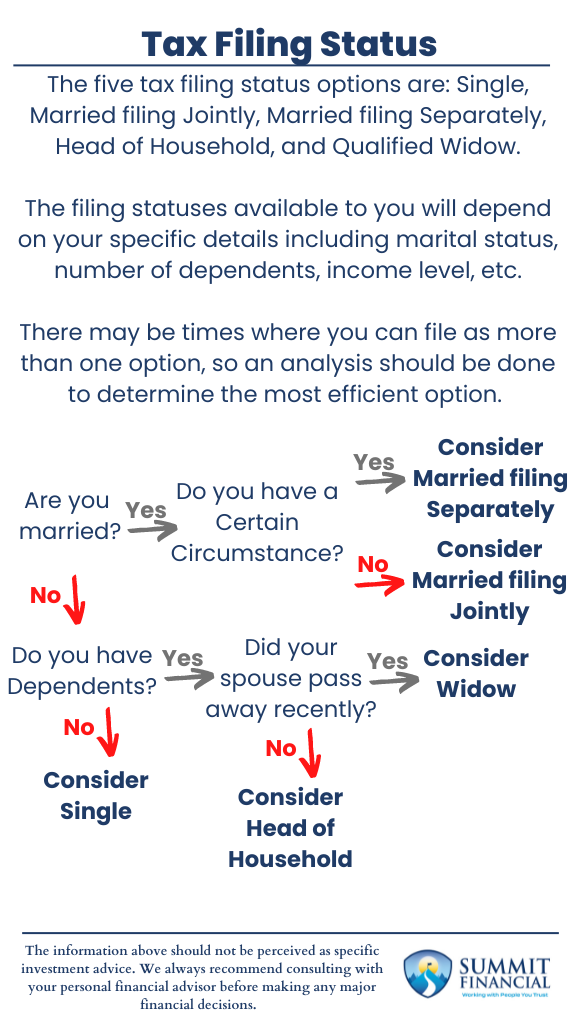

- The five tax filing status options are: Single, Married filing Jointly, Married filing Separately, Head of Household, and Qualified Widow.

- The filing statuses available to you will depend on your specific details, including marital status, number of dependents, income level, etc.

- There may be times where you can file as more than one option, so an analysis should be done to determine the most efficient option.

Every year you are required to elect a Filing Status when your tax returns are prepared. The five filing status options are: Single, Married filing Jointly, Married filing Separately, Head of Household, and Qualified Widow.

It is important to consult your tax preparer every year to help ensure you are selecting an appropriate option. We believe that most people will choose the same status as the previous year, but sometimes there are major life changes that will impact your options and amount of taxes paid.

The factors impacting your options and net taxes include your personal details such as marital status, number of dependents, income level, etc. There may be times where you can file as more than one option, so an analysis should be done to determine the most efficient option.

Single Status Filing

The most basic option and one that most people are familiar with is the filing status of Single. This is the option that is chosen when no other option is available.

This option is usually the last resort since it does not offer many benefits compared to the other options when they are available. I

t is possible that Single will provide a lower net tax compared to other options since the tax brackets are a little more favorable. However, this primarily affects those who are pushing the 30%+ brackets.

Married Filing Jointly

The next simplest filing option and another very common selection is Married filing Jointly. This is the traditional tax filing status that people think of when they mention filing taxes as a married couple.

When two individuals get married, this is likely the option they will choose. Filing your taxes is a little simpler because one return can be submitted instead of preparing a return for each individual.

Filing joint taxes does often result in a decrease in taxes paid compared to if the individuals filed Single returns, especially in the lower income brackets.

However, one drawdown of Filing jointly is that both individuals are equally responsible for the taxes due, even if one spouse earns all the income.

Married Filing Separately

Married couples also have the option of filing their taxes separately. Married filing Separately is a more advanced filing option that may be advantageous in certain circumstances.

One of the most common reasons is for separation of the spouses such as a divorce that is not finalized by year-end. Another possible scenario is if one spouse is pursuing student loan repayment and is currently on an income driven payment plan.

By keeping their income separate, they may qualify for lower monthly payments on their loans until forgiveness is received. Medical Expenses may be another reason to file separately, as a high level of expenses may be deducted if they exceed 7.5% of your income. Separate incomes may make it easier to hit the 7.5% level

Lastly, filing separately would remove the joint obligation for the taxes due, so spouses may file separately if one spouse does not want to be responsible for the obligations of the other.

Head of Household & Qualified Widow

Head of Household and Widow are both very specific tax filing statuses that require the filer to be in a certain situation in order to elect. Head of Household is for unmarried individuals who provide support for dependents and their household. The IRS recognizes your responsibility of providing for others, so you receive a larger standard deduction and more generous tax brackets.

Widow or Widow(er) is for those who recently lost a spouse and claim a dependent child.

This filing option will provide the same benefits as if the Widow was filing taxes jointly. However, this means they would receive a larger standard deduction and usually more favorable tax brackets.

Get Help with Your Taxes

If you have any questions about your Tax Filing Status, taxes, your individual investment portfolio, our 401(k)-recommendation service, or anything else in general, please call our office at (586) 226-2100.

Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please contact us so we can discuss it.

We hope you learned something today. We would love to hear your feedback or suggestions.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, James Wink, James Baldwin,

If you found this article helpful, consider reading:

- How Do Bull Markets and Bear Markets Differ

- Navigating College Funding

- Financial Planning Mistakes to Avoid

Sources:

- https://www.investopedia.com/terms/f/filingstatus.asp

- https://www.nerdwallet.com/article/taxes/how-to-choose-tax-filing-status

- https://www.cnbc.com/2022/02/24/heres-when-married-filing-separately-makes-sense-tax-experts-say.html