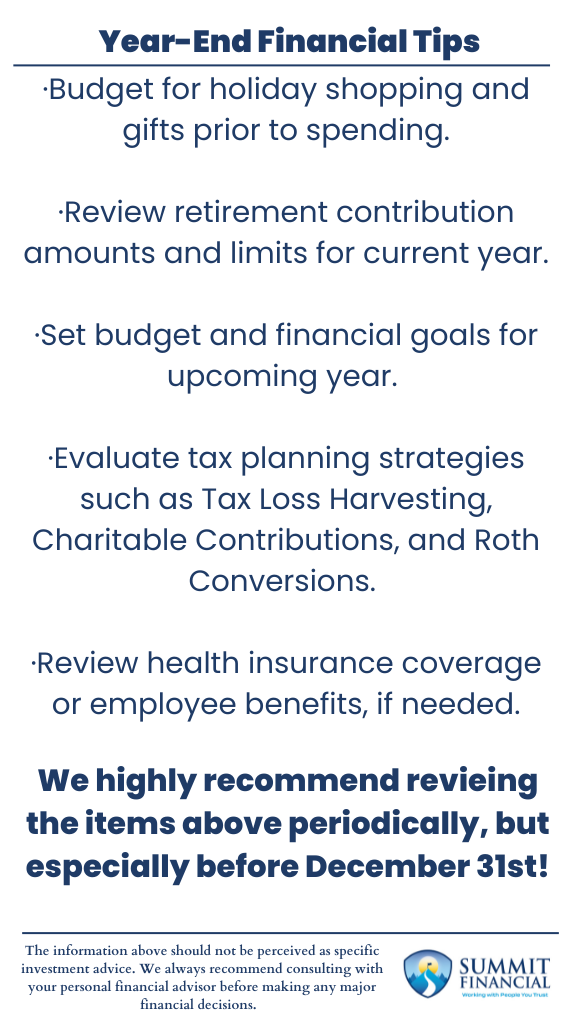

- Budget for holiday shopping and gifts before spending.

- Review retirement contribution amounts and limits for the current year.

- Set budget and financial goals for the upcoming year.

- Evaluate tax planning strategies such as Tax Loss Harvesting, Charitable Contributions, and Roth Conversions.

- Review health insurance coverage or employee benefits, if needed.

The end of the year tends to be a very hectic time for many individuals and families. We created this blog post to help identify important financial areas that may be overlooked during this busy period. Many of the ideas below have deadlines near the end of the year or possibly even December 31st. It is important to consider all of these actions throughout the year, but even more important to ensure they are completed before any potential deadlines.

Track Holiday Spending

First, we want to start with an idea that may be part of the reason for the craziness of the season: Holiday Shopping. This time of year is often spent frantically searching and attempting to buy the best gift for our loved ones. Some may try to find the best deal they can on a list of items, while others may simply buy the gift they know will bring the biggest smile.

Of course, we want to please those we are buying gifts for, but there should be a limit on the amount you will spend on gifting. This is an important reminder to review your budget and set a limit on gifts before you begin spending.

Waiting until afterward often results in excess spending above your budget and potentially an increase in credit card amounts. Plan out a total gifting budget, how many people you need to buy for, and how much of the budget should be allocated to each individual.

This will help ensure you do not overspend and remain on track within your budget. The holidays can be very expensive and detrimental to your budget if you do not plan accordingly.

Review Retirement Contributions

Once your holiday spending budget is set, review any excess savings you may have sitting at the bank. While many retirement accounts have a contribution of the Mid-April Tax Filing deadline, reviewing your investment contributions at year-end may allow you to start the New Year with forward-looking contributions.

We find it much easier on client planning when contributions are completed by year-end rather than the overlapping period in the Spring. Ensuring you make contributions before December 31st may also alleviate the tax headache in case you file taxes early. An amended return may be needed if you decide to make contributions after you have already filed.

Assess Your Financial Plan

The end of the year is also a great time to sit down and review your overall financial plan. You can track any progress made in the current year towards your financial goals and identify any potential pitfalls. This would give you an idea of where to focus on the upcoming year and make any potential changes to your plan.

This is a great time to review and update your goals for the New Year to ensure you start the year on track for success. For example, did you hit the investment savings amount you were hoping to reach this year? If not, then perhaps adjust your budget for the upcoming year to ensure you hit the goal for next year.

Speaking of budget, year-end is also a great time to review your spending to see if any expenses have changed in amount or frequency. This refresher would allow you to start the upcoming year on the right foot as your budget has been updated for any changes in costs.

Plan for Tax Season

It is important to review specific tax considerations before the end of the year. One of our top ideas for year-end tax planning is Tax Loss Harvesting.

Tax Loss Harvesting

This is a process where you sell investments in a non-qualified brokerage account for a loss before year end. The realized loss will offset any realized gains and may potentially reduce your overall tax bill. This can be an important strategy in years like 2022 when we saw a substantial amount of market volatility.

Charitable Contributions

Next, consider charitable contributions in order to potentially reduce your tax bill if you plan on itemizing your deductions. It is important to ensure your charitable gifting is concluded by year end so that you receive the appropriate deduction come tax time.

However, this strategy may only be beneficial if you already plan on itemizing your deductions. You may not see any taxable benefit if you plan on taking the standard deduction.

Roth Conversions

Lastly, consider Roth Conversions if they are appropriate for your situation. This strategy involves realizing the income taxes within a Traditional IRA and moving the savings into a Roth IRA where they will begin to grow tax-free. This is most beneficial for those retirees who have little to no taxable income, especially if they are not receiving Social Security yet. The lower your tax bracket is, the more beneficial this strategy becomes.

Review Your Health Insurance Coverage

Lastly, the end of the year always coincides with the health insurance Open Enrollment season. This is the time of year for those on Medicare or an individual health insurance plan to review their options for the upcoming year.

Pricing and benefits tend to change from year to year, so we always suggest reviewing your situation during Open Enrollment. The federal government provides cost savings for low-income individuals through the Marketplace, so it is important to review any potential subsidies you may qualify for.

If you are receiving employer benefits, check with your HR department to see when your open enrollment is. It very well may be the end of the year, or it may occur throughout the year.

You may have options available through your employer that you are not aware of, or possibly your options may have changed since you last review them. If you are in need of coverage, we have a very talented staff that can assist you with re-shopping your coverages for Individual coverage, Small Group Plans, Medicare Supplemental, Prescription drugs, Vision, Dental, or any other needs you may have. You can contact them at (248) 779-1000 or through their website at https://summithealthmedicare.net/

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

If you found this article helpful, consider reading:

- Navigating College Funding

- Financial Planning Mistakes to Avoid

- Debt Repayment Strategies

- How to Negotiate a Raise

Sources:

- https://www.irs.gov/retirement-plans/ira-year-end-reminders#:~:text=If%20you’re%20still%20working,contributions%20until%20April%2018%2C%202023.

- https://www.thinkadvisor.com/2022/11/10/10-budgeting-mistakes-clients-make-advisors-advice/

- https://www.usbank.com/financialiq/plan-your-future/manage-wealth/year-end-financial-checklist.html

- https://www.fidelity.com/retirement-ira/roth-conversion-checklists

- https://www.healthcare.gov/see-plans/#/