Tax Loss Harvesting is a great end-of-the-year tax planning tool. The goal of this exercise is to sell investments at a loss to offset other potential income taxes.

Offsetting Capital Gains and Income

Capital losses can be used to reduce capital gains in a given year since only the ending net result is the taxable outcome.

- If you made $10,000 in trading stocks but are currently down $5,000 in your current positions, you can sell your current positions before year-end to cut your tax liability in half.

- If you do not have capital gains, then you could deduct $3,000 worth of losses to offset your ordinary income.

- Any loss above $3,000 will be carried over into the next year and the process will be repeated indefinitely.

Losses do not expire and will continue to carry over into the following year until all losses are deducted.

Tax Loss Harvesting and Account Types

It is important to remember that tax loss harvesting only works when selling investments within a taxable account. Qualified accounts are normally not taxed until withdrawals are made, so losses cannot be deducted prematurely either.

Selling investments at a loss within your IRA will not trigger any tax deductions to offset your Non-Qualified Brokerage gains.

Understanding the Wash Sale Rule

It is also important to consider the Wash Sale Rule when debating Tax Loss Harvesting. This rule may prevent you from deducting the loss if the same or similar investment is purchased again in the near future. The Wash Sale timeframe is 61 days, including 30 days before and 30 days after selling the investment for a loss.

Triggering a Wash Sale will prevent you from deducting the losses for taxes, but you do not necessarily miss out on the loss itself. The cost basis for the newly acquired position is adjusted for the previous loss. Essentially, the loss is carried over and applied to the new position rather than being realized.

Avoiding the Wash Sale Rule

Lastly, it is important to consider your overall financial plan when evaluating the benefits of tax loss harvesting. The Wash Sale rule is a big concern since you may be limited in trading specific securities if you are trying to claim the loss for taxes.

And this rule applies to all of your holdings and typically includes any spousal investments as well. This means that if you sell stock for tax loss harvesting, you cannot buy the stock back within 30 days from any of your accounts. But what if you think the stock has potential for gains in the short-term?

If that’s the case, then you may be better off just holding the position as is. You are not able to avoid the Wash Sale by selling a stock in your Non-Qualified Brokerage while buying the same stock in your IRA.

Those transactions would trigger the Wash Sale, and the loss would not be deductible.

Is Tax Loss Harvesting Right for You? – Key Takeaways

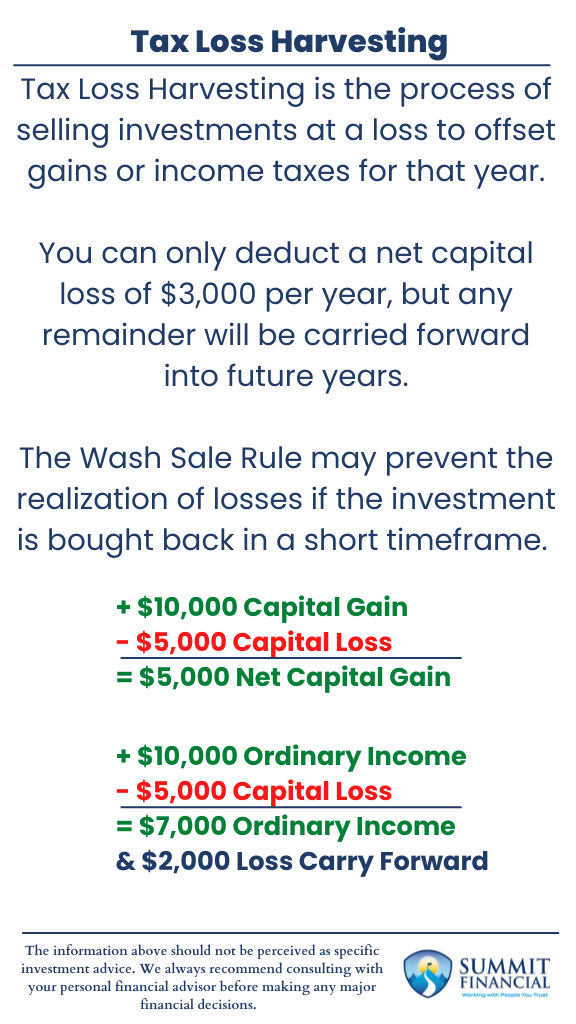

- Tax Loss Harvesting is the process of selling investments at a loss to offset gains or income taxes for that year.

- You can only deduct a net capital loss of $3,000 per year, but any remainder will be carried forward into future years.

- The Wash Sale Rule may prevent the realization of losses if the investment is bought back in a short timeframe.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100.

Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, James Wink and James Baldwin

If you found this article helpful, consider reading:

- Navigating College Funding

- Financial Planning Mistakes to Avoid

- Debt Repayment Strategies

- How to Negotiate a Raise

Sources:

- https://www.bankrate.com/investing/how-to-deduct-stock-losses-from-taxes/

- https://www.schwab.com/learn/story/how-to-cut-your-tax-bill-with-tax-loss-harvesting#:~:text=Tax%2Dloss%20harvesting%20generally%20works,%243%2C000%20of%20your%20ordinary%20income.

- https://www.investopedia.com/articles/taxes/08/tax-loss-harvesting.asp

- https://www.fidelity.com/learning-center/personal-finance/wash-sales-rules-tax