As the saying goes, do not place all your eggs in one basket. This is perhaps one of the most important lessons when discussing investment management and retirement planning. (This post will solely cover diversifying stock positions and we will be releasing a post targeted towards bonds and miscellaneous investments in the coming months.)

What is Diversification in Stocks?

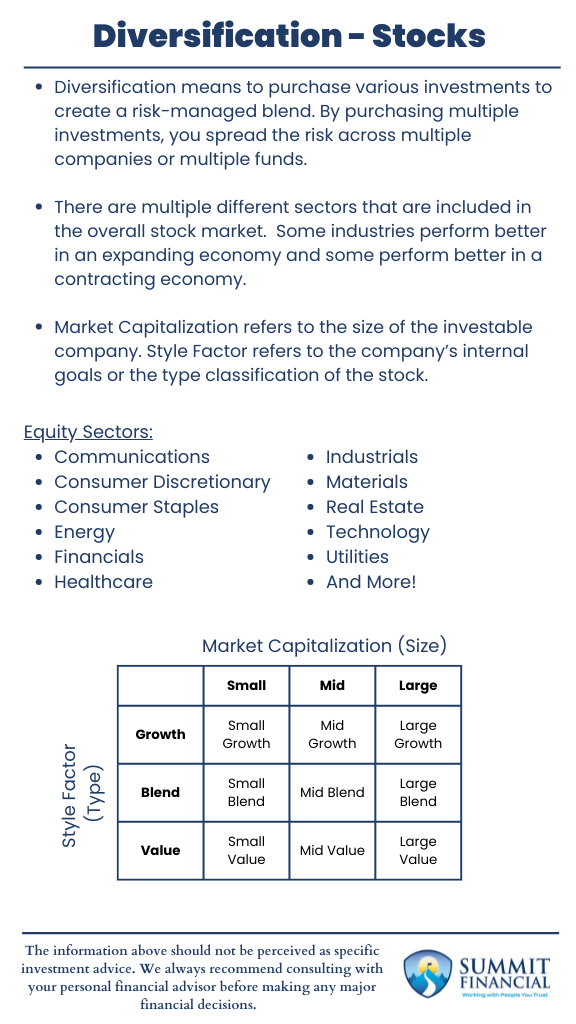

Before we dive into the various diversification options, let’s cover what this strategy means. Overall, diversification means to purchase various investments to create a risk-managed blend. By purchasing multiple investments, you spread the risk across multiple companies or multiple funds. The more investments you hold, the less risk you will incur, but this will be accompanied by less potential as well.

Risk and Reward of Diversification

Owning 100 stocks is less risky than owning 1 stock, but you will experience less growth if that 1 stock really takes off. This is due to the fact that the owned companies will only be 1/100th of the size in a diversified portfolio. If you are going to focus on only a few ideas, it is best to make sure you are confident in those choices because while there is more upside potential, the downside risk is just as great. On top of simply purchasing more positions to diversify a portfolio, there are also other characteristics to consider.

Beware of Overdiversification

We do feel the need to address the concern of overdiversification. Having your investments spread too thin may hinder the potential for more substantial growth. We feel that it is important to focus on the companies and areas that have the ability to outperform and decrease exposure to those that may be expected to underperform. As Warren Buffet once said, “Wide diversification is only required when investors do not understand what they are doing.”

Sector Diversification: Spreading Investments Across Industries

There are multiple different sectors that are included in the overall stock market. These sectors include Technology, Healthcare, Financials, Energy, Utilities, Industrials, Consumer Staples, etc. Obviously, purchasing only one sector relies heavily on that specific industry. We believe that a blend of sectors is appropriate in any environment, but the correct blend depends on the state of the economy. Some industries may perform better in an expanding economy and some may perform better in a contracting economy.

For example, Energy is based strongly off of the price of oil and economic production. If there is a slowdown and the economy weakens, corporations will not be purchasing as much oil, travel will decrease, and this industry may suffer. Consumer Staples includes toilet paper and laundry detergent suppliers. These types of companies are typically in demand since these are essential items for human life. Staples can be consistent through various economic stages. Technology may perform well in a growing economy since companies are spending more money on their technological research and design advancements.

Utility companies may perform well during slowdowns since individuals and businesses still need to pay their monthly bills. Financials may perform well in an expanding environment because companies and individuals are able to afford more debt, and banks earn the interest on the loans they issue. These are just a few examples, but every sector may have a more a preferred economic environment in which it thrives compared to other industries.

Now that we know the basics to sector diversification, how do we apply this to a portfolio? It depends on the stage of the economy. As described above, we feel that aggressive sectors may perform better in growing economies and defensive sectors may perform better during economic slowdowns. Aggressive sectors can also see more swings in their stock price, and defensive sectors may provide dividend benefits to shareholders.

This is precisely why we utilize a rotating sector strategy with our in-house portfolios. Depending on your personal risk tolerance and time horizon, your preferred blend may vary from others’. Active management allows us to buy and sell our preferred sectors, while a long-term buy-and-hold strategy may potentially benefit the most from a blend of various sectors.

Factor Diversification: Market Capitalization and Investment Style

Market Capitalization refers to the size of the investable company or equity fund. Typically, these are referred to as Small Cap, Mid Cap, and Large Cap companies. Smaller companies are usually considered more aggressive positions because they do not have the history nor size to withstand large financial strains. Larger companies would tend to have more assets, more revenues, and normally a longer track record as well. Therefore, large companies are generally considered less risky investments. And of course, medium sized companies fall right between their small and large competitors.

Style Factor refers to the company’s internal goals. These are similar ideas to the market capitalizations listed above. Included in these objectives are Growth and Value, but some mutual funds or ETF’s will mix-and-match and can create Blend funds. Growth companies are generally focus on increasing revenues, profit, and their share prices. Value companies may focus on maintaining consistency in their business operations and preventing negative fluctuations in their stock price. Value companies also often tend to provide dividends to shareholders. Blended funds create a combination of both growth and value companies.

So, now that we have discussed the different types of factor diversification, how do we apply this to an investment portfolio? Well, of course, it all depends on the individual investor and their personal goals and objectives.

Those who are more aggressive and do not care about wild swings in their account balance, could focus on more growth focused companies. Individuals who are more risk averse may want to invest in household name companies. With this being said, we do believe that a mixture is often the best move. By holding both, you are potentially able to position yourself appropriately for whichever direction the economy moves.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

Sources: