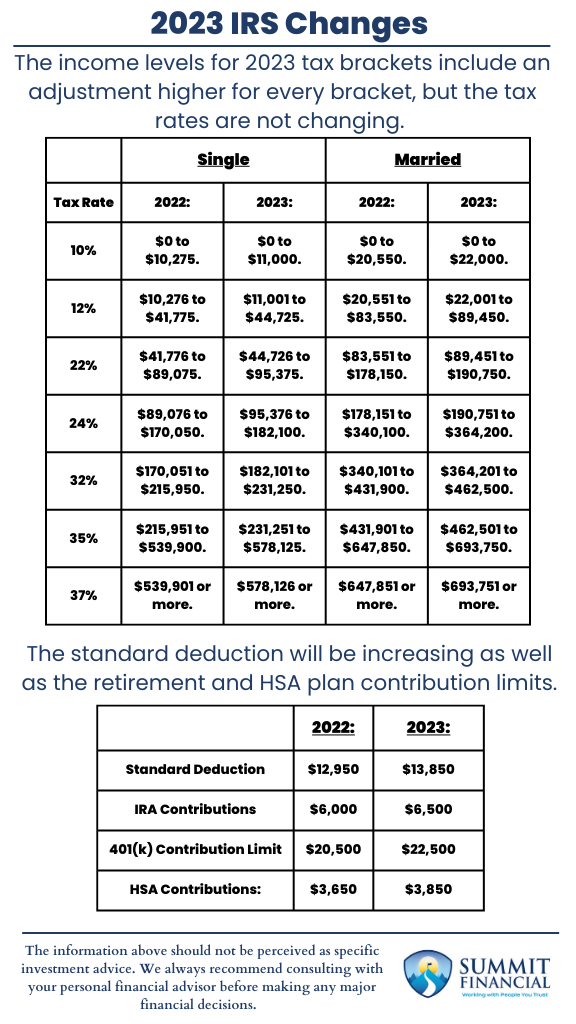

- The income levels for 2023 tax brackets include an adjustment higher for every bracket, but the tax rates are not changing.

- The standard deduction will be increasing as well as the retirement and HSA plan contribution limits.

- These changes should be taken into consideration for individuals and families with more involved tax planning situations since estimates and plans may need to be updated, but the changes will have an impact on every tax filer.

It is typical for the IRS to make certain changes every year based on previous and anticipated levels of inflation. In a high inflationary environment, consumers are spending more on everyday goods and services as well as large ticket items. Because households must increase spending, it is very common for high inflation to result in an increase in average wages. These higher wages may lose value if the individual or family is forced to pay more in taxes or is limited to accessing certain retirement or tax benefits based on an increase in income.

The IRS’ goal is not to hinder nor benefit anyone who simply receives an inflationary pay raise. If your income outpaces inflation, then you may have a higher tax bill or face certain limitations. If your income increases slower than inflation, then you might actually owe less in taxes.

Federal Income Tax Brackets

One of the biggest changes that the IRS reviews annually is the adjustments made to income tax brackets. As is the case for 2023, the tax bracket rates typically do not change from year to year unless new legislation is passed. However, the income levels that define where one bracket starts and one bracket ends do tend to increase annually.

The tax rates have remained at 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The levels of income that define the various brackets all rose by roughly 7% over the 2022 levels. The increase that we see for 2023 is not a typical amount, but neither is the inflation we are currently experiencing. The degree of inflation is the primary driver in deciding how much these brackets should be shifted.

Standard Deduction

We believe it is important to note a few other areas that are also receiving inflation increases. The standard deduction, which directly reduces taxable income for filers, will be receiving a roughly 7% increase for 2023. Since this benefit is not based on your level of income, such as the brackets, this means that every tax filer will benefit from this increase.

Tax Efficiency Accounts

Tax efficiency and retirement accounts will also receive an inflation increase, which allows individuals and families to contribute a similar percentage of their income. If income is rising and contribution limits do not increase, there becomes a disparity in the average budget and would hinder investors. Accounts such as IRAs, 401(k)’s, 403(b)’s, 457’s, HSA’s, are all receiving increases to their contribution limits, although the increases are not fully consistent among the account types. Qualified accounts that include an income phaseout level will also receive an increase to the maximum income allowed.

There is an abundance of changes that occur from year to year. This blog post only highlighted a few examples, which we believe to be some of the most important. Please reach out to your tax or financial advisor if you would like to discuss this in further detail.

Speak With a Trusted Advisor

If you have any questions about changes for 2023, your investment portfolio, taxes, retirement planning, our 401(k)-recommendation service, or anything else in general, please give our office a call at (586) 226-2100.

Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

If you found this article helpful, consider reading:

- Navigating College Funding

- Financial Planning Mistakes to Avoid

- Debt Repayment Strategies

- How to Negotiate a Raise

Sources:

- https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2023

- https://www.nerdwallet.com/article/taxes/tax-changes

- https://www.irs.gov/newsroom/taxpayers-should-review-the-401k-and-ira-limit-increases-for-2023#:~:text=The%20amount%20individuals%20can%20contribute,also%20all%20increase%20for%202023.

- https://www.fidelity.com/learning-center/smart-money/hsa-contribution-limits

- https://www.investopedia.com/ask/answers/111715/are-tax-brackets-adjusted-inflation.asp