Our last two blogs discussed the importance of saving for retirement through our discussion of Time Value of Money, and we also touched on how to budget appropriately for these savings within our Budgeting 101 post. Now, we will be discussing the differences between two primary retirement savings account types: Roth and Traditional.

Before we begin, we will be focusing on the differences as they relate to Individual Retirement Accounts (IRA). While many employers offer a Traditional and Roth 401(k), the rules are very similar, but we recommend speaking with your advisor regarding the overall differences between 401(k)’s and IRA’s.

What is a Traditional IRA?

So, what is a Traditional IRA? This type of account is used to fund retirement using pre-tax dollars. Since an IRA is most often funded from a bank account using after-tax dollars, most investors receive a tax deduction for the amount they contribute to a Traditional IRA.

This deduction makes the contributions pre-tax. You remove this amount from your income tax return, so you will not have to pay taxes on the amount contributed. When qualified withdrawals are made from the account, income taxes will be due on the full amount.

What is a Roth IRA?

This type of account is used to fund retirement using post-tax dollars. Much like Traditional IRA’s, these accounts are most typically funded from a bank account. Since this is an after-tax account, you will not receive a deduction for your tax return.

Contribution amounts must still be included in your annual income. When qualified withdrawals are made from the account, there will be no income taxes due. You have already paid your income taxes on this money, so you do not need to pay it again.

From a purely numbers standpoint, does it make more sense to invest on a pre-tax or a post-tax basis? The answer is hidden within your income tax bracket. At the time of contribution, if your tax bracket is higher than it is when you will be making withdrawals, it may make sense to invest on a pre-tax basis.

If your tax bracket is lower than it will be in retirement, it may be best to invest on a post-tax basis. Essentially, you want to consider paying the taxes when you are in the lower bracket.

Planning for Future Tax Brackets

Let’s look at the numbers for this one: (identical tax bracket of 20%)

|

Traditional |

Roth |

|||

| Present Value: |

$10,000 0 |

Present Value: |

$10,000 0 |

|

| Taxes Due: |

$0 $10,00 |

Taxes Due: | $2,000 | |

| Remaining Value: | 0 | Remaining Value: | $8,000 | |

| Years Invested: | 10 | Years Invested: | 10 | |

| Annual Growth: |

6% $17,908 |

Annual Growth: |

6% $14,327 |

|

| Future Value: | 8 | Future Value: | 7 | |

| Future Taxes Due: | $3,582 | Future Taxes Due: | $0 | |

| Future End Value: |

$14,327 7 |

Future End Value: |

$14,327 7 |

|

As you can see in the table above, as long as your income tax bracket is the same now as it will be in retirement, it does not matter if you focus on pre-tax or post-tax savings.

(Disclaimer: Additional retirement income may cause Social Security benefits to become taxable and additional income may cause long-term capital gains to be taxed at a higher rate. We recommend meeting with a CPA to discuss your in-depth tax planning situation.)

However, there are more factors to consider rather than just potential monetary growth. For example, a big difference between a Roth and Traditional IRA is that you may be able to withdraw your contributions penalty and tax-free from a Roth IRA. Only the growth in the Roth account is subject to penalties and taxes. In a traditional IRA, however, the entire account is subject to early withdrawal penalties and taxes.

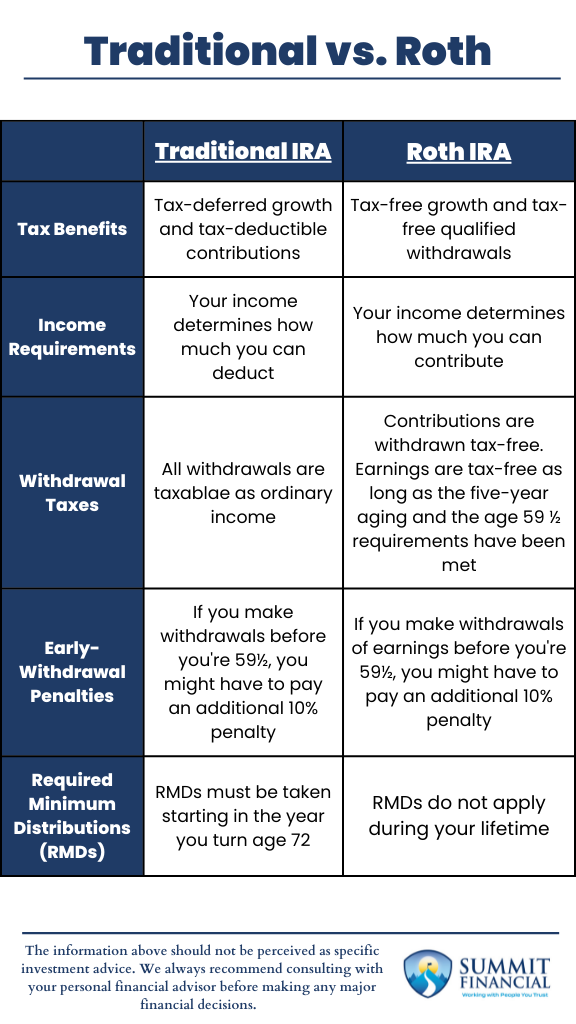

Please check out the table below to view a summary of these accounts as well as some other account differences:

How do we know what tax brackets will look like in the future? Well, no one knows that answer for sure. Please consider that our Federal government does not have enough funding set aside for various pension obligations, Medicare, Medicaid, Social Security, or our national debt which now stands at $269,269 per taxpayer or $35.3 Trillion total at the time of this writing.

That leads us to believe that tax brackets have a high probability of increasing in the future. Because of this, we often recommend Roth investments because paying taxes now may be advantageous versus paying taxes later.

Financial Planning and Review Meeting

If you have any questions about your investment portfolio, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

Sources:

Disclosures regarding our performance reporting: Because some clients are in the 10% tax bracket and others are in the 37% Federal tax bracket, we have decided to report performance before taxes. If you have a non-qualified account, please feel free to contact us to determine your individualized rate of return after tax. All of Summit’s performance is after our 1.25% advisory fee that is deducted monthly. Your fees may be higher or lower depending upon the number of assets invested with our firm. Feel free to contact us to receive online access so you can see your personalized rate of return. The Aggregate bond index we use is ticker: AGG. All dividends and distributions are reinvested and included in the performance. The S&P 500 index quoted above does not include dividends within the performance. If a holding within our portfolio does pay a dividend or other income, it is reinvested, so our performance does include dividends. This report has been prepared from data believed reliable, but no representation is made as to accuracy or completeness. Total return and principal value will vary depending upon the deduction of advisory fees, brokerage commissions, reinvestment of dividends and other earnings or fund charges. This information is provided to you in combined form, solely for your convenience and ease of review, and is not an offer or solicitation to buy or sell any securities. In order to verify that all account values and transactions are accurate, we encourage you to compare the information provided in our statement with the statement you receive directly from your custodian. All written content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. Past performance does not guarantee future results.