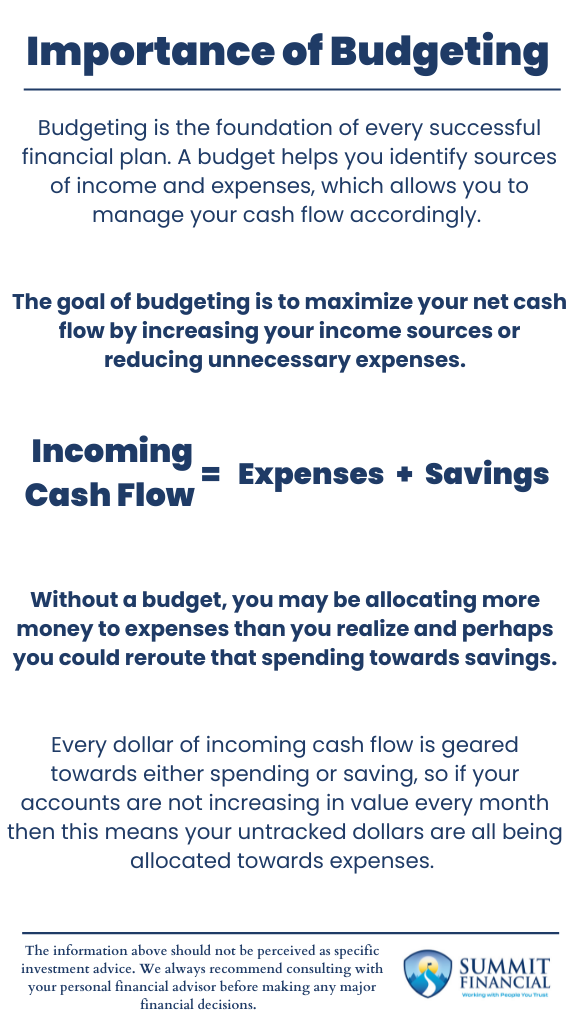

Budgeting is the foundation of every successful financial plan. A budget helps you identify sources of income and expenses, which allows you to manage your cash flow accordingly. The goal of budgeting is to maximize your net cash flow by increasing your income sources or reducing unnecessary expenses.

Creating a Budgeting Worksheet

We recommend our clients use an excel spreadsheet so that their budget can be updated periodically with a few clicks of the mouse. We have an in-house document that identifies just about every monthly/annual expense you could think of, and the spreadsheet will automatically calculate your net cash flow. (Let us know if you would like a copy!)

Maximizing Your Income

Not everyone has the option to increase their income, but this is the most obvious way to increase your cash flow since income is the beginning of the budgeting equation. If you can get a promotion, work extra hours, pick up an extra job, etc., then your overall incoming cash flow should be higher. This will give you a cash flow head start and will allow you to be more flexible with your expenses or savings.

Cutting Unnecessary Expenses

Since increasing income is not usually an option, most people use a budget to control their expenses. By listing every expense, then you are able to identify areas that may be too high or too frequent. For example, if you spend $1,000 per month at restaurants and only $200 at the grocery store, then perhaps you can flip these around and try to save on your food bills.

Maybe your cable bill is $100 per month but then you have another $50 in streaming subscriptions. This could be a sign to maybe cut back one or the other. By listing every expense that you incur, you may be able to find weaknesses or areas of overspending in your budget.

Keeping Your Budget on Track

Believe it or not, every dollar you earn is allocated towards a financial goal, even if you are not aware of it! Every dollar of incoming cash flow is geared towards either spending or saving, so if your accounts are not increasing in value every month then this means your untracked dollars are all being allocated towards expenses.

It is normally preferred that you are able to set aside savings every month towards a future financial goal rather than spending all of your incoming cash flow. Without a budget, you may be allocating more money to expenses than you realize, and perhaps you could reroute that spending toward savings.

Incoming Cash Flow – Expenses – Savings = $0

Basics of Budgeting – Highlights

- Budgeting is the management of incoming cash and outgoing expenses

- The goal of budgeting is to maximize net cash flow by reducing unnecessary expenses

- Incoming Cash Flow – Expenses – Savings = $0

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, James Wink, and James Baldwin

If you found this article helpful, consider reading: