2025 Tax Updates: Key Provisions from the Big, Beautiful Bill

On July 4, 2025, President Trump signed into law the Big Beautiful Bill, a comprehensive legislative package introducing significant changes to the federal tax code. This legislation marks a new phase in national fiscal policy, with implications for income deductions, tax credits, and reporting requirements for individuals and families. (White House Source)

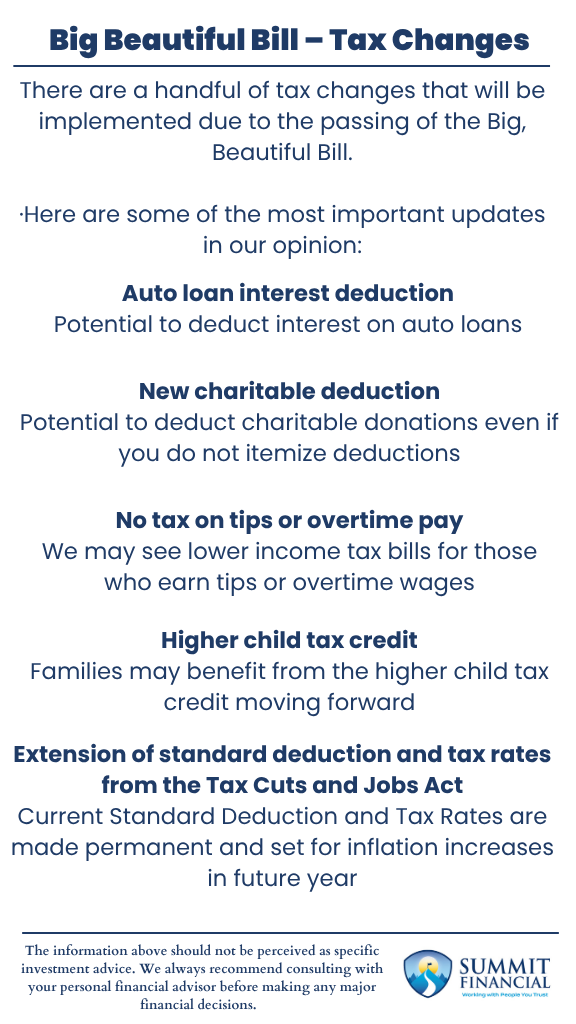

This article provides a structured overview of the key tax changes enacted by the bill, including:

- New deductions for qualified auto loan interest

- A universal charitable contribution allowance

- Income tax exemptions for tips and overtime

- Revisions to the Child Tax Credit

- Extensions of select provisions from the Tax Cuts and Jobs Act

Auto Loan Interest Deduction for U.S.- Manufactured Vehicles

A new deduction is being offered to those who have interest on loans for “Made in America” automobiles (Bankrate Source). Whether you itemize or take the standard deduction, you will be able to deduct up to $10,000 per year in interest from your income tax return.

There are specific requirements for the vehicle in order to qualify, specifically this deduction does not apply to used vehicles.

We believe this aligns with the president’s goal of bringing production back to America.

New Charitable Deduction Without Itemizing

Starting in 2026, taxpayers who do not itemize may still deduct up to $2,000 annually in qualified charitable contributions (Bankrate Source).

In our opinion, the hurdle to itemizing deductions is somewhat high, so we appreciate how this bill will encourage citizens to donate to charities more than the current tax code.

Tax Exemption for Tips and Overtime Pay

Americans will no longer have to pay income taxes on amounts they receive from tips or from overtime pay (www.bankrate.com).

While this may not impact all Americans, we believe it will lessen the tax burden on those who will benefit from it. However, now that these will be tax-free sources of income, we are interested to see if employers will reduce the amount of overtime pay that is offered or if consumers will begin tipping less than they are currently.

It is important to note that tips and overtime will be taxed over a specified amount.

Expanded Child Tax Credit for 2025

In addition to other benefits for families that we will cover in a future post, an adjustment was made to the Child Tax Credit. This bill will increase the amount of the Child Tax Credit up to $2,200. This is an increase over 2024, but also an extension of the current tax code that was set to be reverted soon (Bankrate Source).

We believe one of President Trump’s goals is to increase birth rates in our country, and this enhanced tax credit could be one incentive to help with that goal.

Extension of Tax Brackets and Standard Deduction

Lastly, the Big, Beautiful Bill does extend some tax changes that were included in the Tax Cuts and Jobs Act back in 2017. We believe the two most important parts of this are the extension of the current tax brackets and the current standard deduction (Bankrate Source).

We believe Americans should benefit from this overall on their tax returns, as both of these amounts were set to decrease in the near future. This bill will make the current amounts permanent and then index them for inflation, resulting in annual increases moving forward.

Finally, a new deduction is being introduced for those on Social Security, and we may see more Americans receiving “tax-free” Social Security (Bankrate Source).

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Sincerely,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

Sources:

**

Zach Bachner

After graduating from Central Michigan University in 2017 with specialized degrees in Finance and Personal Financial Planning, Zachary “Zach” Bachner set himself apart by earning the CFP® designation and passing the Series 7, 63, 65 licensing exams early in his career. Zach gained valuable real-world experience with the team at Summit Financial Consulting, who treated him like family. Their guidance helped him refine his skills in practical, client-centered planning, where putting their needs first was non-negotiable. This focus on trust-building not only allowed him to cultivate strong relationships, but also allowed him to continue doing what he loves most: solving client problems through efficient financial planning strategies. Leveraging his experience, Zach now helps others navigate finances through clear, informative writing. His work has been published in major outlets like Yahoo Finance, MarketWatch, and Investment Business Daily, establishing him as a valued resource. By simplifying complex topics, Zach aims to empower everyday people to confidently pursue their financial goals