. All dividends and distributions are reinvested and included in the performance. The S&P 500 index quoted above does not include dividends within the version. If a holding within our portfolio does pay a dividend or other income, it is reinvested, so our performance does include dividends. This report has been prepared from data believed reliable, but no representation is made as to accuracy or completeness. Total return and principal value will vary depending upon the deduction of advisory fees, brokerage commissions, reinvestment of dividends and other earnings or fund charges. This information is provided to you in combined form, solely for your convenience and ease of review and is not an offer or solicitation to buy or sell any securities. In order to verify that all account values and transactions are accurate, we encourage you to compare the information provided in our statement with the statement you receive directly from your custodian. All written content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. Past performance does not guarantee future results.