We have seen the FIRE movement become a more popular goal among our clients, and we have also seen it posted online more in recent years.

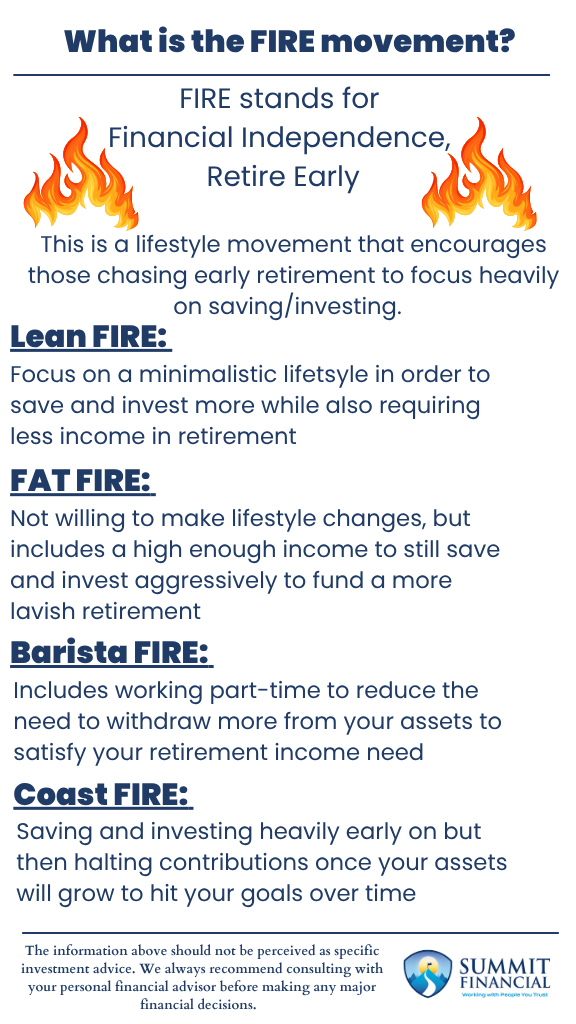

Due to the rising popularity we have seen, we felt it would make for an interesting blog topic for those unfamiliar with it. FIRE stands for Financial Independence, Retire Early. Overall, it is a lifestyle movement that encourages those chasing early retirement to focus heavily on saving/investing (Source: Investopedia).

Financial Independence, Retire Early (FIRE): How it Works

The goal is to accumulate enough assets to fund your retirement, with the specific aim of retiring before the traditional full retirement age. Followers of this movement tend to focus on their asset level in relation to their income needs in order to calculate how much they need to have saved (Source: www.investopedia.com).

The typical withdrawal rate is around 4% of total assets, so if someone wanted to live off of $50,000 a year from their investments, then they would need $1,250,000 in order to generate that 4% withdrawal rule.

This person would have a FIRE asset goal of $1,250,000. If they have $250,000 saved, are saving $25,000 a year, and expect an 8% growth rate, then they could potentially have a FIRE time goal of roughly 13.25 years using a time value of money calculator to solve for when they would hit that $1,250,000 goal.

Four FIRE Variations to Know

Lean FIRE: There are different variations that we want to highlight since not everyone will have the same goals. First, Lean FIRE refers to what I believe is the more traditional definition of FIRE when I think of this movement.

This strategy focuses very heavily on cutting any unnecessary expenses. This involves adopting a minimalist lifestyle to minimize expenses and maximize savings and investments. This type of lifestyle also requires less income to fund, so you would potentially need a lower level of total assets in order to fund a successful retirement (Source: NerdWallet).

Fat FIRE: Next, the opposite strategy would be Fat FIRE. This would be the same goal of saving/investing heavily in order to retire early, but you plan on funding a more lavish lifestyle compared to someone in the Lean FIRE strategy. Essentially, you try to find ways to save and invest as much as possible without cutting more expenses than you are comfortable with.

This means you will have a much higher retirement income need, so a higher level of total assets would be required. You will likely be spending more during your accumulation years, so your annual savings amount may be lower too (Source: NerdWallet). I find this more along the lines of a traditional retirement mindset, but you happen to have enough discretionary income that you are able to save/invest the excess and still achieve an early retirement.

Barista FIRE: Next, Barista FIRE refers to the strategy of saving enough to be able to quit your current 9-5 full-time job. Your income from that point would be funded by your savings withdrawals, but also a part-time job to fill the gap (Source: NerdWallet).

This part-time job lessens the amount of withdrawals needed to fund your lifestyle, so you can succeed with a lower level of total assets potentially. We actually see a lot of clients who retire at full retirement age or beyond still go out and get part-time jobs. A lot of people have trouble sitting at home during retirement and they find a part-time job to avoid getting bored. However, the Barista FIRE strategy would require a part-time job in order to be successful and working is not optional, even if it is less than you used to work.

Coast FIRE: Lastly, Coast FIRE focuses heavily on hitting your FIRE number or years early on. Once you have a decent amount saved/invested, you may be able to halt contributions and just let your assets “coast” and grow until you have enough to retire (Source: Forbes).

This strategy does not require you to continue to focus on saving and investing all the way until you hit your goal. The idea is to really focus heavily early on and then let time do its thing and allow the assets to grow. The numbers for this strategy fluctuate a lot since it really depends on when you specifically want to retire, but also when you specifically want to stop saving.

Financial Independence Retire Early – Summary Snapshot

- FIRE stands for Financial Independence, Retire Early

- This is a lifestyle movement that encourages those chasing early retirement to focus heavily on saving/investing.

- There are different variations including Lean FIRE, Fat FIRE, Barista FIRE, and Coast FIRE.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general inquiries, please contact our office at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have experienced any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please call us so we can discuss them.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Sincerely,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, James Wink,

If you found this article helpful, consider reading:

- How Do Bull Markets and Bear Markets Differ

- Navigating College Funding

- Financial Planning Mistakes to Avoid

- Tax Filing Explained