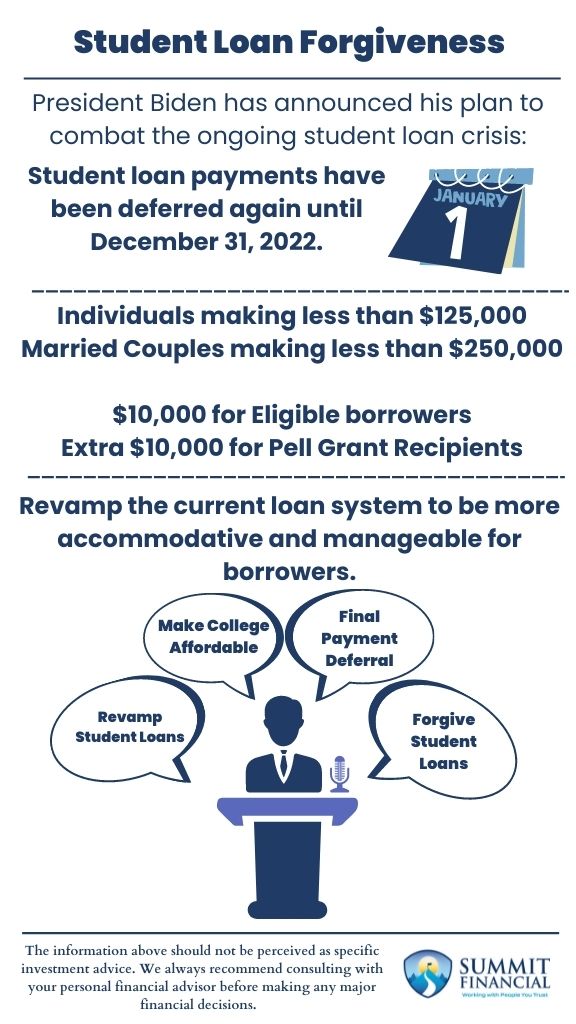

- As a result, student loan payments have been deferred again until December 31, 2022.

- Middle to low-income families may be eligible for up to $10,000 of forgiveness and $20,000 for those who received Pell Grants during college.

- Revamp the current loan system to be more accommodative and manageable for borrowers.

American Student Loan Dilemma

Student Loans have continued to burden the lower and middle class. Currently, 45 million borrowers hold a total of $1.6 trillion in student loan debt. College education has been seen as one of the best ways to get a head start on a financially successful career, but that advantage can be heavily offset by loan payments when college costs are not covered out of pocket.

In America, many individuals and families resort to student loans to afford an adequate education. But unfortunately, many borrowers spend decades trying to repay this debt. Consequently, some cannot afford to become homeowners, save for retirement, or may struggle with monthly bills due to their financial debts.

Furthermore, not all college graduates end up with jobs that pay well enough for them to repay their loans. Also, there are college students who take out loans and never graduate, as well as graduates who never use their degrees. In some cases, it may have been better if these individuals did not attend school, but hindsight is always 20/20.

Biden has announced two main actions to help those already burdened with student loans. First, they are extending the current payment deferral until the end of 2022.

It has been stated that this will be the final extension of the deferment, but of course, we will not know if that holds true until we get there. If the economy does not recover, then perhaps a further extension will be provided.

How Much Will be Forgiven?

More importantly, though, the current administration will be forgiving $10,000 of loans per borrower and up to $20,000 if the individual received Pell Grants for college assistance. However, this forgiveness will be limited to those making less than $125,000/$250,000 for single/married borrowers. More information on how to apply for student loan forgiveness and the steps required will be available in the near future.

The final extension of payments is meant to be used as a grace period while the forgiveness is distributed. Hence, borrowers know whether or not they will be responsible for payments at the beginning of 2023. The forgiveness could potentially fully eliminate the loans for 20 million borrowers, while another 23 million should receive a portion of their debt forgiven.

The income limit ensures only low to middle-class individuals receive the forgiveness, and the Pell Grant bonus amplifies the assistance to those who attended school as part of a low-income family. However, the assistance has received a fair amount of pushback.

Skyrocketing Cost of College

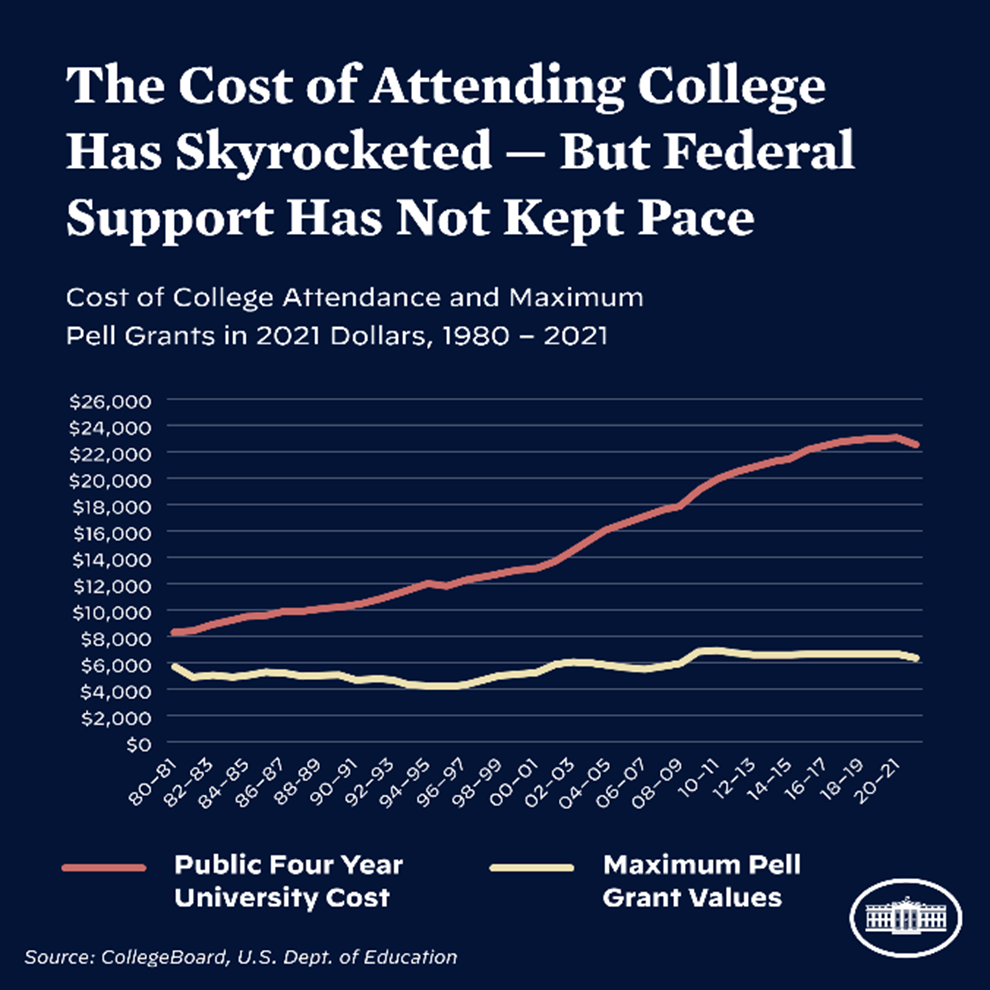

One part of the problem is the skyrocketing cost of a college education. The chart below shows that the cost of college has almost tripled in the past 40 years, with the main increases starting at the turn of the century.

However, the level of financial support from the government via Pell Grants has remained relatively flat over the same period. In other words, students are faced with higher costs without additional financial support.

Biden’s plan to tackle the student loan crisis includes increasing the Pell Grant benefits while also attempting to keep colleges and universities from drastically rising their costs.

Questions Left Unanswered

There are a number of questions raised, including the following:

- What about the individuals that have already repaid their loans, especially those who continued to make payments during the deferment?

- What about those who did not attend college and went into a trade school or directly into the workforce?

- What about the high-income doctors who potentially have the largest amount of student loans?

There is an abundance of valid counterpoints to debt forgiveness, and we believe more needs to be done. Simply forgiving loans will not prevent this issue from arising in the future.

Future Analysis Needed

More specific details will be released on this topic, but we believe educational institutions may be limited in regards to the price increases they implement and may also include additional transparency so future students and families can make more informed decisions about schooling. We also believe the government may need to reassess the interest rates on student loans. For example, should student loans be a form of profit for the government or a private third party?

Speak With a Trusted Advisor

If you have any questions about Student Loan Forgiveness, your investment portfolio, retirement planning, taxes, our 401(k)-recommendation service, or anything else, please call our office at (586) 226-2100.

Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

If you found this article helpful, consider reading:

- Navigating College Funding

- Financial Planning Mistakes to Avoid

- Debt Repayment Strategies

- How to Negotiate a Raise

Sources:

- https://studentaid.gov/manage-loans/forgiveness-cancellation

- https://studentaid.gov/debt-relief-announcement/

- https://www.whitehouse.gov/briefing-room/statements-releases/2022/08/24/fact-sheet-president-biden-announces-student-loan-relief-for-borrowers-who-need-it-most/

- https://www.investopedia.com/terms/s/student-loan-forgiveness.asp

- https://www.yahoo.com/video/details-emerge-student-loan-forgiveness-122150050.html