It is becoming increasingly common for employers to no longer offer pension benefits for retirement. Pensions are very costly to the employer as wages continue to rise and life expectancy continues to extend longer.

This means that the employer may be forced to set aside larger amounts of savings or continue to pay these expenses further down the road. This is why employers are shifting towards a defined contribution retirement plan such as a 401(k) with an employer match instead.

These types of plans are simply more cost-effective for the employer, but they also shift the responsibility of retirement saving more to the employee side.

How Employees Are Affected by the Loss of Pensions

Because of this, clients are often interested in how they can replace this reliable income stream that is no longer available through a company pension plan.

Social Security will pay you monthly benefits throughout retirement, but:

-

Those amounts are often not enough to cover all of your expenses

Clients, especially those who are more conservative, would prefer to have an additional income stream that they can count on regardless of the stock/bond market performance. This is an example of a need that can be solved with an annuity solution.

Replacing the Guaranteed Income Stream with Annuity Income

Because of this shift, clients are often interested in how they can replace the guaranteed income stream that is no longer available from traditional pensions. Social Security will pay you monthly benefits throughout retirement, but those amounts are often not enough to cover all of your expenses.

Many clients, especially those who are more conservative, would prefer to have an additional income stream that they can count on regardless of the stock/bond market performance. This is an example of a need that can be solved with an annuity solution.

What Role Do Annuities Play in Retirement Income?

Annuities were originally designed to provide lifetime income through annuitization of the policies. This means:

-

The contract would be turned into an income stream

-

Distributed to the annuitant throughout their lifetime

Nowadays, these types of policies contain an income benefit or rider that:

-

Replicates the income stream

-

Allows for an account value and death benefit feature

-

Helps if the contract is not fully depleted

Annuities are technically insurance products offered by life insurance providers. Life insurance is used to protect against unexpected death, while income annuities are used to protect against unexpected longevity.

This is why life insurance companies offer them – they are some of the few entities that can offer protection on both sides of the life/death coin. Their margin spreads, along with the actuarial probabilities, help ensure the companies earn a profit on the business.

Types of Annuity Income Options and Their Implications

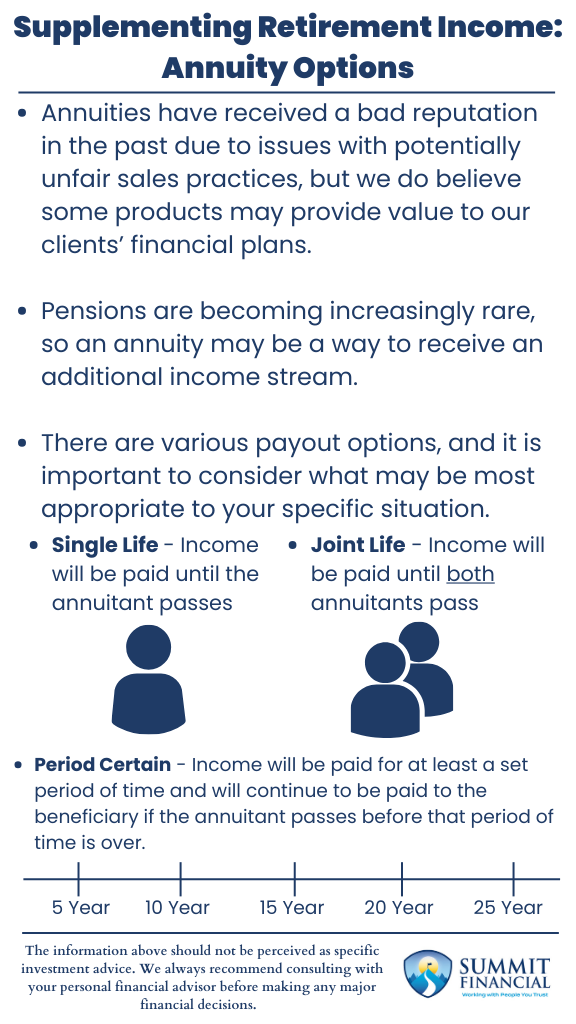

A few different annuitization or income options are available within the contracts, and these are similar to the pension options that are available at retirement to those who receive that benefit.

The simplest option is Single Life, and these pay out an income benefit until the annuitant passes away. Joint Life policies typically cover spouses and will pay until both annuitants pass away. Still, normally, the monthly amount is lower to offset the potential of receiving benefits for a longer period of time.

The biggest downside to these options is that if the annuitants pass away within the first few years of the payout, the income streams will cease at that point.

The other main income option is Period Certain, which means that the income benefit is guaranteed to last a selected period of time. This option is great for protecting against unexpected death since the income benefit will continue to be paid to the beneficiary if the annuitant does not outlive the desired period of time.

Making Informed Decisions on Annuity Income

It is important to consider all the investment options available with your advisor before making any major financial decisions.

Annuities can be a great solution for the right situation, but:

-

They are not appropriate for everyone

-

They can also be very complicated products

We do our best to break them down piece by piece to ensure the client fully understands what they are purchasing. We have a wide variety of options available at our fingertips, and we continue to analyze them all to make sure we are only utilizing the best options at any point in time.

Income solutions are only one reason to consider an annuity policy, but there are others that fit other goals as well and we may cover these topics in a future blog post.

Annuity Income – Highlights

- Annuities have received a bad reputation in the past due to issues with potentially unfair sales practices, but we do believe some products may provide value to our clients’ financial plans.

- Pensions are becoming increasingly rare, so an annuity may be a way to receive an additional income stream.

- There are various payout options, and it is important to consider what may be most appropriate to your specific situation.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink.

Sources:

- https://www.investopedia.com/terms/a/annuitizationmethod.asp

- https://www.irs.gov/retirement-plans/annuities-a-brief-description

If you found this article helpful, consider reading: