We’ve previously explored the fundamentals of choosing between Traditional and Roth IRAs in one of our earlier posts.

Given its popularity among our clients and recent developments that could influence decision-making, we believe it’s pertinent to revisit the topic of pre-tax and post-tax options in light of recent developments that may impact these decisions.

What Are Pre-Tax and Post-Tax Contributions?

Traditional IRA and 401(k) accounts allow for pre-tax retirement savings meaning that income taxes are not due on these savings until withdrawals are made. You receive a tax deduction for the amount contributed every year.

If you put $5,000 into a Traditional retirement account, then your taxable income is reduced by $5,000 for that year. This applies whether you make the contributions to a Traditional IRA or if you have 401(k) contributions withheld from your paychecks. Income taxes will not be due from this account until withdrawals are made during retirement.

Roth IRA and 401(k) accounts allow for post-tax retirement savings meaning the income tax is already paid and withdrawals are tax-free throughout retirement.

Unlike Traditional savings, you will not receive any tax benefit in the year contributions are made. However, these accounts will grow tax-deferred, and retirement withdrawals will be tax-free.

It is important to note that any withdrawals before age 59 ½ may trigger income taxes and may also include a 10% early withdrawal penalty on the accumulated earnings, so this may invalidate the primary benefit of Roth retirement savings.

How Tax Brackets Influence Your IRA Choice

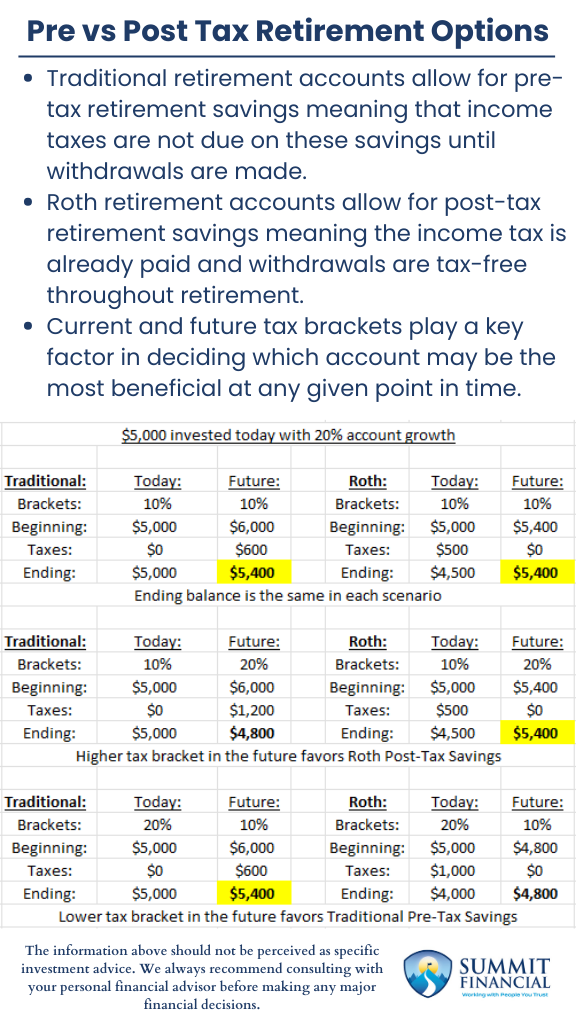

Current and future tax brackets play a key factor in deciding which account may be the most beneficial at any given point in time. If you are in a higher tax bracket now and expect a lower bracket in retirement, then it is usually more beneficial to choose the Traditional retirement option and delay the taxes until you are in a lower bracket in the future.

If you expect a higher bracket in retirement, then it may be a better choice to choose the Roth option now and pay the tax while you are in a lower bracket.

If your retirement tax bracket will be the same as today, then there should mathematically not be a difference in the tax outcome regardless of the option you choose.

There are a few other factors that we would like to consider when evaluating these decisions. First, over the long term, we do expect tax brackets to rise. It is no secret that the U.S. Government has a substantial amount of debt. Due to the cost of military spending, social security obligations, etc., we do not anticipate government spending to decline in the near future.

The government may instead decide to raise tax brackets to generate more income in order to pay back these debts. President Trump implemented tax reform measures that lowered tax brackets, and those are on schedule to be reversed at the end of 2025. We might see higher tax brackets relatively soo,n depending on the outcome of the upcoming presidential election.

Long-Term Impacts of IRA Decisions on Your Heirs

Lastly, we want to think of a bigger picture when discussing our client’s overall financial goals. For example, if we forecast that a client may have substantial retirement savings when they pass away, then the tax burden would fall onto the next generation.

Depending on where your income bracket is compared to where your children’s tax brackets will be in the future, may dictate which account is more beneficial at that point in time. By thinking longer term with the next generation in mind, we can feel comfortable that we have analyzed the goal of reducing the amount of total taxes paid on retirement savings.

Key Considerations Before Making Your IRA Choice

- Traditional retirement accounts allow for pre-tax retirement savings meaning that income taxes are not due on these savings until withdrawals are made.

- Roth retirement accounts allow for post-tax retirement savings meaning the income tax is already paid and withdrawals are tax-free throughout retirement.

- Current and future tax brackets play a key factor in deciding which account may be the most beneficial at any given point in time.

Financial Planning and Review Meeting

We’d love to have a review meeting with you to discuss investments, retirement income planning, college planning for kids or grandkids, tax preparation, health insurance, including Medicare supplemental and prescription drug plans, and various other financial planning topics. Please get in touch with our office at (586) 226-2100 to schedule a meeting today!

If you’ve had any changes to your income, job status, marriage status, a new birth in the family, 401K options, address, risk tolerance, or any other financial changes, please contact us right away.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink.

If you found this article helpful, consider reading:

Sources:

- https://summitfc.net/traditional-vs-roth-ira/

- https://www.schwab.com/ira/roth-vs-traditional-ira#:~:text=With%20a%20Roth%20IRA%2C%20you,current%20income%20after%20age%2059%C2%BD.

- https://finance.yahoo.com/news/trump-era-tax-cuts-set-160750197.html#:~:text=While%20the%20legislation%20made%20some,revert%20to%20pre%2DTCJA%20levels.&text=Largely%20dependent%20on%20which%20party,the%20tax%20code%20are%20coming