Dividend investing is a common practice among stock market investors, especially those with lower risk tolerance. However, to truly understand dividends, it is essential to consider the variables. As part of our Personal Financial Planning 101 series, this article will unpack how dividends are taxed.

What Is Dividend Investing?

Dividend investing is a common practice among stock market investors, especially those with a lower risk tolerance. When a corporation has excess earnings, instead of reinvesting those funds into the company, the earnings can alternatively be paid out as a dividend which is sort of a thank you for being part owner of the company.

The Role of Dividends in an Investment Strategy

Dividend payments normally occur quarterly and are usually provided by larger, more value focused companies but any company is able to issue them if they desire. Dividend amounts and frequencies are not guaranteed since companies may decide to alter or cancel future dividend payments.

However, dividends are sometimes offered to attract investors because the company does not expect much growth potential moving forward. Eliminating or reducing a dividend may hurt the attractiveness of the underlying company from an investment standpoint.

Qualified vs. Non-Qualified Dividends

The taxation of dividends relies heavily on whether or not the dividend is considered qualified. These requirements mainly focus on if the company is a domestic, or if it’s international then if the company complies to U.S. tax laws.

There is also a holding period requirement before the dividends become qualified for the investor. Often, the dividend investors receive will be qualified as long as they are not being paid by an uncompliant international company.

How Dividends Are Taxed

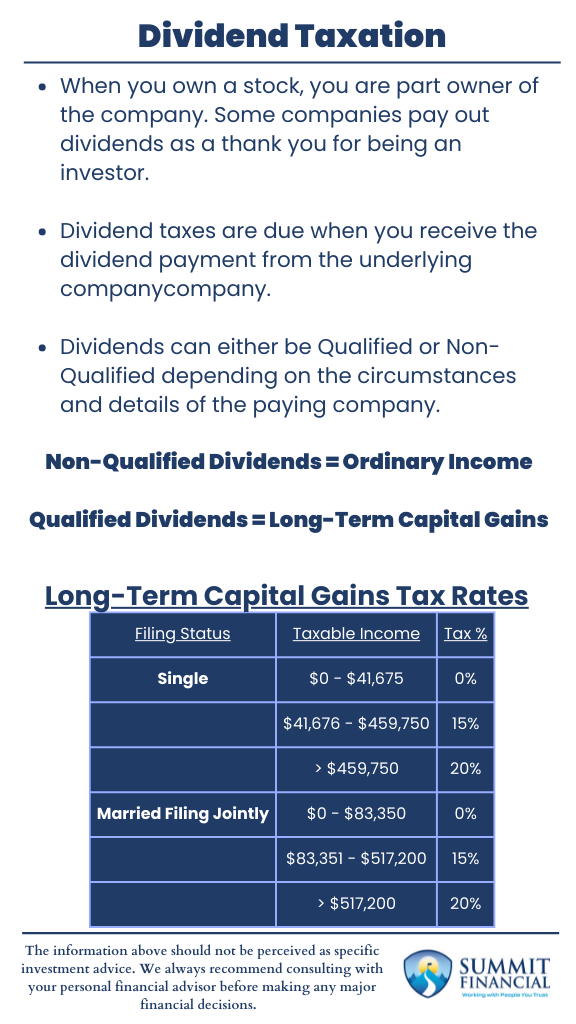

Non-Qualified dividends are taxed as ordinary income. These dividend payments do not qualify for the preferred tax treatment, so they are recorded and taxed at traditional income rates. Qualified dividends offer much more value to investors since they are taxed at long-term capital gains rates.

Reinvested Dividends: What to Keep in Mind

This means that those in the lower tax brackets may not need to pay any taxes on their dividend income. Also, those in the higher brackets will be capped at a tax rate of 20%. The growth of the investments may still be taxed at various rates, but the dividend payments will be taxed according to the schedules above. Also, it is important to note that dividends are taxed regardless if they were paid in cash or automatically reinvested into additional shares.

Taxes on Dividends – Summarized

- When you own a stock, you are part owner of the company. Some companies pay out dividends as a thank you for being an investor.

- Dividend taxes are due when you receive the dividend payment from the company.

- Dividends can either be Qualified or Non-Qualified depending on the circumstances and details of the paying company.

- Qualified Dividends are taxed at the long-term capital gains tax rate and Non-Qualified Dividends are taxed as ordinary income.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

Sources:

- https://www.fidelity.com/tax-information/tax-topics/qualified-dividends

- https://www.investopedia.com/ask/answers/090415/dividend-income-taxable.asp

If you found this article helpful, consider reading: