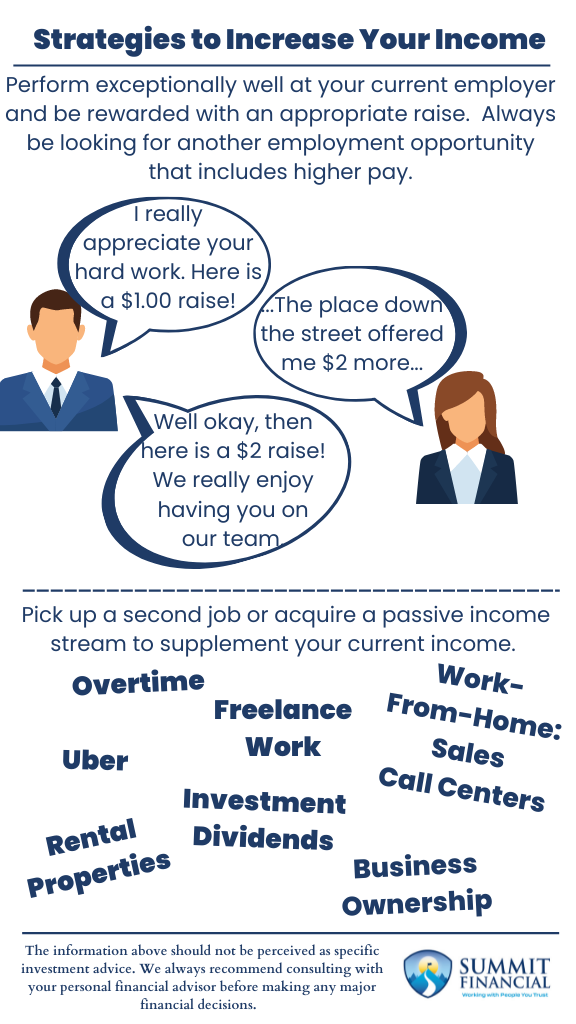

- Perform exceptionally well at your current employer and be rewarded with an appropriate raise.

- Always be looking for another employment opportunity that includes higher pay.

- Pick up a second job or acquire a passive income stream to supplement your current income.

The recent highs in inflation have caused many individuals and families to reevaluate their monthly budget. Cutting or eliminating expenses can be the first step toward achieving an effective budget. But what if you have already done that to the fullest extent?

Sometimes finding ways to increase your income may be easier than reducing already thin expenses

Negotiate a Raise with Your Employer

One of the simplest way to increase your income is to receive a raise from your current employer. We firmly believe everyone’s pay should at least be indexed for inflation otherwise you will be able to afford less and less every year.

If you are performing exceptionally well at your job, especially compared to your peers, it is important for your efforts to be rewarded. However, sometimes an employer may not know there is a problem until they are informed about it.

This means that it may be up to the employee to begin the conversation regarding a potential raise.

Consider Higher-Paying Positions

A good way to approach an employer for a raise is to know your value. This may be easy to do among coworkers, but this may not help much if they also are not receiving appropriate raises. The easiest way to know your value is to look for your exact or similar position at a competitor and determine how much they are paid.

Sometimes this is posted directly on job recruitment boards, sometimes you need to contact the company directly for more info, and sometimes that info is not provided unless you apply for the position.

Explore Better Employment Opportunities

Continuing to look for additional employment opportunities is something everyone should practice from time to time, even if they are fully satisfied with their job.

Knowing how much a competitor would pay you is great leverage when speaking with your employer about a raise. (It is also usually cheaper to keep employees than hire new ones, so they are likely willing to pay to keep their existing employee base.)

Pick Up a Second Job or Side Gig

Another way to increase your income is to pick up a second job. This could also be perceived as picking up additional hours or shifts at your current employer. If overtime is not available, then you could consider another job during your off hours.

Things such as Uber, DoorDash, etc. are very flexible and allow you to determine your own hours. There has been a huge shift towards a Work-From-Home lifestyle, and many people are finding jobs that are more convenient for them.

Sales reps, call centers, etc. are providing opportunities for additional work with flexible hours. We have also seen an increase in those finding work through creative arts such as music, drawing/painting, graphic design, content creation, etc.

Fiverr is an example of website that allows freelance workers to post their skills and potentially receive commissions for their work

Create Passive Income Streams

Lastly, one of the most impactful ways to increase your income is to acquire a source of passive income. Passive Income refers to compensation earned without having to spend your time on it.

These would be options such as rental properties, investment dividends, and business ownership. There are certainly other options to consider, but these are some of the most common.

Unfortunately, they also require a financial commitment before you are able to receive the income. This route may not be suitable for everyone, but it is a great potential wealth accumulation tool.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100.

Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Sincerely,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, James Wink, James Baldwin

If you found this article helpful, consider reading: