You may have heard of the phrase “Emergency Fund” before, but perhaps you don’t know specifically what it meant. This blog will highlight exactly what an emergency fund is, how to create one, and why we believe COVID-19 stressed the importance of being prepared.

- An Emergency Fund is used as preparation for large, unexpected expenses.

- Building savings into your budget can be an effective way to save for your Emergency Fund.

- COVID-19 has highlighted the importance of having an Emergency Fund.

What is Considered an Emergency Fund?

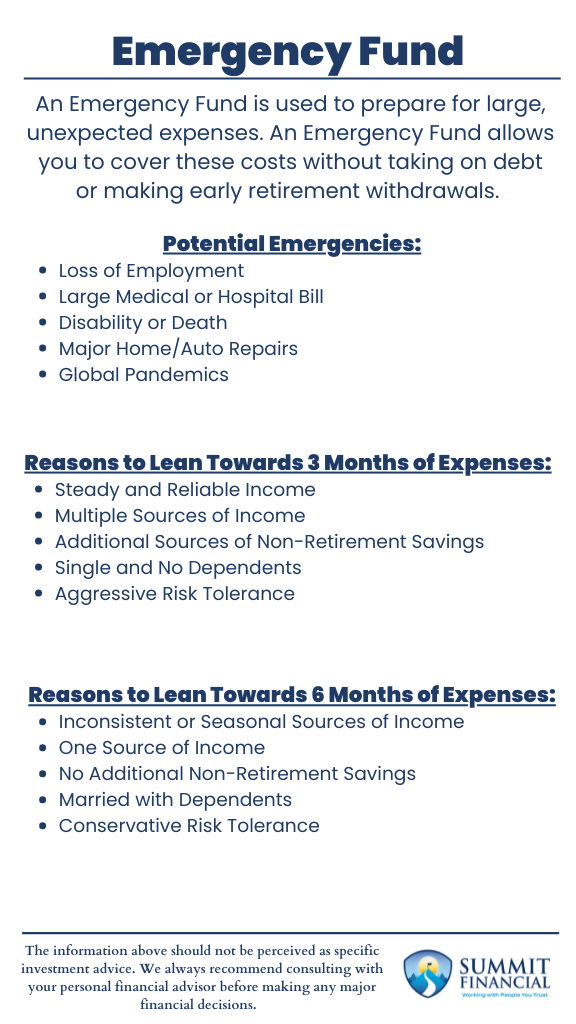

An Emergency Fund is a pool of savings that has been set aside to cover any large, unexpected expenses. These expenses typically include medical bills, automotive repairs/replacement, lost income due to lack of employment, etc. All these expenses can happen very suddenly and can create a huge financial burden on an individual or family.

How Much Should Your Emergency Fund Be?

The recommended size of an Emergency Fund varies by case, but we normally suggest somewhere between 3-6 months’ worth of expenses. If you are single with a stable income, then you can afford to be on the lower end of the scale. If you have a family with irregular income amounts, then we recommend being on the higher end of the 3-6 month range.

How to Build an Emergency Fund

Creating an Emergency Fund does not happen overnight and can be difficult if you have a tight budget already. Most people need to build their Emergency Fund over time since they do not have a large sum of money just sitting around that they can relabel as “Emergency Fund.” This process comes back to the health of your budget stradgey and finding ways to squeeze out extra savings every month. By setting money aside every month, you can build your Emergency Fund over time until it reaches your desired level.

It is especially important not to draw from this fund for anything non-emergency-related since those withdrawals would only set you back towards achieving this savings goal. We also do not recommend investing this money in any shape or form since we want the funds to be readily accessible, and we do not want to risk the fund losing value.

Why an Emergency Fund is Essential

Lastly, we wanted to touch on why we believe it is so important to establish an Emergency Fund. COVID-19 has taught us that the world we live in can change drastically in the blink of an eye. Many people were left unemployed and were concerned as to how they would continue to pay their bills. (Granted, the government did help with the unemployment assistance, but that benefit was not announced at the very beginning.)

This initial level of concern highlights exactly why an Emergency Fund is needed. Being out of work for 3 months could be detrimental, but it could also be manageable if you had the proper savings set aside. We are also seeing a huge shift in the workforce as a record setting amount of individuals are leaving their jobs for new employers. This transition period can also be very stressful since it may present a period of time with no income. Once again, having the proper savings can make this career shift much more tolerable.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, James Wink and James Baldwin