We have seen that our clients are often surprised that they have a few different options to consider as it relates to their employer sponsored retirement plans when they change jobs.

This blog post will detail the different options that are available and what our typical input is as it relates to this decision.

Option 1: Withdrawing Your 401(k) Funds

First, consider withdrawing the funds from the account (even though we rarely recommend it). Withdrawals from pre-tax retirement accounts trigger taxable income, which would lead to increased taxes and could also trigger an early withdrawal penalty if you are below age 59 ½.

This is not a common path for our clients since these funds are set aside long-term for retirement and we believe it is normally best to keep these funds in a tax deferred account for those long-term benefits.

Option 2: Leaving the Account with Your Previous Employer

Next, if the previous employer allows, the employee could leave the account as is within the previous employer’s plan. This means the account would stay where it is, and the employee could continue to manage it as they have been.

However, since they are no longer with that employer, contributions will not be allowed into that account moving forward. One of the reasons we see this option utilized is if there is a loan within the account, and the funds cannot be moved elsewhere until the loan is repaid.

Option 3: Rolling Funds into a New Employer’s Plan

If your new employer also offers a retirement plan, you could consider rolling the previous plan into the new one. This decision should take into consideration the investment options within both plans. Some retirement plans offer a wide variety of investments to choose from, while others only offer a select lineup.

If you have a diverse lineup in the previous plan, it may be worth considering not rolling into the new one since that would restrict your investment flexibility. However, we have noticed that a lot of accounts enjoy the simplicity of having their accounts consolidated and not having to monitor more accounts than necessary.

Option 4: Rolling Over to a Traditional IRA

Lastly, you could consider rolling the funds into a Traditional IRA with a different financial institution. Similar to the point above, investment flexibility is important for some clients and a Traditional IRA may provide you with more investments to choose from. Further, these types of accounts could typically be managed by an investment advisor like we offer for our clients.

This could be an option if you already have an IRA or other accounts with an advisor since it would consolidate the accounts into one custodian. It could also provide professional management if that is a preference of yours, or you could access solutions not available within an employer plan, such as an annuity option.

Factors to Consider When Deciding What to Do with Your Old 401(k)

We wanted to mention that different employer retirement plans, along with IRA options, may have different investments, fees, and associated benefits. This decision may be straightforward for some, but others may be more complicated. We recommend meeting with your personal advisor to discuss the pros and cons of your options to help make a more informed decision.

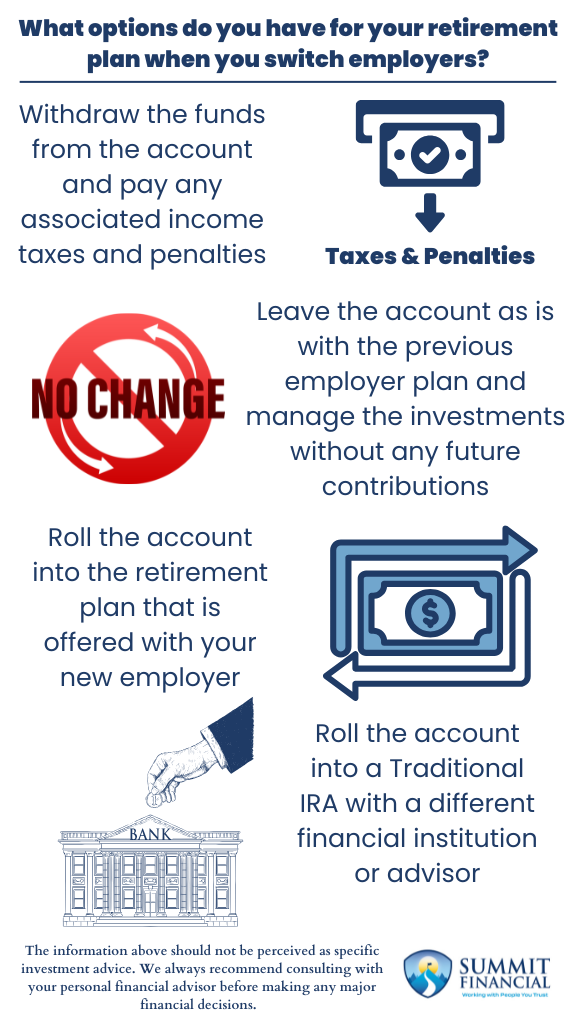

Key Takeaways: 401(k) Options When Changing Jobs

- Withdraw the funds from the account and pay any associated income taxes and penalties

- Leave the account as is with the previous employer plan and manage the investments without any future contributions

- Roll the account into the retirement plan that is offered with your new employer

- Roll the account into a Traditional IRA with a different financial institution or advisor

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Sincerely,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, James Wink, and James Baldwin

If you found this article helpful, consider reading:

- How Do Bull Markets and Bear Markets Differ

- Navigating College Funding

- Financial Planning Mistakes to Avoid

- Tax Filing Explained

Sources: