As we begin 2025, we wanted to address some of the upcoming changes to tax laws that may impact our financial planning clients. While there are certainly more changes than we will discuss here, we specifically wanted to focus on changes that will be more front and center of our client conversations.

We suggest discussing with your CPA if you have any specific questions about your tax planning strategies and how things may change with any of the updated rules for 2025.

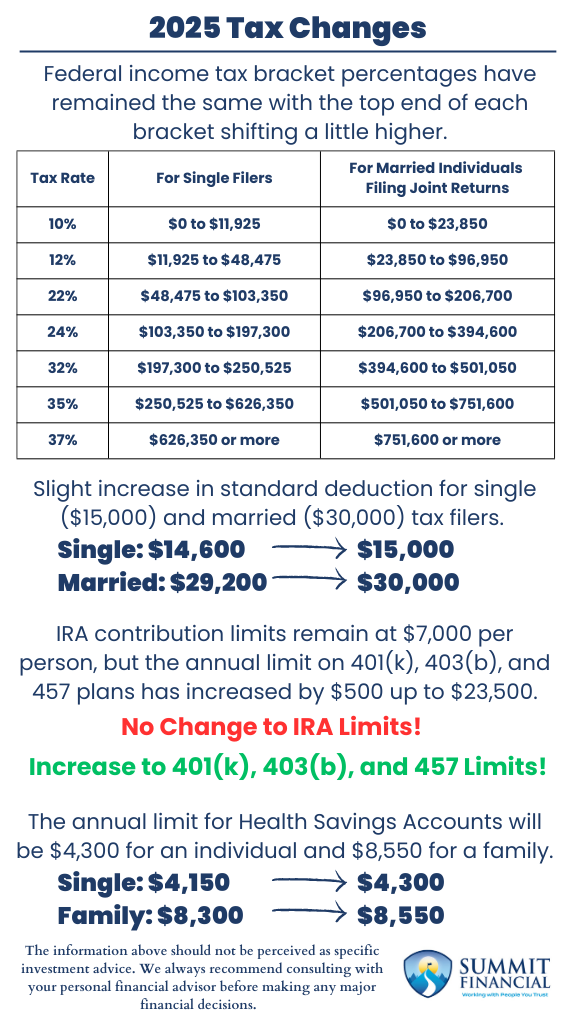

However, the income brackets for those rates are shifting slightly higher.

For example, the 12% bracket for an individual was $11,600-$47,150 in 2024, and it will be $11,925-$48,475 in 2025.

This slight change is seen across the board for both single and married filers. This means that every filer will be able to get a little bit more income taxed at their lower rates, which for filers with identical taxable income amounts for 2024 and 2025, they should see a slightly less amount of tax owed since slightly more income will be within the lower brackets.

| Tax Rate | For Single Filers | For Married Individuals Filing Joint Returns | For Heads of Households |

|---|---|---|---|

| 10% | $0 to $11,925 | $0 to $23,850 | $0 to $17,000 |

| 12% | $11,925 to $48,475 | $23,850 to $96,950 | $17,000 to $64,850 |

| 22% | $48,475 to $103,350 | $96,950 to $206,700 | $64,850 to $103,350 |

| 24% | $103,350 to $197,300 | $206,700 to $394,600 | $103,350 to $197,300 |

| 32% | $197,300 to $250,525 | $394,600 to $501,050 | $197,300 to $250,500 |

| 35% | $250,525 to $626,350 | $501,050 to $751,600 | $250,500 to $626,350 |

| 37% | $626,350 or more | $751,600 or more | $626,350 or more |

Source: https://taxfoundation.org/data/all/federal/2025-tax-brackets/

Standard Deduction Increases Slightly for 2025

On top of this change in the income bracket ranges, there was also a slight increase in the standard deduction amount for 2025. Single filers will have a standard deduction of $15,000 and married filers will have a standard deduction of $30,000.

This is a $400 and $800 increase, respectively. An increasing standard deduction should yield a tax savings for filers, especially those who have an identical level of taxable income for 2024 and 2025.

This slight increase also means that the hurdle amount to benefit from itemized deductions has also increased. For example, single filers with $14,800 would benefit from itemized deductions in 2024 but would benefit from the standard deduction in 2025.

Retirement Savings Options: What’s Changing and What’s Not

Next, we wanted to discuss retirement savings options that may be changing for 2025. Unfortunately, the contribution limit for IRA’s, including Traditional and Roth accounts, will not be increasing. These will remain at their $7,000 limit.

However, some employer-sponsored plans such as 401(k), 403(b), and 457 accounts are seeing a slight increase. These are all shifting by $500 so the new maximum contribution allowed will be $23,500 for 2025.

Federal Income Tax Brackets Remain the Same but Shift Higher

First, we wanted to mention that the federal income tax brackets percentages will remain the same for 2025. The tax rates of 10%, 12%, 22%, 24%, 32%, 35%, and 37% are not changing for the 2025 tax year.

Also, we are seeing a slight increase in the amount that can be contributed to Health Savings Accounts. These are moving up to $4,300 for single coverage and $8,550 for family coverage, which are a couple of hundred dollars more than the 2024 amounts.

Conclusion: 2025 Tax Changes

- Federal income tax bracket percentages have remained the same, with the top end of each bracket shifting a little higher.

- Slight increase in standard deduction for single ($15,000) and married ($30,000) tax filers.

- IRA contribution limits remain at $7,000 per person, but the annual limit on 401(k), 403(b), and 457 plans has increased by $500 up to $23,500.

- The annual limit for Health Savings Accounts will be $4,300 for an individual and $8,550 for a family.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, James Wink

If you found this article helpful, consider reading:

Sources:

- https://www.irs.gov/newsroom/irs-releases-tax-inflation-adjustments-for-tax-year-2025

- https://taxfoundation.org/data/all/federal/2025-tax-brackets/

- https://taxfoundation.org/data/all/federal/2024-tax-brackets/

- https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000

- https://www.fidelity.com/learning-center/smart-money/hsa-contribution-limits