The recent high in inflation has many economists and everyday citizens wondering if we are headed to the next recession. Two consecutive quarters of negative GDP reports signal a recession by the traditional definition, so we have technically entered a recession.

However, we are still seeing reports of positive earnings growth and a strong labor market, which is not typical of a recessionary environment.

It is possible these reports may trend lower in the near future, but we believe it is best to be prepared for any potential outcome. Whether or not we are technically in a recession, everyone should be prepared just in case.

What Happens in a Recession?

A recession can certainly have a negative impact on your overall financial plan. Recessions are normally accompanied by a weak labor market, which means more people may find themselves without steady employment.

A gap in income is a high risk to most families. As many currently know, a recession may also be associated with high inflation, which generally increases the cost of a household’s monthly expenses.

Grocery trips, gas, heating/cooling costs are just a few of the monthly expenses that consumers may have to budget a larger amount towards.

Lastly, recessions often cause volatility in the stock and bond markets. This volatility may hinder income potential and retirement estimates for those who are nearing retirement and plan to make short-term withdrawals.

How a Recession Can Impact Your Financial Plan

Recessions can occur slowly, or they can appear to happen overnight. The variability at which recessions occur suggests that households should always be prepared to endure the economic slowdown. It is much more beneficial to be proactive about the recession potential than to be reactive once the hardships begin.

We believe there are a few key areas that can always be improved:

- Review Your Budget – Analyzing your monthly budget to control high or unnecessary expenses. By sticking with a consistent budget and making adjustments as needed, you will be aware of the areas that may be reduced or eliminated in order to free up additional cash flow.

- Increase Your Income – It is important for many to continue increasing their income through their working years, whether through consistent pay raises, new employment, or potentially a side hustle.

- Enhance Your Skillset – Learning new skills can also be a high priority in order to stay competitive in the workforce.

- Build an Emergency Fund – Every household should have an appropriate emergency fund just in case there is a hardship, such as a loss of income. This is a great defense against a recessionary job loss since you would be able to afford monthly expenses for a few months while you look for new employment.

- Stay Committed to Long-Term Investments – For those with extra cash flow, staying on track with contributions to investment and savings accounts is crucial. Market volatility can be nerve-wracking, but it can also present strong buying opportunities for long-term investors. Sticking to your financial plan ensures that you remain on track toward your long-term goals.

How to Strengthen Your Financial Plan Before a Recession

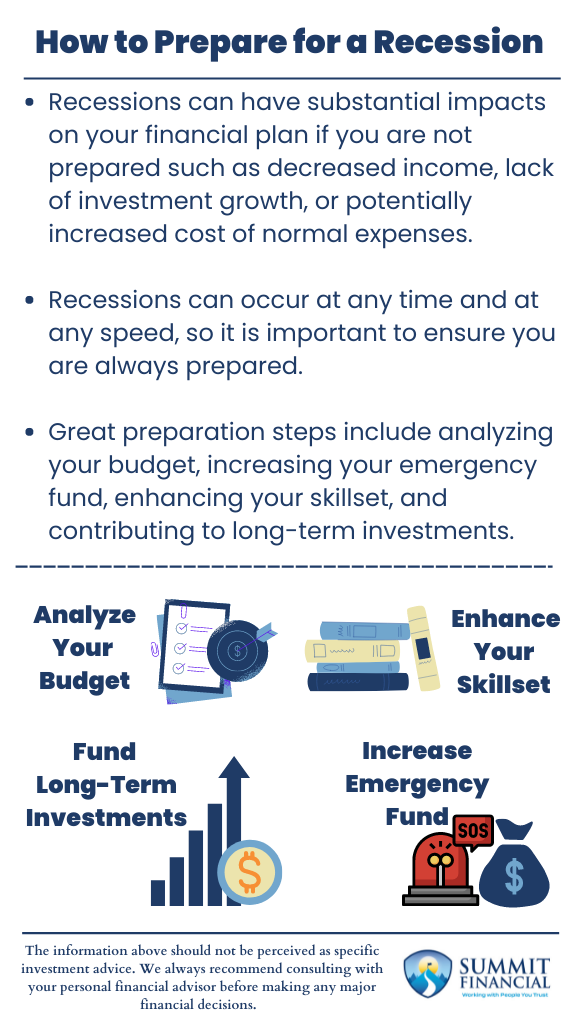

- Recessions can have substantial impacts on your financial plan if you are not prepared such as decreased income, lack of investment growth, or potentially increased cost of normal expenses.

- Recessions can occur at any time and at any speed, so it is important to ensure you are always prepared.

- Great preparation steps include analyzing your budget, increasing your emergency fund, enhancing your skillset, and contributing to long-term investments.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker.

If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it. We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, James Wink and James Baldwin

If you found this article helpful, consider reading:

- Navigating College Funding

- Financial Planning Mistakes to Avoid

- Debt Repayment Strategies

- How to Negotiate a Raise

Sources: