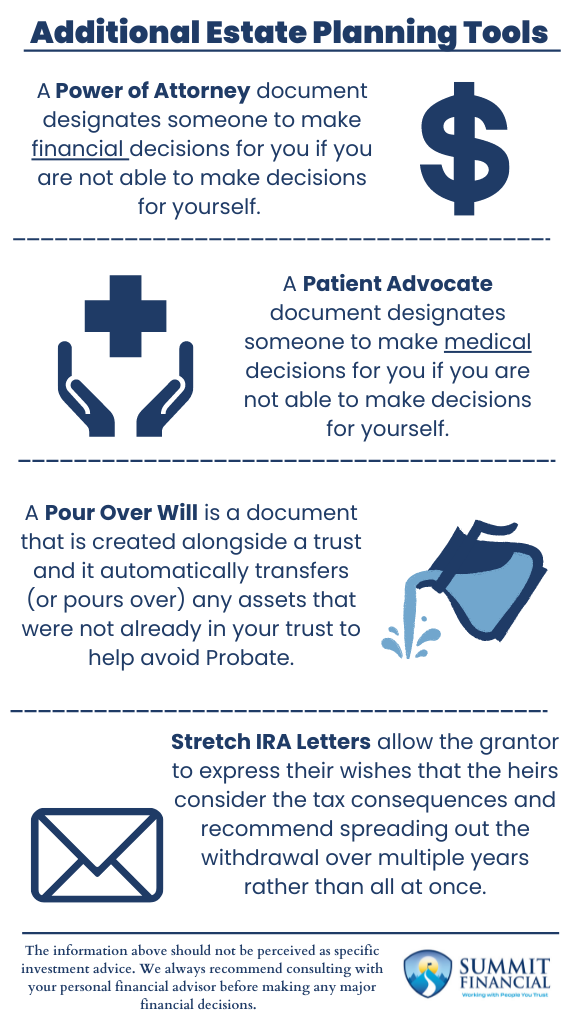

This month, we will continue our discussion of estate planning techniques. We will be focusing on four additional tools that can be used to enhance an individual’s estate planning. These tools are Power of Attorneys, Patient Advocates, Pour Over Wills, and Stretch IRA Language.

If you would like to explore these options in more detail, please contact us directly or speak to your estate planning attorney. If you do not have an existing attorney relationship, we have referrals that would be more than happy to answer any questions you may have.

Power of Attorney: Ensuring Financial Control

A Power of Attorney document designates someone to make financial decisions for you if you are not able to make decisions for yourself. The “principal” assigns a trusted individual, the “agent”, to act on their behalf for a variety of decisions. Specifically, these designations are used to allow others to perform financial actions. For example, someone who will be traveling abroad for an extended period may assign a Power of Attorney so that their trusted agent can file their tax return while they are abroad. Another scenario would include an elderly individual allowing their trusted child to process their banking and investment transactions.

Patient Advocate: Planning for Medical Decisions

These designations are very similar to the Power of Attorney designations we described above. However, these powers are specifically for medical decisions. A Patient Advocate document designates someone to make medical decisions for you if you are not able to make decisions for yourself.

If the principal is in a long-term coma, they are not able to make their own medical decisions at that time. There could be a lot of important decisions to be made at this time, including elective surgery, preference for prescription drugs, continuation of life support, etc. Since these decisions are crucial to an individual’s health, we highly recommend selecting an agent that will have similar beliefs as yours to ensure your wishes are met even if you are unable to communicate them.

Both of these designations mentioned above can become active depending on the principal’s wishes. If they are active day one and will last until death, these are considered “durable” or “non-springing” Power of Attorneys. If they become active when the principal becomes incapacitated, then these are referred to as “springing” powers of attorney. Springing powers typically require consent from two medical professionals to confirm the principal’s incapacitation.

Pour Over Wills: Avoiding Probate Hassles

A Pour Over Will is a document that is created alongside a trust, and it automatically transfers (or pours over) any assets that were not already in your trust to help avoid Probate. This tool is self-explanatory and applies a blanket to any assets that are not included in the trust.

The Pour Over will allow for any unaccounted-for assets to be treated as if they were specifically in the trust. This prevents the probate process for any assets that may have been missed when drafting the trust. For example, if you recently purchased a new car, it may not have been included in the trust at the time of your death. The Pour Over Will moves that new car into your trust and will be distributed according to the guidelines within the trust. It will not go through probate for a judge to decide.

Stretch IRA Language: Maximizing Inheritance Efficiency

If you have pre-tax retirement savings like a 401K or IRA, there is a good chance Stretch IRA language can help your heirs receive a larger inheritance by reducing unnecessary taxes. While Stretch IRA Language does not have any legal powers, it is a strong recommendation for the heirs. This language is usually included in an estate plan through a letter from the grantors and is given to the heirs at the time of death.

The goal of this letter is to instruct heirs to meet with a financial advisor or accountant to consider the tax consequences of withdrawing large amounts at once. These large withdrawals will normally create high tax consequences, and a large chunk of the inheritance may be paid to the government. These Stretch IRA Letters allow the grantor to express their wishes that the heirs consider the tax consequences and recommend spreading out the withdrawal over multiple years rather than all at once.

Speak With a Trusted Advisor

If you have any questions about how inflation may affect your investment portfolio, taxes, our 401(k)-recommendation service, or anything else, please call our office at (586) 226-2100.

Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please call us so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

If you found this article helpful, consider reading: