Transitioning from our previous discussion on estate planning, we will be looking at various types of insurance over the next few months. Overall, insurance is a risk management process. Risk is managed by buying the insurance policy to protect against a financial loss event.

We will cover the basics of life, health, disability, and then finally home and auto insurance.

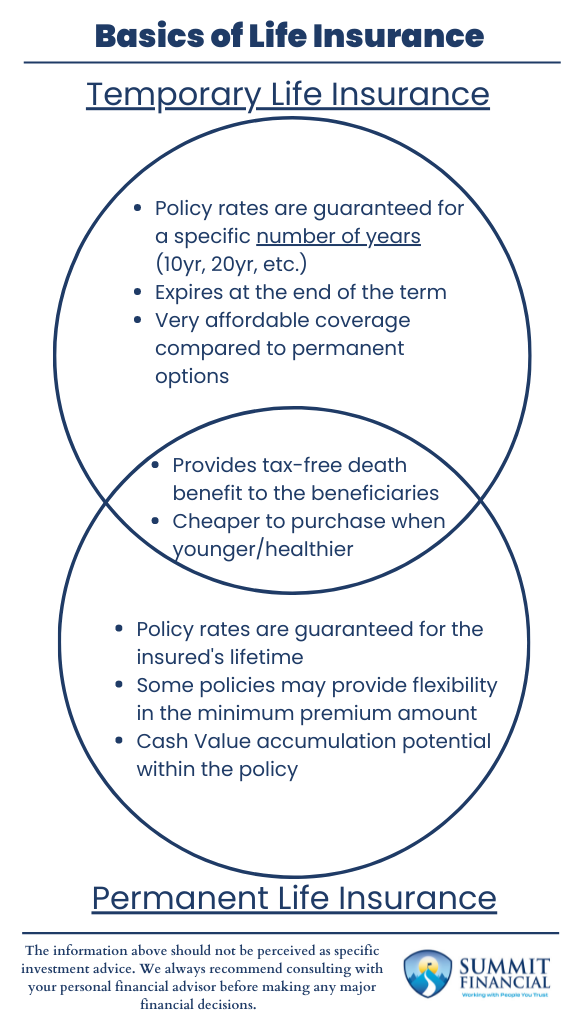

Life insurance can come in various forms, and each type has its own positives and negatives. We will be breaking down the different types of policies and their associated benefits and pitfalls. First, we will be covering Temporary policies and then we will discuss Permanent policies.

How Temporary Life Insurance Works

This type of life insurance is more commonly referred to as Term insurance. This is because the policy is purchased and will only exist for a certain number of years. The term of a temporary policy is normally purchased in 5-year increments, such as 10-year, 15-year, 20-year, etc. The monthly or annual price of this policy is locked-in for the policy life. At the end of the term, the policy will either expire or you may be able to continue the coverage at a new, much higher premium.

Term insurance is usually very attractive because of its price. Temporary insurance is offered at a large discount compared to permanent policies. The common phrase “Buy Term and Invest the Difference” highlights the difference.

Since the price is so much cheaper, term policies free up cash flow for individuals and allow them to set aside these savings for retirement. These cheap policies may allow you to accomplish multiple financial goals.

The downside to temporary insurance is right in the name; they are temporary. The average life expectancy is around 85-90 years, so life insurance companies offer these policies assuming you will live that long.

If your policy term expires at age 70, the life insurance company is assuming you will live beyond that and will not use the policy. This is a financial drawdown for the policyowner since they would have paid for the policy for all those years and they never used it.

How Permanent Life Insurance Works

Permanent life insurance has more versions than temporary insurance and are often considered to be more complicated. This coverage is referred to as permanent because the policy will last until the insured dies or until premiums are no longer paid.

To discuss these policies, we need to highlight the differences between Fixed and Variable policies as well as the differences between Whole Life and Universal policies.

Cash Value is often a benefit included with permanent policies. This is an underlying policy benefit that will grow as the policy ages. This benefit can be withdrawn by the policy owner or it may be used to enhance the policy’s death benefit. Fixed and Variable policies differ in the way that the Cash Value grows.

Fixed policies credit a consistent interest rate to the policy, and Variable policies may be invested more aggressively using mutual funds. The appropriate form of insurance depends on the owners’ risk tolerance and financial goals.

Whole Life vs. Universal Life Insurance

Whole Life insurance is the most traditional form of permanent policies. This type of policy includes consistent policy premiums and benefits. Since the premiums cannot be altered, the underlying cash value will grow more regularly.

Universal life insurance policies offer more flexible premiums and are normally less expensive than whole life. Universal policies, when designed correctly, are a cost-effective way to purchase permanent insurance.

When they are designed incorrectly, a policy owner could have the policy run out of cash value, and no longer offer coverage. Universal policies have a minimum required premium, but some individuals may choose to pay more if they would like a higher death benefit or cash value.

Speak With a Trusted Advisor

If you have any questions about how inflation may affect your investment portfolio, retirement planning, taxes, our 401(k)-recommendation service, or any questions about life insurance, please call our office at (586) 226-2100.

Please feel free to forward this commentary to a friend, family member, or co-worker. Also, if you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please call us so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

If you found this article helpful, consider reading:

- Navigating College Funding

- Financial Planning Mistakes to Avoid

- Debt Repayment Strategies

- How to Negotiate a Raise

If you are looking to learn more about life insurance, check out these additional resources! Our very own Zachary Bachner has contributed to a variety of articles in the past, and these two pieces may further answer some of your life insurance questions. The information within these articles should not be taken as financial advice but rather as educational information. Please reach out to your personal advisor if you are interested in purchasing a life insurance policy

Read: Affordable Life Insurance Companies and Finding the Best Life Insurance